Berkshire Hathaway 2015 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2015 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

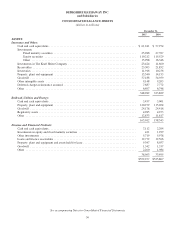

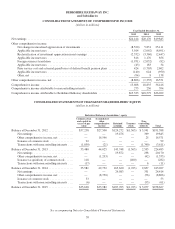

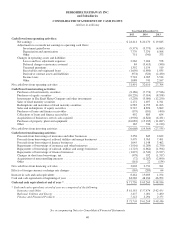

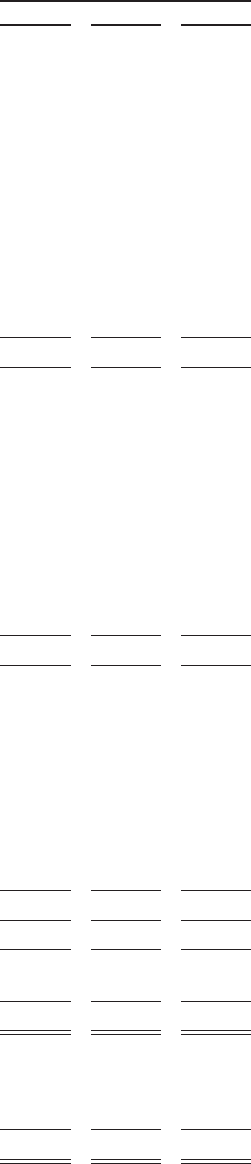

BERKSHIRE HATHAWAY INC.

and Subsidiaries

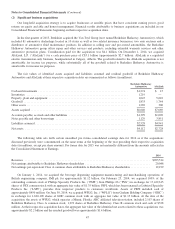

CONSOLIDATED STATEMENTS OF CASH FLOWS

(dollars in millions)

Year Ended December 31,

2015 2014 2013

Cash flows from operating activities:

Net earnings ................................................................ $24,414 $ 20,170 $ 19,845

Adjustments to reconcile net earnings to operating cash flows:

Investment gains/losses ................................................... (9,373) (3,575) (4,065)

Depreciation and amortization ............................................. 7,779 7,370 6,508

Other ................................................................. 751 (341) 373

Changes in operating assets and liabilities:

Losses and loss adjustment expenses ........................................ 2,262 7,404 578

Deferred charges reinsurance assumed ....................................... 84 (3,413) (340)

Unearned premiums ...................................................... 1,392 1,159 519

Receivables and originated loans ........................................... (1,650) (1,890) 1,035

Derivative contract assets and liabilities ...................................... (974) (520) (2,430)

Income taxes ........................................................... 5,718 4,905 3,514

Other ................................................................. 1,088 741 2,167

Net cash flows from operating activities .............................................. 31,491 32,010 27,704

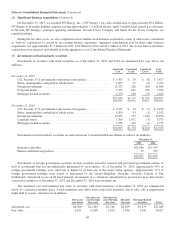

Cash flows from investing activities:

Purchases of fixed maturity securities ............................................ (8,186) (7,774) (7,546)

Purchases of equity securities .................................................. (10,220) (7,014) (8,558)

Investments in The Kraft Heinz Company and other investments ...................... (5,258) (3,000) (12,250)

Sales of fixed maturity securities ............................................... 2,172 1,697 4,311

Redemptions and maturities of fixed maturity securities ............................. 6,583 6,795 11,203

Sales and redemptions of equity securities ........................................ 8,747 8,896 3,869

Purchases of loans and finance receivables ........................................ (179) (181) (490)

Collections of loans and finance receivables ...................................... 492 885 654

Acquisitions of businesses, net of cash acquired ................................... (4,902) (4,824) (6,431)

Purchases of property, plant and equipment ....................................... (16,082) (15,185) (11,087)

Other ..................................................................... 165 336 (1,210)

Net cash flows from investing activities .............................................. (26,668) (19,369) (27,535)

Cash flows from financing activities:

Proceeds from borrowings of insurance and other businesses ......................... 3,358 845 2,622

Proceeds from borrowings of railroad, utilities and energy businesses .................. 5,479 5,765 7,491

Proceeds from borrowings of finance businesses ................................... 1,045 1,148 3,462

Repayments of borrowings of insurance and other businesses ......................... (1,916) (1,289) (2,750)

Repayments of borrowings of railroad, utilities and energy businesses .................. (1,725) (1,862) (1,596)

Repayments of borrowings of finance businesses .................................. (1,827) (1,543) (3,927)

Changes in short term borrowings, net ........................................... (378) 932 (1,317)

Acquisitions of noncontrolling interests .......................................... (72) (1,287) (2,890)

Other ..................................................................... (161) 22 (134)

Net cash flows from financing activities .............................................. 3,803 2,731 961

Effects of foreign currency exchange rate changes ...................................... (165) (289) 64

Increase in cash and cash equivalents ................................................ 8,461 15,083 1,194

Cash and cash equivalents at beginning of year ........................................ 63,269 48,186 46,992

Cash and cash equivalents at end of year * .......................................... $71,730 $ 63,269 $ 48,186

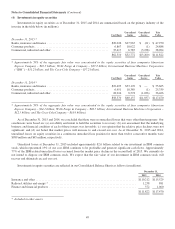

* Cash and cash equivalents at end of year are comprised of the following:

Insurance and Other ......................................................... $ 61,181 $ 57,974 $ 42,433

Railroad, Utilities and Energy ................................................. 3,437 3,001 3,400

Finance and Financial Products ................................................ 7,112 2,294 2,353

$ 71,730 $ 63,269 $ 48,186

See accompanying Notes to Consolidated Financial Statements

40