Berkshire Hathaway 2015 Annual Report Download - page 24

Download and view the complete annual report

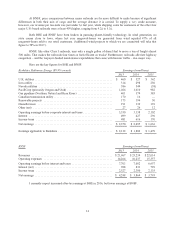

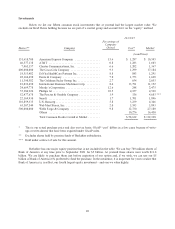

Please find page 24 of the 2015 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Our own BNSF was formed in 1995 by a merger between Burlington Northern and Santa Fe. In 1996, the

merged company’s first full year of operation, 411 million ton-miles of freight were transported by 45,000

employees. Last year the comparable figures were 702 million ton-miles (plus 71%) and 47,000 employees

(plus only 4%). That dramatic gain in productivity benefits both owners and shippers. Safety at BNSF has

improved as well: Reportable injuries were 2.04 per 200,000 man-hours in 1996 and have since fallen more

than 50% to 0.95.

‹A bit more than a century ago, the auto was invented, and around it formed an industry that insures cars

and their drivers. Initially, this business was written through traditional insurance agencies – the kind

dealing in fire insurance. This agency-centric approach included high commissions and other underwriting

expenses that consumed about 40¢ of the premium dollar. Strong local agencies were then in the driver’s

seat because they represented multiple insurers and could play one company off against another when

commissions were being negotiated. Cartel-like pricing prevailed, and all involved were doing fine –

except for the consumer.

And then some American ingenuity came into play: G. J. Mecherle, a farmer from Merna, Illinois, came up

with the idea of a captive sales force that would sell the insurance products of only a single company. His

baby was christened State Farm Mutual. The company cut commissions and expenses – moves that

permitted lower prices – and soon became a powerhouse. For many decades, State Farm has been the

runaway volume leader in both auto and homeowner’s insurance. Allstate, which also operated with a

direct distribution model, was long the runner-up. Both State Farm and Allstate have had underwriting

expenses of about 25%.

In the early 1930s, another contender, United Services Auto Association (“USAA”), a mutual-like

company, was writing auto insurance for military officers on a direct-to-the-customer basis. This marketing

innovation rose from a need that military personnel had to buy insurance that would stay with them as they

moved from base to base. That was business of little interest to local insurance agencies, which wanted the

steady renewals that came from permanent residents.

The direct distribution method of USAA, as it happened, incurred lower costs than those enjoyed by State

Farm and Allstate and therefore delivered an even greater bargain to customers. That made Leo and Lillian

Goodwin, employees of USAA, dream of broadening the target market for its direct distribution model

beyond military officers. In 1936, starting with $100,000 of capital, they incorporated Government

Employees Insurance Co. (later compressing this mouthful to GEICO).

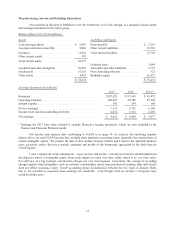

Their fledgling did $238,000 of auto insurance business in 1937, its first full year. Last year GEICO did

$22.6 billion, more than double the volume of USAA. (Though the early bird gets the worm, the second

mouse gets the cheese.) GEICO’s underwriting expenses in 2015 were 14.7% of premiums, with USAA

being the only large company to achieve a lower percentage. (GEICO is fully as efficient as USAA but

spends considerably more on advertising aimed at promoting growth.)

With the price advantage GEICO’s low costs allow, it’s not surprising that several years ago the company

seized the number two spot in auto insurance from Allstate. GEICO is also gaining ground on State Farm,

though it is still far ahead of us in volume. On August 30, 2030 – my 100th birthday – I plan to announce

that GEICO has taken over the top spot. Mark your calendar.

GEICO employs about 34,000 people to serve its 14 million policyholders. I can only guess at the

workforce it would require to serve a similar number of policyholders under the agency system. I believe,

however, that the number would be at least 60,000, a combination of what the insurer would need in direct

employment and the personnel required at supporting agencies.

22