Berkshire Hathaway 2015 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2015 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

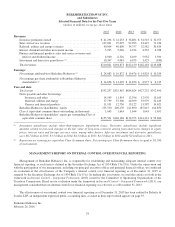

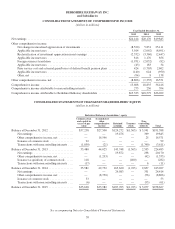

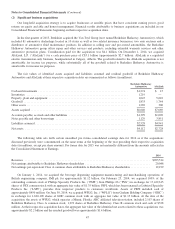

BERKSHIRE HATHAWAY INC.

and Subsidiaries

CONSOLIDATED STATEMENTS OF EARNINGS

(dollars in millions except per-share amounts)

Year Ended December 31,

2015 2014 2013

Revenues:

Insurance and Other:

Insurance premiums earned ............................................ $ 41,294 $ 41,253 $ 36,684

Sales and service revenues ............................................ 107,001 97,097 92,993

Interest, dividend and other investment income ............................ 5,235 5,026 4,934

Investment gains/losses ............................................... 9,363 3,503 3,881

162,893 146,879 138,492

Railroad, Utilities and Energy:

Revenues .......................................................... 40,004 40,690 34,757

Finance and Financial Products:

Sales and service revenues ............................................ 5,430 5,094 4,635

Interest, dividend and other investment income ............................ 1,510 1,432 1,474

Investment gains/losses ............................................... 10 72 184

Derivative gains/losses ............................................... 974 506 2,608

7,924 7,104 8,901

210,821 194,673 182,150

Costs and expenses:

Insurance and Other:

Insurance losses and loss adjustment expenses ............................. 26,527 26,406 21,275

Life, annuity and health insurance benefits ................................ 5,413 5,181 5,072

Insurance underwriting expenses ....................................... 7,517 6,998 7,248

Cost of sales and services ............................................. 87,029 78,873 75,953

Selling, general and administrative expenses .............................. 13,723 12,198 11,732

Interest expense ..................................................... 460 419 395

140,669 130,075 121,675

Railroad, Utilities and Energy:

Cost of sales and operating expenses .................................... 27,650 29,378 25,157

Interest expense ..................................................... 2,653 2,378 1,865

30,303 31,756 27,022

Finance and Financial Products:

Cost of sales and services ............................................. 2,915 2,758 2,566

Selling, general and administrative expenses .............................. 1,586 1,523 1,550

Interest expense ..................................................... 402 456 541

4,903 4,737 4,657

175,875 166,568 153,354

Earnings before income taxes ............................................. 34,946 28,105 28,796

Income tax expense .................................................. 10,532 7,935 8,951

Net earnings ........................................................... 24,414 20,170 19,845

Less: Earnings attributable to noncontrolling interests ....................... 331 298 369

Net earnings attributable to Berkshire Hathaway shareholders ................ $ 24,083 $ 19,872 $ 19,476

Net earnings per equivalent Class A share outstanding* ...................... $ 14,656 $ 12,092 $ 11,850

Average equivalent Class A shares outstanding* ............................. 1,643,183 1,643,456 1,643,613

* Average shares outstanding and net earnings per share are shown on an equivalent Class A common stock basis. Equivalent Class B shares

outstanding are 1,500 times the equivalent Class A amount. Net earnings per equivalent Class B share outstanding are one-fifteen-

hundredth (1/1,500) of the equivalent Class A amount or $9.77 for 2015, $8.06 for 2014 and $7.90 for 2013.

See accompanying Notes to Consolidated Financial Statements

38