Berkshire Hathaway 2015 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2015 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (Continued)

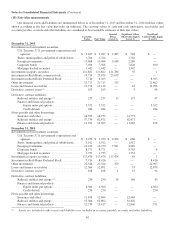

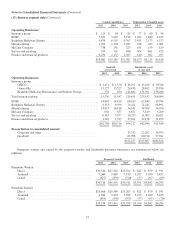

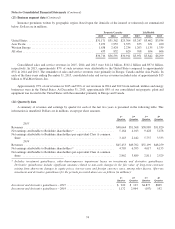

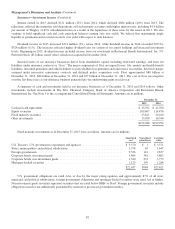

(23) Business segment data (Continued)

A disaggregation of our consolidated data for each of the three most recent years is presented in the tables which follow (in

millions).

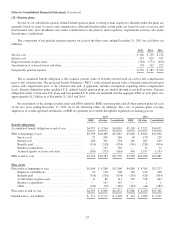

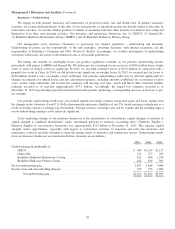

Revenues Earnings before income taxes

2015 2014 2013 2015 2014 2013

Operating Businesses:

Insurance group:

Underwriting:

GEICO ................................... $ 22,718 $ 20,496 $ 18,572 $ 460 $ 1,159 $ 1,127

General Re ................................ 5,975 6,264 5,984 132 277 283

Berkshire Hathaway Reinsurance Group ........ 7,207 10,116 8,786 421 606 1,294

Berkshire Hathaway Primary Group ............ 5,394 4,377 3,342 824 626 385

Investment income ............................. 4,562 4,370 4,735 4,550 4,357 4,713

Total insurance group ............................... 45,856 45,623 41,419 6,387 7,025 7,802

BNSF ............................................ 21,967 23,239 22,014 6,775 6,169 5,928

Berkshire Hathaway Energy .......................... 18,231 17,614 12,743 2,851 2,711 1,806

Manufacturing ..................................... 36,136 36,773 34,258 4,893 4,811 4,205

McLane Company .................................. 48,223 46,640 45,930 502 435 486

Service and retailing ................................ 23,466 14,276 13,284 1,720 1,546 1,469

Finance and financial products ........................ 6,964 6,526 6,110 2,086 1,839 1,564

200,843 190,691 175,758 25,214 24,536 23,260

Reconciliation to consolidated amount:

Investment and derivative gains/losses .............. 10,347 4,081 6,673 10,347 4,081 6,673

Interest expense, not allocated to segments .......... — — — (374) (313) (303)

Investments in Kraft Heinz ....................... 730 694 146 730 694 146

Corporate, eliminations and other .................. (1,099) (793) (427) (971) (893) (980)

$210,821 $194,673 $182,150 $34,946 $28,105 $28,796

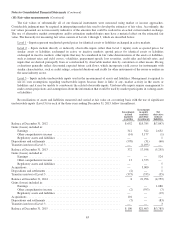

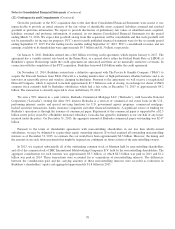

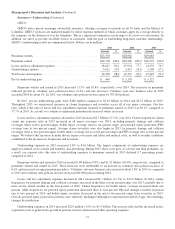

Interest expense Income tax expense

2015 2014 2013 2015 2014 2013

Operating Businesses:

Insurance group .................................... $ — $ — $ — $ 1,475 $1,768 $2,083

BNSF ............................................ 928 833 729 2,527 2,300 2,135

Berkshire Hathaway Energy .......................... 1,830 1,623 1,139 450 589 130

Manufacturing ..................................... 50 69 70 1,548 1,544 1,403

McLane Company .................................. 13 14 12 195 169 178

Service and retailing ................................ 40 11 21 651 576 557

Finance and financial products ........................ 384 463 529 708 597 556

3,245 3,013 2,500 7,554 7,543 7,042

Reconciliation to consolidated amount:

Investment and derivative gains/losses .................. — — — 3,622 760 2,334

Interest expense, not allocated to segments .............. 374 313 303 (131) (110) (106)

Investments in Kraft Heinz ........................... — — — (111) 41 51

Corporate, eliminations and other ...................... (104) (73) (2) (402) (299) (370)

$3,515 $3,253 $2,801 $10,532 $7,935 $8,951

72