Berkshire Hathaway 2015 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2015 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BERKSHIRE HATHAWAY INC.

and Subsidiaries

Management’s Discussion and Analysis of

Financial Condition and Results of Operations

Results of Operations

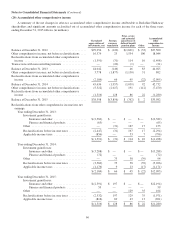

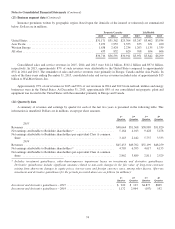

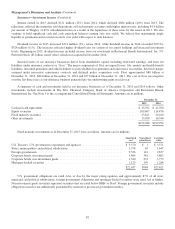

Net earnings attributable to Berkshire Hathaway shareholders for each of the past three years are disaggregated in the table

that follows. Amounts are after deducting income taxes and exclude earnings attributable to noncontrolling interests. Amounts

are in millions.

2015 2014 2013

Insurance – underwriting ......................................................... $ 1,162 $ 1,692 $ 1,995

Insurance – investment income .................................................... 3,725 3,542 3,708

Railroad ...................................................................... 4,248 3,869 3,793

Utilities and energy ............................................................. 2,132 1,882 1,470

Manufacturing, service and retailing ................................................ 4,683 4,468 3,877

Finance and financial products ..................................................... 1,378 1,243 1,008

Investment and derivative gains/losses .............................................. 6,725 3,321 4,337

Other ......................................................................... 30 (145) (712)

Net earnings attributable to Berkshire Hathaway shareholders ........................ $24,083 $19,872 $19,476

Through our subsidiaries, we engage in a number of diverse business activities. Our operating businesses are managed on

an unusually decentralized basis. There are essentially no centralized or integrated business functions (such as sales, marketing,

purchasing, legal or human resources) and there is minimal involvement by our corporate headquarters in the day-to-day

business activities of the operating businesses. Our senior corporate management team participates in and is ultimately

responsible for significant capital allocation decisions, investment activities and the selection of the Chief Executive to head

each of the operating businesses. It also is responsible for establishing and monitoring Berkshire’s corporate governance

practices, including, but not limited to, communicating the appropriate “tone at the top” messages to its employees and

associates, monitoring governance efforts, including those at the operating businesses, and participating in the resolution of

governance-related issues as needed. The business segment data (Note 23 to the accompanying Consolidated Financial

Statements) should be read in conjunction with this discussion.

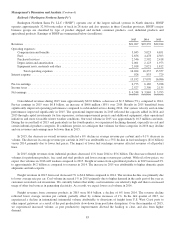

Our insurance businesses generated after-tax earnings from underwriting of $1.2 billion in 2015, a decline of $530 million

from 2014, which reflected rising claim costs at GEICO and lower earnings from our reinsurers, partially offset by increased

earnings from our other primary insurance operations. In 2014, earnings from underwriting declined $303 million compared to

2013, which was primarily due to lower earnings from reinsurance.

Our railroad business generated a 9.8% increase in after-tax earnings in 2015 compared to 2014. Results in 2015 were

positively impacted by improved service levels and lower fuel costs. Railroad earnings increased 2.0% in 2014 compared to

2013, although earnings were negatively impacted by various service-related challenges during the year.

After-tax earnings of our utilities and energy businesses in 2015 increased 13.3% over 2014, which increased 28.0% over

2013. Earnings in 2015 and 2014 benefitted from the inclusion of newly-acquired businesses (AltaLink beginning in December

2014 and NV Energy beginning in December 2013) and higher earnings from several of our other energy businesses.

After-tax earnings of our manufacturing, service and retailing businesses in 2015 increased 4.8% in the aggregate over

2014. In 2015, the positive impacts of business acquisitions and higher earnings from our building products businesses were

partly offset by lower earnings from certain of our industrial products and service businesses. Earnings of our manufacturing,

service and retailing businesses in 2014 increased 15.2% over 2013, reflecting the impact of bolt-on business acquisitions,

earnings growth in certain operations and reductions in earnings attributable to noncontrolling interests.

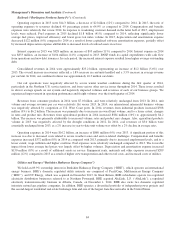

After-tax investment and derivative gains/losses were approximately $6.7 billion in 2015, $3.3 billion in 2014 and $4.3

billion in 2013. In 2015, after-tax gains included a non-cash holding gain of approximately $4.4 billion that was realized in

connection with our investment in Kraft Heinz common stock. In 2014, after-tax gains included approximately $2.0 billion

related to the exchanges of Phillips 66 common stock and Graham Holdings Company common stock for a specified subsidiary

of each of those companies. After-tax investment gains in 2013 included gains associated with the fair value increases of certain

investment securities where unrealized gains or losses were reflected in periodic earnings. Derivative contracts contributed

after-tax gains of $633 million in 2015, $329 million in 2014 and $1.7 billion in 2013. We believe that investment and

derivative gains/losses are often meaningless in terms of understanding our reported results or evaluating our economic

performance. These gains and losses have caused and will likely continue to cause significant volatility in our periodic earnings.

75