Berkshire Hathaway 2015 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2015 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (Continued)

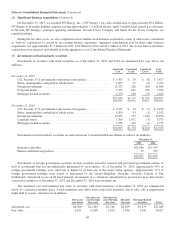

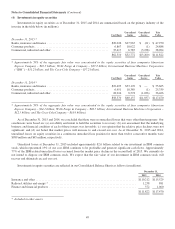

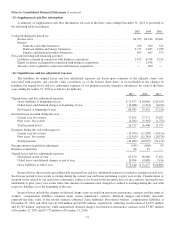

(7) Investment gains/losses

Investment gains/losses, including other-than-temporary impairment (“OTTI”) losses, for each of the three years ending

December 31, 2015 are summarized below (in millions).

2015 2014 2013

Fixed maturity securities—

Gross gains from sales and other disposals .......................................... $ 104 $ 360 $1,783

Gross losses from sales and other disposals .......................................... (171) (89) (139)

Equity securities—

Gross gains from sales and redemptions ............................................ 9,526 4,016 1,253

Gross losses from sales and redemptions ............................................ (103) (125) (62)

OTTI losses ...................................................................... (26) (697) (228)

Other ............................................................................ 43 110 1,458

$9,373 $3,575 $4,065

Investment gains from equity securities in 2015 included a non-cash holding gain of approximately $6.8 billion in

connection with our investment in Kraft Heinz common stock (see Note 6). Gains from equity securities during 2014 included

non-cash holding gains of approximately $2.1 billion from the exchange of Phillips 66 (“PSX”) common stock in connection

with the acquisition of Phillips Specialty Products Inc. (subsequently renamed Lubrizol Specialty Products Inc. (“LSPI”)) and

the exchange of Graham Holding Company (“GHC”) common stock for WPLG, Inc. (“WPLG”). The PSX/LSPI exchange was

completed on February 25, 2014 and the GHC/WPLG exchange was completed on June 30, 2014. These holding gains

represented the excess of the respective fair value of the net assets of LSPI and WPLG received over the respective cost basis of

the PSX and GHC shares exchanged.

In October 2013, we realized a gain of $680 million with respect to the repurchase of $4.4 billion par amount of 11.45%

Wrigley subordinated notes, which we acquired in 2008 for $4.4 billion in connection with the Mars acquisition of Wrigley. We

also realized additional gains in 2013 from the dispositions and conversions of corporate bonds. Other investment gains/losses

in 2013 included $1.4 billion related to the changes in the valuations of warrants of General Electric Company (“GE”) and The

Goldman Sachs Group (“GS”), which we acquired in 2008 and exercised in October 2013.

We record investments in equity and fixed maturity securities classified as available-for-sale at fair value and record the

difference between fair value and cost in other comprehensive income. OTTI losses recognized in earnings represent reductions

in the cost basis of the investment, but not the fair value. Accordingly, such losses that are included in earnings are generally

offset by a credit to other comprehensive income, producing no net effect on shareholders’ equity as of the balance sheet date.

In 2014, we recorded an OTTI charge of $678 million related to our investment in equity securities of Tesco PLC. We recorded

OTTI losses on bonds issued by Texas Competitive Electric Holdings of $228 million in 2013.

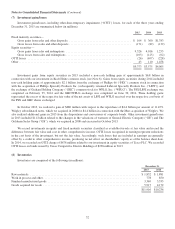

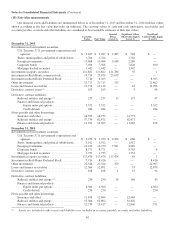

(8) Inventories

Inventories are comprised of the following (in millions).

December 31,

2015 2014

Raw materials .......................................................................... $ 1,852 $ 1,881

Work in process and other ................................................................. 778 850

Finished manufactured goods .............................................................. 3,369 3,333

Goods acquired for resale ................................................................. 5,917 4,172

$11,916 $10,236

52