Berkshire Hathaway 2015 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2015 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis (Continued)

Property and casualty losses (Continued)

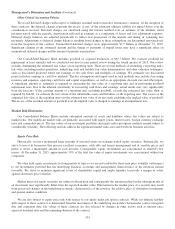

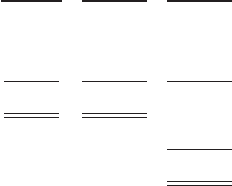

BHRG

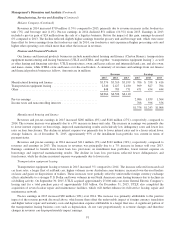

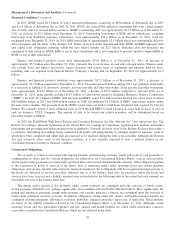

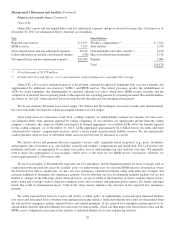

BHRG’s unpaid losses and loss adjustment expenses as of December 31, 2015 are summarized as follows. Amounts are in

millions.

Property Casualty Total

Reported case reserves ........................................................... $1,634 $ 2,606 $ 4,240

IBNR reserves .................................................................. 2,736 4,705 7,441

Retroactive reinsurance ........................................................... — 23,732 23,732

Gross unpaid losses and loss adjustment expenses ...................................... $4,370 $31,043 35,413

Deferred charges and ceded reinsurance receivables .................................... (8,349)

Net unpaid losses and loss adjustment expenses ....................................... $27,064

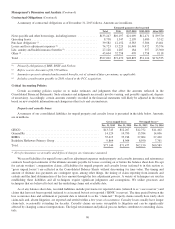

In general, we use a variety of actuarial methodologies to establish unpaid losses and loss adjustment expense liabilities.

Certain methodologies, such as paid and incurred loss development techniques, incurred and paid loss Bornhuetter-Ferguson

techniques and frequency and severity techniques, are utilized, as well as ground-up techniques when appropriate.

A large percentage of BHRG’s aggregate reserves derive from retroactive reinsurance contracts. Gross unpaid losses and

loss adjustment expenses with respect to such contracts were approximately $23.7 billion at December 31, 2015, and were

predominately for casualty or liability coverages. Retroactive reinsurance policies relate to loss events occurring before a

specified date on or before the contract date and include excess-of-loss contracts, in which losses above a contractual retention

are indemnified and contracts that indemnify losses paid by the counterparty immediately after the policy effective date. These

contracts may include significant exposures to asbestos, environmental and other latent injury claims.

The classification “reported case reserves” has no practical analytical value with respect to our retroactive policies. We

review and establish loss reserve estimates in the aggregate by individual contract, considering exposure and development

trends.

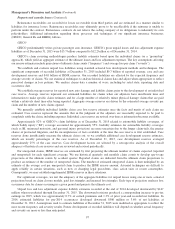

In establishing retroactive reinsurance liabilities, we often analyze historical aggregate loss payment patterns and project

losses into the future under various scenarios. The claim-tail is expected to be very long for many policies and may last several

decades. We assign judgmental probability factors to these aggregate loss payment scenarios and an expectancy outcome is

determined. We monitor claim payment activity and review ceding company reports and other information concerning the

underlying losses. Since the claim-tail is expected to be very long for such contracts, we reassess expected ultimate losses as

significant events related to the underlying losses are reported or revealed during the monitoring and review process.

BHRG’s liabilities under retroactive reinsurance include estimated liabilities for environmental, asbestos and latent injury

losses of approximately $12.4 billion at December 31, 2015. We do not receive consistently reliable information regarding

asbestos, environmental and latent injury claims data from all ceding companies, particularly with respect to multi-line treaty or

aggregate excess-of-loss policies. Periodically, we conduct a ground-up analysis of the underlying loss data to make an estimate

of ultimate reinsured losses. When detailed loss information is unavailable, our estimates are developed by applying recent

industry trends and projections to aggregate client data. Judgments in these areas necessarily include the stability of the legal

and regulatory environment under which these claims will be adjudicated. Legal reform and legislation could also have a

significant impact on the ultimate liabilities for mass tort claims.

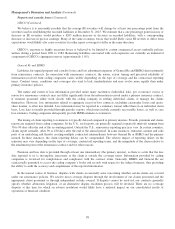

We increased ultimate liabilities for prior years’ retroactive reinsurance contracts by approximately $550 million in 2015.

The increases primarily related to asbestos and environmental risks assumed. The increase, net of deferred charge balances

adjustments related to changes in estimated timing and amount of remaining unpaid liabilities, produced charges to pre-tax

earnings of approximately $90 million. We paid losses and loss adjustment expenses of approximately $1.2 billion in 2015 with

respect to our retroactive reinsurance contracts.

We currently believe that maximum losses payable under our retroactive policies will not exceed approximately $40 billion

due to the aggregate contract limits that are applicable to most of these contracts. Absent significant judicial or legislative

changes affecting asbestos, environmental or latent injury exposures, we also currently believe it unlikely that our reported year

end 2015 gross unpaid losses of $23.7 billion will develop upward to the maximum loss payable or downward by more than

15%.

101