Berkshire Hathaway 2015 Annual Report Download

Download and view the complete annual report

Please find the complete 2015 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

B

ERKSHIRE

H

ATHAWAY

INC.

2015

ANNUAL REPORT

Table of contents

-

Page 1

BERKSHIRE HATHAWAY INC. 2015 ANNUAL REPORT -

Page 2

-

Page 3

...'s Report on Internal Control Over Financial Reporting ...Report of Independent Registered Public Accounting Firm ...Consolidated Financial Statements ...Management's Discussion ...Owner's Manual ...Intrinsic Value ...Common Stock Data ...Operating Companies ...Automobile Dealerships ...Real Estate... -

Page 4

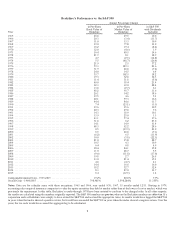

... 2010 2011 2012 2013 2014 2015 ... Compounded Annual Gain - 1965-2015 ...Overall Gain - 1964-2015 ... Notes: Data are for calendar years with these exceptions: 1965 and 1966, year ended 9/30; 1967, 15 months ended 12/31. Starting in 1979, accounting rules required insurance companies to value the... -

Page 5

... over short periods. Last year, for example, book-value performance was superior. Over time, however, market-value gains should continue their historical tendency to exceed gains in book value. * All per-share figures used in this report apply to Berkshire's A shares. Figures for the B shares are... -

Page 6

... non-insurance businesses - earned $13.1 billion in 2015, an increase of $650 million over 2014. Of the five, only Berkshire Hathaway Energy, then earning $393 million, was owned by us in 2003. Subsequently, we purchased three of the other four on an all-cash basis. In acquiring BNSF, however... -

Page 7

... in the United States. I told you earlier about BNSF's record capital expenditures in 2015. At the end of every year, our railroad's physical facilities will be improved from those existing twelve months earlier. Berkshire Hathaway Energy ("BHE") is a similar story. That company has invested $16... -

Page 8

... Though we sold no Kraft Heinz shares, "GAAP" (Generally Accepted Accounting Principles) required us to record a $6.8 billion write-up of our investment upon completion of the merger. That leaves us with our Kraft Heinz holding carried on our balance sheet at a value many billions above our cost and... -

Page 9

...its "Big Four" investments - American Express, Coca-Cola, IBM and Wells Fargo. We purchased additional shares of IBM (increasing our ownership to 8.4% versus 7.8% at yearend 2014) and Wells Fargo (going to 9.8% from 9.4%). At the other two companies, Coca-Cola and American Express, stock repurchases... -

Page 10

.... The managers who succeed Charlie and me will build Berkshire's per-share intrinsic value by following our simple blueprint of: (1) constantly improving the basic earning power of our many subsidiaries; (2) further increasing their earnings through bolt-on acquisitions; (3) benefiting from the... -

Page 11

...of the two quantitative factors: In 2015 our per-share cash and investments increased 8.3% to $159,794 (with our Kraft Heinz shares stated at market value), and earnings from our many businesses - including insurance underwriting income - increased 2.1% to $12,304 per share. We exclude in the second... -

Page 12

... own benefit. Though individual policies and claims come and go, the amount of float an insurer holds usually remains fairly stable in relation to premium volume. Consequently, as our business grows, so does our float. And how we have grown, as the following table shows: Year 1970 1980 1990 2000... -

Page 13

... exceeds its book value Berkshire's attractive insurance economics exist only because we have some terrific managers running disciplined operations that possess hard-to-replicate business models. Let me tell you about the major units. First by float size is the Berkshire Hathaway Reinsurance Group... -

Page 14

...insuring with GEICO. So stop reading - right now! - and go to geico.com or call 800-368-2734. GEICO's cost advantage is the factor that has enabled the company to gobble up market share year after year. (We ended 2015 with 11.4% of the market compared to 2.5% in 1995, when Berkshire acquired control... -

Page 15

... of long-term debt that is not guaranteed by Berkshire. Our credit is in fact not needed because each company has earning power that even under terrible economic conditions would far exceed its interest requirements. Last year, for example, in a disappointing year for railroads, BNSF's interest... -

Page 16

... generation, no state comes close to Iowa, where last year megawatt-hours we generated from wind equaled 47% of all megawatt-hours sold to our retail customers. (Additional wind projects to which we are committed will take that figure to 58% in 2017.) BNSF, like other Class I railroads, uses only... -

Page 17

... ...Total current assets ...Goodwill and other intangibles ...Fixed assets ...Other assets ...$ 6,807 8,886 11,916 970 28,579 30,289 15,161 4,445 $ 78,474 Earnings Statement (in millions) 2015 Revenues ...Operating expenses ...Interest expense ...Pre-tax earnings ...Income taxes and non-controlling... -

Page 18

... as a single entity, the companies in this group are an excellent business. They employed an average of $25.6 billion of net tangible assets during 2015 and, despite their holding large quantities of excess cash and using only token amounts of leverage, earned 18.4% after-tax on that capital. 16 -

Page 19

... an industry-leading performance at Clayton Homes, the second-largest home builder in America. Last year, the company sold 34,397 homes, about 45% of the manufactured homes bought by Americans. In contrast, the company was number three in the field, with a 14% share, when Berkshire purchased it in... -

Page 20

... done well with our mortgage portfolio. Equally important, we have financed much of the portfolio with floating-rate debt or with shortterm fixed-rate debt. Consequently, the incredibly low short-term rates of recent years have provided us a constantly-widening spread between our interest costs and... -

Page 21

...-home mortgages last year, 95.4% of our borrowers were current on their payments at yearend, as they moved toward owning a debt-free home Marmon's rail fleet expanded to 133,220 units by yearend, a number significantly increased by the company's purchase of 25,085 cars from General Electric... -

Page 22

... Below we list our fifteen common stock investments that at yearend had the largest market value. We exclude our Kraft Heinz holding because we are part of a control group and account for it on the "equity" method. 12/31/15 Shares** Company Percentage of Company Owned Cost* Market (in millions... -

Page 23

... American business. ‹ In 1947, shortly after the end of World War II, the American workforce totaled 44 million. About 1.35 million workers were employed in the railroad industry. The revenue ton-miles of freight moved by Class I railroads that year totaled 655 billion. By 2014, Class I railroads... -

Page 24

... model, was long the runner-up. Both State Farm and Allstate have had underwriting expenses of about 25%. In the early 1930s, another contender, United Services Auto Association ("USAA"), a mutual-like company, was writing auto insurance for military officers on a direct-to-the-customer basis... -

Page 25

‹ In its electric utility business, our Berkshire Hathaway Energy ("BHE") operates within a changing economic model. Historically, the survival of a local electric company did not depend on its efficiency. In fact, a "sloppy" operation could do just fine financially. That's because utilities were... -

Page 26

... and expanded Earned Income Tax Credit that would try to make sure America works for those willing to work.) The price of achieving ever-increasing prosperity for the great majority of Americans should not be penury for the unfortunate. Important Risks We, like all public companies, are required... -

Page 27

... sponsor may worry that property losses will skyrocket because of weather changes. And such worries might, in fact, be warranted if we wrote ten- or twenty-year policies at fixed prices. But insurance policies are customarily written for one year and repriced annually to reflect changing exposures... -

Page 28

... begin with a half hour of interviews with managers, directors and shareholders. Then, at 9:30, Charlie and I will commence answering questions. This new arrangement will serve two purposes. First, it may level off or modestly decrease attendance at the meeting. Last year's record of more than 40... -

Page 29

... Berkshire managers who will be captaining their exhibits. And be sure to view the terrific BNSF railroad layout that salutes all of our subsidiaries. Your children (and you!) will be enchanted with it. We will have a new and very special exhibit in the hall this year: a full-size model of the world... -

Page 30

... Weekend" discount pricing. Last year in the week encompassing the meeting, the store did a record $44,239,493 of business. If you repeat that figure to a retailer, he is not going to believe you. (An average week for NFM's Omaha store - the highest-volume home furnishings store in the United States... -

Page 31

... for 18 from the audience. (Last year we had 64 in total.) The questioners from the audience will be chosen by means of 11 drawings that will take place at 8:15 a.m. on the morning of the annual meeting. Each of the 11 microphones installed in the arena and main overflow room will host, so to speak... -

Page 32

...feel like tap dancing to work every day. In fact, my job becomes more fun every year. In 2015, Berkshire's revenues increased by $16 billion. Look carefully, however, at the two pictures on the facing page. The top one is from last year's report and shows the entire Berkshire home-office crew at our... -

Page 33

... Amick, Sharon Heck, Melissa Hawk, Jalayna Busse, Warren Buffett, Angie Wells, Alisa Krueger, Deb Ray, Carrie Sova, Ellen Schmidt Back Row - Tracy Britt Cool, Jennifer Tselentis, Ted Weschler, Joanne Manhart, Bob Reeson, Todd Combs, Dan Jaksich, Debbie Bosanek, Mark Sisley, Marc Hamburg, Kerby Ham... -

Page 34

... subsidiaries, changes in laws or regulations affecting our insurance, railroad, utilities and energy and finance subsidiaries, changes in federal income tax laws, and changes in general economic and market factors that affect the prices of securities or the industries in which we do business... -

Page 35

..., Central States Indemnity Company, and Berkshire Hathaway Life Insurance Company of Nebraska. Our finance and financial products businesses primarily engage in proprietary investing strategies (BH Finance), consumer lending (Clayton Homes, Inc.) and transportation equipment and furniture leasing... -

Page 36

... Financial Data for the Past Five Years (dollars in millions except per-share data) 2015 2014 2013 2012 2011 Revenues: Insurance premiums earned ...$ 41,294 $ 41,253 $ 36,684 $ 34,545 $ 32,075 Sales and service revenues ...107,001 97,097 92,993 81,447 71,226 Railroad, utilities and energy revenues... -

Page 37

... FIRM To the Board of Directors and Shareholders of Berkshire Hathaway Inc. Omaha, Nebraska We have audited the accompanying consolidated balance sheets of Berkshire Hathaway Inc. and subsidiaries (the "Company") as of December 31, 2015 and 2014, and the related consolidated statements of earnings... -

Page 38

BERKSHIRE HATHAWAY INC. and Subsidiaries CONSOLIDATED BALANCE SHEETS (dollars in millions) December 31, 2015 2014 ASSETS Insurance and Other: Cash and cash equivalents ...Investments: Fixed maturity securities ...Equity securities ...Other ...Investments in The Kraft Heinz Company ...Receivables ... -

Page 39

... other borrowings ...Income taxes, principally deferred ...Total liabilities ...Shareholders' equity: Common stock ...Capital in excess of par value ...Accumulated other comprehensive income ...Retained earnings ...Treasury stock, at cost ...Berkshire Hathaway shareholders' equity ...Noncontrolling... -

Page 40

...2015 Year Ended December 31, 2014 2013 Revenues: Insurance and Other: Insurance premiums earned ...Sales and service revenues ...Interest, dividend and other investment income ...Investment gains/losses ...Railroad, Utilities and Energy: Revenues ...Finance and Financial Products: Sales and service... -

Page 41

... STATEMENTS OF CHANGES IN SHAREHOLDERS' EQUITY (dollars in millions) Berkshire Hathaway shareholders' equity Common stock and capital in excess of par value Accumulated other comprehensive income Noncontrolling interests Retained earnings Treasury stock Total Balance at December 31, 2012... -

Page 42

...Derivative contract assets and liabilities ...Income taxes ...Other ...Net cash flows from operating activities ...Cash flows from investing activities: Purchases of fixed maturity securities ...Purchases of equity securities ...Investments in The Kraft Heinz Company and other investments ...Sales... -

Page 43

... FINANCIAL STATEMENTS December 31, 2015 (1) Significant accounting policies and practices (a) Nature of operations and basis of consolidation Berkshire Hathaway Inc. ("Berkshire") is a holding company owning subsidiaries engaged in a number of diverse business activities, including insurance... -

Page 44

... in fair value of derivative contracts that do not qualify as hedging instruments for financial reporting purposes are recorded in earnings or by our regulated utilities businesses as regulatory assets or liabilities when recovery through regulated rates is probable. (g) Fair value measurements As... -

Page 45

...depreciation rate is applied to the gross investment in a particular class of property, despite differences in the service life or salvage value of individual property units within the same class. When our regulated utilities or railroad retires or sells a component of the assets accounted for using... -

Page 46

...contracts are earned when due. Premiums earned are stated net of amounts ceded to reinsurers. For contracts containing experience rating provisions, premiums earned reflect estimated loss experience under the contracts. Sales revenues derive from the sales of manufactured products and goods acquired... -

Page 47

... the related premiums are earned. Direct incremental acquisition costs include commissions, premium taxes, and certain other costs associated with successful efforts. All other underwriting costs are expensed as incurred. The recoverability of capitalized insurance policy acquisition costs generally... -

Page 48

... Financial Statements. (u) New accounting pronouncements to be adopted subsequent to December 31, 2015 In May 2014, the FASB issued ASU 2014-09 "Revenue from Contracts with Customers." ASU 2014-09 applies to contracts with customers, excluding, most notably, insurance and leasing contracts. ASU 2014... -

Page 49

... 2015, Berkshire acquired the Van Tuyl Group (now named Berkshire Hathaway Automotive), which included 81 automotive dealerships located in 10 states as well as two related insurance businesses, two auto auctions and a distributor of automotive fluid maintenance products. In addition to selling new... -

Page 50

... 1.2 million electric and 0.2 million retail natural gas customers in Nevada. NV Energy's principal operating subsidiaries, Nevada Power Company and Sierra Pacific Power Company, are regulated utilities. During the last three years, we also completed several smaller-sized business acquisitions, many... -

Page 51

... Company - $10.5 billion; Wells Fargo & Company - $27.2 billion; International Business Machines Corporation ("IBM") - $11.2 billion; and The Coca-Cola Company - $17.2 billion). Cost Basis Unrealized Gains Unrealized Losses Fair Value December 31, 2014 * Banks, insurance and finance ...Consumer... -

Page 52

... the dividends were paid by a U.S.-based company. (6) Investments in The Kraft Heinz Company On June 7, 2013, Berkshire and an affiliate of the global investment firm 3G Capital (such affiliate, "3G"), through a newly formed holding company, H.J. Heinz Holding Corporation ("Heinz Holding"), acquired... -

Page 53

... had sold a proportionate share of its investment. As a result, we recorded a non-cash pre-tax holding gain of approximately $6.8 billion in the third quarter of 2015, representing the excess of the fair value of Kraft Heinz common stock at the date of the merger over our carrying value associated... -

Page 54

... of General Electric Company ("GE") and The Goldman Sachs Group ("GS"), which we acquired in 2008 and exercised in October 2013. We record investments in equity and fixed maturity securities classified as available-for-sale at fair value and record the difference between fair value and cost in... -

Page 55

...% of the loan balances were current as to payment status. (10) Property, plant and equipment and assets held for lease A summary of property, plant and equipment of our insurance and other businesses follows (in millions). Ranges of estimated useful life December 31, 2015 2014 Land ...Buildings and... -

Page 56

...and assets held for lease (Continued) A summary of property, plant and equipment of our railroad and our utilities and energy businesses follows (in millions). Ranges of estimated useful life December 31, 2015 2014 Railroad: Land ...Track structure and other roadway ...Locomotives, freight cars and... -

Page 57

Notes to Consolidated Financial Statements (Continued) (11) Goodwill and other intangible assets A reconciliation of the change in the carrying value of goodwill is as follows (in millions). December 31, 2015 2014 Balance at beginning of year ...Acquisitions of businesses ...Other, including ... -

Page 58

...generate electricity, wholesale electricity purchased and sold and natural gas supplied for customers. Derivative instruments, including forward purchases and sales, futures, swaps and options, are used to manage a portion of these price risks. Derivative contract assets are included in other assets... -

Page 59

... years ending December 31, 2015 is presented in the following table (in millions). 2015 2014 2013 Cash paid during the period for: Income taxes ...Interest: Insurance and other businesses ...Railroad, utilities and energy businesses ...Finance and financial products businesses ...Non-cash investing... -

Page 60

...Before the effects of changes in deferred charges and liability discounts, incurred losses included reductions for prior years' events of approximately $1.5 billion in 2015 and 2014 and $1.9 billion in 2013. In each year, these reductions derived from our direct insurance business (including private... -

Page 61

... with all applicable debt covenants. Berkshire does not guarantee any debt, borrowings or lines of credit of BNSF, BHE or their subsidiaries. Weighted Average Interest Rate December 31, 2015 2014 Finance and financial products: Issued by Berkshire Hathaway Finance Corporation ("BHFC") due 2016-2043... -

Page 62

... of distributable earnings of foreign subsidiaries would not be material. Income tax expense reflected in our Consolidated Statements of Earnings for each of the three years ending December 31, 2015 is as follows (in millions). 2015 2014 2013 Federal ...State ...Foreign ...Current ...Deferred... -

Page 63

... 2015 2014 2013 Earnings before income taxes ...Hypothetical income tax expense computed at the U.S. federal statutory rate ...Dividends received deduction and tax exempt interest ...State income taxes, less U.S. federal income tax benefit ...Foreign tax rate differences ...U.S. income tax credits... -

Page 64

... 23,679 Investment in Kraft Heinz Preferred Stock ...7,710 8,363 - Other investments ...21,717 21,717 315 Loans and finance receivables ...12,772 13,112 - Derivative contract assets (1) ...103 103 - Derivative contract liabilities: Railroad, utilities and energy (1) ...Finance and financial products... -

Page 65

...value on a recurring basis with the use of significant unobservable inputs (Level 3) for each of the three years ending December 31, 2015 follow (in millions). Investments in fixed maturity securities Investments in equity securities and other investments Net derivative contract liabilities Balance... -

Page 66

... ...6,580 Warrant pricing model Discount for transferability and hedging restrictions 3,552 Option pricing model Volatility 7% 21% 31 basis points 284 Discounted cash flow Credit spreads Other investments consist of perpetual preferred stocks and common stock warrants that we acquired in a few... -

Page 67

... are issued. Berkshire's Board of Directors ("Berkshire's Board") has approved a common stock repurchase program under which Berkshire may repurchase its Class A and Class B shares at prices no higher than a 20% premium over the book value of the shares. Berkshire may repurchase shares in the open... -

Page 68

...December 31, 2015 ...Reclassifications from other comprehensive income into net earnings: Year ending December 31, 2013: Investment gains/losses: Insurance and other ...Finance and financial products ...Other ...Reclassifications before income taxes ...Applicable income taxes ...Year ending December... -

Page 69

... generally recoverable through the regulated rate making process. BHE 2015 All other Consolidated BHE 2014 All other Consolidated Benefit obligations Accumulated benefit obligation at end of year ...PBO at beginning of year ...Service cost ...Interest cost ...Benefits paid ...Business acquisitions... -

Page 70

... fair value with significant unobservable inputs (Level 3) for the years ending December 31, 2015 and 2014 consisted primarily of real estate and limited partnership interests. Plan assets are generally invested with the long-term objective of producing earnings to adequately cover expected benefit... -

Page 71

...2017 2018 2019 2020 After 2020 Total $1,347 $1,187 $1,012 $884 $796 $3,512 $8,738 Our subsidiaries regularly make commitments in the ordinary course of business to purchase goods and services used in their businesses. The most significant of these relate to our railroad, utilities and energy... -

Page 72

... Corporation ("Leucadia") owning the other 50% interest. Berkadia is a servicer of commercial real estate loans in the U.S., performing primary, master and special servicing functions for U.S. government agency programs, commercial mortgagebacked securities transactions, banks, insurance companies... -

Page 73

... Underwriting multiple lines of property and casualty insurance policies for primarily commercial accounts Operates one of the largest railroad systems in North America Regulated electric and gas utility, including power generation and distribution activities and real estate brokerage activities... -

Page 74

... taxes 2015 2014 2013 Operating Businesses: Insurance group: Underwriting: GEICO ...General Re ...Berkshire Hathaway Reinsurance Group ...Berkshire Hathaway Primary Group ...Investment income ...Total insurance group ...BNSF ...Berkshire Hathaway Energy ...Manufacturing ...McLane Company ...Service... -

Page 75

... to Consolidated Financial Statements (Continued) (23) Business segment data (Continued) Capital expenditures 2015 2014 2013 Depreciation of tangible assets 2015 2014 2013 Operating Businesses: Insurance group ...BNSF ...Berkshire Hathaway Energy ...Manufacturing ...McLane Company ...Service and... -

Page 76

... Financial Statements (Continued) (23) Business segment data (Continued) Insurance premiums written by geographic region (based upon the domicile of the insured or reinsured) are summarized below. Dollars are in millions. 2015 Property/Casualty 2014 2013 2015 Life/Health 2014 2013 United States... -

Page 77

.... 2015 2014 2013 Insurance - underwriting ...Insurance - investment income ...Railroad ...Utilities and energy ...Manufacturing, service and retailing ...Finance and financial products ...Investment and derivative gains/losses ...Other ...Net earnings attributable to Berkshire Hathaway shareholders... -

Page 78

... insurance and reinsurance contracts specially designed to meet the unique needs of insurance and reinsurance buyers. Underwriting results from our insurance businesses are summarized below. Amounts are in millions. 2015 2014 2013 Underwriting gain attributable to: GEICO ...General Re ...Berkshire... -

Page 79

... strategy to be a low-cost auto insurer. In addition, we strive to provide excellent service to customers, with the goal of establishing long-term customer relationships. GEICO's underwriting results are summarized below. Dollars are in millions. 2015 Amount % 2014 Amount % 2013 Amount % Premiums... -

Page 80

... all of its product lines. Our management does not evaluate underwriting performance based upon market share and our underwriters are instructed to reject inadequately priced risks. In 2015, we changed the allocation of certain underwriting expenses related to a global systems implementation project... -

Page 81

... to a new 10-year, 20% quota-share contract with Insurance Australia Group Ltd. ("IAG"), which became effective on July 1, 2015. Partially offsetting this increase were premium declines in property catastrophe, property quota-share and London facilities business. Our premium volume is generally... -

Page 82

... significant in 2015 or 2013, whereas premiums in 2014 included $3 billion from a single contract with Liberty Mutual Insurance Company ("LMIC"). Under the LMIC agreement, we reinsure substantially all of LMIC's unpaid losses and allocated loss adjustment expense liabilities related to (a) asbestos... -

Page 83

...-sized businesses; and Central States Indemnity Company, a provider of credit and Medicare Supplement insurance. Premiums earned in 2015 and 2014 increased by approximately $1.0 billion over the corresponding prior year. The increases were primarily attributable to volume increases from BH Specialty... -

Page 84

... value), which was acquired in December 2014. Invested assets of our insurance businesses derive from shareholder capital, including reinvested earnings, and from net liabilities under insurance contracts or "float." The major components of float are unpaid losses, life, annuity and health benefit... -

Page 85

... Santa Fe, LLC ("BNSF") operates one of the largest railroad systems in North America. BNSF operates approximately 32,500 route miles of track in 28 states and also operates in three Canadian provinces. BNSF's major business groups are classified by type of product shipped and include consumer... -

Page 86

... of railroad assets in service. Interest expense in 2015 was $928 million, an increase of $95 million (11%) compared to 2014. Interest expense in 2014 was $833 million, an increase of $104 million (14%) compared to 2013. BNSF funds its capital expenditures with cash flow from operations and new debt... -

Page 87

... millions. Revenues 2015 2014 2013 2015 Earnings 2014 2013 PacifiCorp ...MidAmerican Energy Company ...NV Energy ...Northern Powergrid ...Natural gas pipelines ...Other energy businesses ...Real estate brokerage ...Earnings before corporate interest and income taxes ("EBIT") ...Corporate interest... -

Page 88

... versus 2014, which was primarily due to lower gas sales as a result of reduced system and operational balancing activities, partially offset by higher transportation revenues. In 2015, EBIT increased $22 million (6%) as compared to 2014, as decreased costs of gas sold and lower operating expenses... -

Page 89

... with the NV Energy and AltaLink acquisitions. BHE's consolidated effective income tax rates were approximately 16% in 2015, 23% in 2014 and 7% in 2013. In each year, BHE's income tax rates reflect significant production tax credits from wind-powered electricity generation in the United States. BHE... -

Page 90

... lower sales volumes to customers in or related to the oil and gas industry. The negative effect of foreign currency translation and lower selling prices in 2015 was partially offset by the impact of bolt-on acquisitions by Lubrizol ($433 million). Pre-tax earnings in 2015 of these businesses... -

Page 91

... building products businesses generated increased earnings compared to 2013. Shaw's earnings were lower due to comparatively higher raw material costs. Consumer products Revenues of our consumer products manufacturers were approximately $9.1 billion in 2015, relatively unchanged from 2014. In 2015... -

Page 92

...quarter of 2015, we acquired The Van Tuyl Group (now named Berkshire Hathaway Automotive or "BHA") which included 81 auto dealerships located in 10 states. BHA sells new and pre-owned automobiles and offers repair and other related services and products, and includes two related insurance businesses... -

Page 93

...exchange effects attributable to a stronger U.S. Dollar and lower volumes in our North American crane leasing business due to declines in oil drilling activity. On September 30, 2015, UTLX acquired approximately 25,000 tank cars from General Electric Company's leasing unit for a total purchase price... -

Page 94

... meaningful or useful in evaluating periodic earnings, we are providing information to explain the nature of such gains and losses when reflected in earnings. Pre-tax investment gains in 2015 included non-cash holding gains related to our investment in Kraft Heinz of $6.8 billion, as well as net... -

Page 95

... and generally higher index values, partially offset by the negative impact of lower interest rate assumptions. In 2013, derivative contracts generated pre-tax gains of $2.6 billion, including gains of $2.8 billion from equity index put option contracts and a loss of $213 million from our credit... -

Page 96

...our investments in Kraft Heinz) of $152.2 billion. We used cash of approximately $4.9 billion in 2015 to fund business acquisitions. On July 1, 2015, Berkshire used cash of approximately $5.3 billion to acquire additional shares of Kraft Heinz common stock. In 2015, Berkshire Hathaway parent company... -

Page 97

...BHFC senior notes are used to fund loans originated and acquired by Clayton Homes. We currently intend to issue additional notes in 2016 through BHFC to fund a portion of assets held for lease of our rail tank car business, UTLX Company. The amount of debt to be issued and related maturities will be... -

Page 98

... liabilities for unpaid property and casualty losses is presented in the table below. Amounts are in millions. Gross unpaid losses Dec. 31, 2015 Dec. 31, 2014 Net unpaid losses * Dec. 31, 2015 Dec. 31, 2014 GEICO ...General Re ...BHRG ...Berkshire Hathaway Primary Group ...Total ... $13,743 14... -

Page 99

...We use statistical techniques to analyze historical claims data and adjust when appropriate to reflect perceived changes in loss patterns. We analyze claims data a number of ways, including by rated state, reporting date and occurrence date. We establish average reserves for reported new auto damage... -

Page 100

... reinsurance contract and for other reasons. Premium and loss data is provided through at least one intermediary (the primary insurer), so there is a risk that the loss data reported to us is incomplete, inaccurate or the claim is outside the coverage terms. Information provided by ceding companies... -

Page 101

... and Analysis (Continued) Property and casualty losses (Continued) General Re General Re's gross and net unpaid losses and loss adjustment expenses and gross reserves by major line of business as of December 31, 2015 are summarized below. Amounts are in millions. Type Line of business Reported case... -

Page 102

...as of December 31, 2014. In 2015, reported claims for prior years' property loss events were less than expected and we reduced our estimated ultimate liabilities by $260 million. However, the nature of property loss experience tends to be more volatile because of the effect of catastrophes and large... -

Page 103

... is determined. We monitor claim payment activity and review ceding company reports and other information concerning the underlying losses. Since the claim-tail is expected to be very long for such contracts, we reassess expected ultimate losses as significant events related to the underlying losses... -

Page 104

...value, strike price, interest rate, dividend rate and contract expiration date. The weighted average interest and dividend rates used as of December 31, 2015 and December 31, 2014 were 1.5% and 3.3%, respectively. The interest rates as of December 31, 2015 and 2014 were approximately 63 basis points... -

Page 105

... 59% of the total fair value of equity investments was concentrated within four companies. We often hold equity investments for long periods of time so we are not troubled by short-term price volatility with respect to our investments provided that the underlying business, economic and management... -

Page 106

..., business acquisitions and for other general purposes. We strive to maintain high credit ratings so that the cost of our debt is minimized. We rarely utilize derivative products, such as interest rate swaps, to manage interest rate risks. The fair values of our fixed maturity investments and... -

Page 107

... significant foreign business and foreign currency risk of their own. Our net assets subject to translation are primarily in our insurance, utilities and energy and certain manufacturing and services subsidiaries, as well as through our investment in Kraft Heinz common stock that is accounted for... -

Page 108

.... We utilize derivative contracts to a limited degree in managing commodity price risks, most notably at BHE. BHE's exposures to commodities include variations in the price of fuel required to generate electricity, wholesale electricity that is purchased and sold and natural gas supply for customers... -

Page 109

...the stocks of those companies. If we have good long-term expectations, short-term price changes are meaningless for us except to the extent they offer us an opportunity to increase our ownership at an attractive price. 2. In line with Berkshire's owner-orientation, most of our directors have a major... -

Page 110

... our true economic performance. Charlie and I, both as owners and managers, virtually ignore such consolidated numbers. However, we will also report to you the earnings of each major business we control, numbers we consider of great importance. These figures, along with other information we will... -

Page 111

... utilities and railroad businesses, loans that are non-recourse to Berkshire. Here, we will favor long-term, fixed-rate loans. 8. A managerial "wish list" will not be filled at shareholder expense. We will not diversify by purchasing entire businesses at control prices that ignore long-term economic... -

Page 112

...Berkshire share would need to remain constant, and by our preferences at 1-to-1. As that implies, we would rather see Berkshire's stock price at a fair level than a high level. Obviously, Charlie and I can't control Berkshire's price. But by our policies and communications, we can encourage informed... -

Page 113

... report our per-share book value, an easily calculable number, though one of limited use. The limitations do not arise from our holdings of marketable securities, which are carried on our books at their current prices. Rather the inadequacies of book value have to do with the companies we control... -

Page 114

... of dividends. It would be difficult to develop a peer group of companies similar to Berkshire. The Corporation owns subsidiaries engaged in a number of diverse business activities of which the most important is the property and casualty insurance business and, accordingly, management has used the... -

Page 115

... years, our compounded annual gain in pre-tax, non-insurance earnings per share is 21.0%. During the same period, Berkshire's stock price increased at a rate of 22.1% annually. Over time, you can expect our stock price to move in rough tandem with Berkshire's investments and earnings. Market price... -

Page 116

... and low sales prices per share, as reported on the New York Stock Exchange Composite List during the periods indicated: 2015 Class A High Low High Class B Low High Class A Low High 2014 Class B Low First Quarter ...Second Quarter ...Third Quarter ...Fourth Quarter ...Dividends $227,500 223,012... -

Page 117

...Water Systems (1) ...97 Western Enterprises (1) ...252 R.C.Willey Home Furnishings ...2,589 World Book (1) ...152 WPLG, Inc...189 XTRA ...376 Non-insurance total ...319,305 Corporate Office ...25 361,270 (1) (2) (3) (4) A Scott Fetzer Company A Berkshire Hathaway Energy Company A Fruit of the Loom... -

Page 118

BERKSHIRE HATHAWAY INC. AUTOMOBILE DEALERSHIPS Dealership Name City, State Dealership Name City, State Arrowhead Cadillac Superstition Springs Lexus Acura Of Peoria Infiniti of Peoria Peoria Ford Peoria Nissan ABC Nissan Bell Honda Camelback Ford Lincoln Camelback Hyundai Camelback ... -

Page 119

... * Brand State Major Cities Served Number of Agents RealtySouth Roberts Brothers Inc. Long Companies Guarantee Real Estate Intero Real Estate Services Berkshire Hathaway HomeServices California Properties Berkshire Hathaway HomeServices New England Properties Berkshire Hathaway HomeServices Fox... -

Page 120

BERKSHIRE HATHAWAY INC. DAILY NEWSPAPERS Publication City Circulation Daily Sunday Alabama Opelika Auburn News Dothan Eagle Florida Jackson County Floridan Iowa The Daily Nonpareil Nebraska York News-Times The North Platte Telegraph Kearney Hub Star-Herald The Grand Island Independent Omaha World-... -

Page 121

... recommending or referring you to any particular lender, the following provides a list of lenders that currently offer financing for manufactured and modular home purchases in your general area. Please consider the information provided by these lenders (if available) and select two or more lenders... -

Page 122

-

Page 123

... and computer outsourcing. MERYL B. WITMER, Managing member of the General Partner of Eagle Capital Partners L.P., an investment partnership. Letters from Annual Reports (1977 through 2015), quarterly reports, press releases and other information about Berkshire may be obtained on the Internet at... -

Page 124

BERKSHIRE HATHAWAY INC. Executive Offices - 3555 Farnam Street, Omaha, Nebraska 68131