Berkshire Hathaway 2015 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2015 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis (Continued)

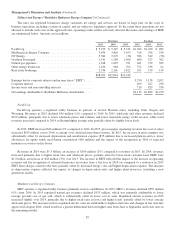

Utilities and Energy (“Berkshire Hathaway Energy Company”) (Continued)

Other energy businesses (Continued)

Revenues and EBIT in 2014 from other energy businesses increased $372 million and $174 million, respectively, over

revenues and EBIT in 2013. The increases were primarily attributable to increased revenues from new solar facilities as

additional assets were placed in service and the acquisition of AltaLink on December 1, 2014.

Real estate brokerage

Real estate brokerage revenues and EBIT in 2015 increased 17% and 37%, respectively, compared to 2014. The revenue

increase reflected comparative increases in closed transactions and average home prices and the impact of business acquisitions.

The increase in EBIT in 2015 was primarily due to the increased revenues, net of commission expense, as well as a lower

operating expense to revenue ratio as compared to 2014.

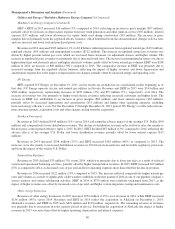

Revenues of the real estate brokerage businesses increased $339 million (19%) in 2014 as compared to 2013. The increase

reflected the impact of revenues from acquired businesses, partially offset by lower revenues from existing operations, due to a

6% decline in closed units and lower franchise revenues. EBIT of $139 million in 2014 were unchanged from 2013 as the

increase in EBIT from acquired businesses was offset by lower EBIT from existing businesses and higher operating expenses.

Corporate interest and income taxes

Corporate interest includes interest on unsecured debt issued by BHE. In 2015 and 2014, corporate interest expense

increased over the corresponding prior year due to new borrowings in connection with the NV Energy and AltaLink

acquisitions.

BHE’s consolidated effective income tax rates were approximately 16% in 2015, 23% in 2014 and 7% in 2013. In each

year, BHE’s income tax rates reflect significant production tax credits from wind-powered electricity generation in the United

States. BHE’s effective rates in 2015 and 2013 included the impact of reductions in deferred income tax liabilities as a result of

enacted statutory income tax rate decreases in the United Kingdom and increased deferred state income tax benefits.

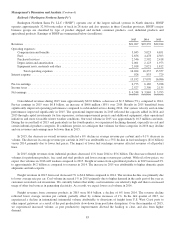

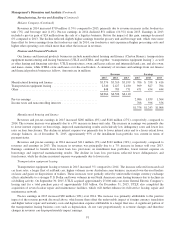

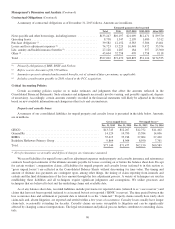

Manufacturing, Service and Retailing

A summary of revenues and earnings of our manufacturing, retailing and service businesses follows. Amounts are

in millions.

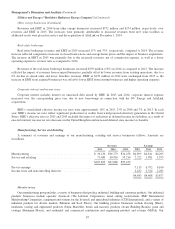

Revenues Earnings

2015 2014 2013 2015 2014 2013

Manufacturing .......................................... $ 36,136 $36,773 $34,258 $4,893 $4,811 $4,205

Service and retailing ..................................... 71,689 60,916 59,214 2,222 1,981 1,955

$107,825 $97,689 $93,472

Pre-tax earnings ......................................... 7,115 6,792 6,160

Income taxes and noncontrolling interests .................... 2,432 2,324 2,283

$4,683 $4,468 $3,877

Manufacturing

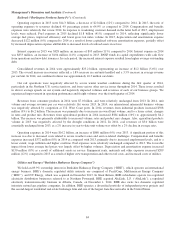

Our manufacturing group includes a variety of businesses that produce industrial, building and consumer products. Our industrial

products businesses include specialty chemicals (The Lubrizol Corporation), metal cutting tools/systems (IMC International

Metalworking Companies), equipment and systems for the livestock and agricultural industries (CTB International), and a variety of

industrial products for diverse markets (Marmon and Scott Fetzer). Our building products businesses include flooring (Shaw),

insulation, roofing and engineered products (Johns Manville), bricks and masonry products (Acme Building Brands), paint and

coatings (Benjamin Moore), and residential and commercial construction and engineering products and systems (MiTek). Our

87