Berkshire Hathaway 2015 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2015 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Normally, it is risky business to lend long at fixed rates and borrow short as we have been doing at

Clayton. Over the years, some important financial institutions have gone broke doing that. At Berkshire, however,

we possess a natural offset in that our businesses always maintain at least $20 billion in cash-equivalents that earn

short-term rates. More often, our short-term investments are in the $40 billion to $60 billion range. If we have, say,

$60 billion invested at

1

⁄

4

% or less, a sharp move to higher short-term rates would bring benefits to us far exceeding

the higher financing costs we would incur in funding Clayton’s $13 billion mortgage portfolio. In banking terms,

Berkshire is – and always will be – heavily asset-sensitive and will consequently benefit from rising interest rates.

Let me talk about one subject of which I am particularly proud, that having to do with regulation. The

Great Recession caused mortgage originators, servicers and packagers to come under intense scrutiny and to be

assessed many billions of dollars in fines and penalties.

The scrutiny has certainly extended to Clayton, whose mortgage practices have been continuously

reviewed and examined in respect to such items as originations, servicing, collections, advertising, compliance, and

internal controls. At the federal level, we answer to the Federal Trade Commission, the Department of Housing and

Urban Development and the Consumer Financial Protection Bureau. Dozens of states regulate us as well. During the

past two years, indeed, various federal and state authorities (from 25 states) examined and reviewed Clayton and its

mortgages on 65 occasions. The result? Our total fines during this period were $38,200 and our refunds to customers

$704,678. Furthermore, though we had to foreclose on 2.64% of our manufactured-home mortgages last year,

95.4% of our borrowers were current on their payments at yearend, as they moved toward owning a debt-free home.

************

Marmon’s rail fleet expanded to 133,220 units by yearend, a number significantly increased by the

company’s purchase of 25,085 cars from General Electric on September 30. If our fleet was connected to form a

single train, the engine would be in Omaha and the caboose in Portland, Maine.

At yearend, 97% of our railcars were leased, with about 15-17% of the fleet coming up for renewal each

year. Though “tank cars” sound like vessels carrying crude oil, only about 7% of our fleet carries that product;

chemicals and refined petroleum products are the lead items we transport. When trains roll by, look for the UTLX or

Procor markings that identify our tank cars. When you spot the brand, puff out your chest; you own a portion of that

car.

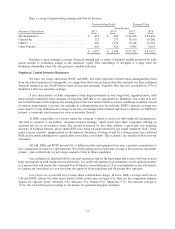

Here’s the earnings recap for this sector:

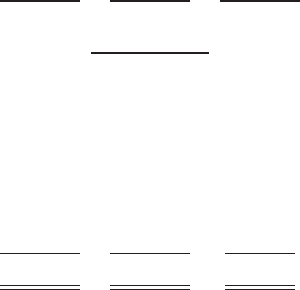

2015 2014 2013

(in millions)

Berkadia (our 50% share) ............................. $ 74 $ 122 $ 80

Clayton ............................................ 706 558 416

CORT ............................................. 55 49 42

Marmon – Containers and Cranes ....................... 192 238 226

Marmon – Railcars ................................... 546 442 353

XTRA ............................................. 172 147 125

Net financial income* ................................ 341 283 322

$ 2,086 $ 1,839 $ 1,564

* Excludes capital gains or losses

19