Berkshire Hathaway 2015 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2015 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.While I’m on the subject of our owners’ gaining knowledge, let me remind you that Charlie and I believe

all shareholders should simultaneously have access to new information that Berkshire releases and, if possible,

should also have adequate time to digest and analyze it before any trading takes place. That’s why we try to issue

financial data late on Fridays or early on Saturdays and why our annual meeting is always held on a Saturday. We

do not follow the common practice of talking one-on-one with large institutional investors or analysts, treating them

instead as we do all other shareholders. There is no one more important to us than the shareholder of limited means

who trusts us with a substantial portion of his savings.

************

For good reason, I regularly extol the accomplishments of our operating managers. They are truly All-Stars

who run their businesses as if they were the only asset owned by their families. I also believe the mindset of our

managers to be as shareholder-oriented as can be found in the universe of large publicly-owned companies. Most of

our managers have no financial need to work. The joy of hitting business “home runs” means as much to them as

their paycheck.

Equally important, however, are the 24 men and women who work with me at our corporate office. This

group efficiently deals with a multitude of SEC and other regulatory requirements, files a 30,400-page Federal

income tax return – that’s up 6,000 pages from the prior year! – oversees the filing of 3,530 state tax returns,

responds to countless shareholder and media inquiries, gets out the annual report, prepares for the country’s largest

annual meeting, coordinates the Board’s activities, fact-checks this letter – and the list goes on and on.

They handle all of these business tasks cheerfully and with unbelievable efficiency, making my life easy

and pleasant. Their efforts go beyond activities strictly related to Berkshire: Last year, for example, they dealt with

the 40 universities (selected from 200 applicants) who sent students to Omaha for a Q&A day with me. They also

handle all kinds of requests that I receive, arrange my travel, and even get me hamburgers and french fries

(smothered in Heinz ketchup, of course) for lunch. No CEO has it better; I truly do feel like tap dancing to work

every day. In fact, my job becomes more fun every year.

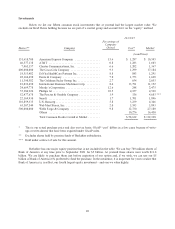

In 2015, Berkshire’s revenues increased by $16 billion. Look carefully, however, at the two pictures on the

facing page. The top one is from last year’s report and shows the entire Berkshire home-office crew at our

Christmas lunch. Below that photo is this year’s Christmas photo portraying the same 25 people identically

positioned. In 2015, no one joined us, no one left. And the odds are good that you will see a photo of the same 25

next year.

Can you imagine another very large company – we employ 361,270 people worldwide – enjoying that kind

of employment stability at headquarters? At Berkshire we have hired some wonderful people – and they have stayed

with us. Moreover, no one is hired unless he or she is truly needed. That’s why you’ve never read about

“restructuring” charges at Berkshire.

On April 30th, come to Omaha – the cradle of capitalism – and meet my gang. They are the best.

February 27, 2016 Warren E. Buffett

Chairman of the Board

30