Berkshire Hathaway 2014 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2014 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion (Continued)

Utilities and Energy (“Berkshire Hathaway Energy Company”) (Continued)

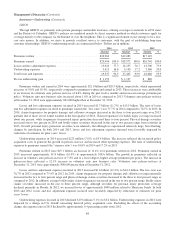

Natural Gas Pipelines

Natural gas pipeline revenues increased $122 million (13%) in 2014 compared to 2013. The increase reflected

comparatively higher revenues from increased natural gas rates and volumes as a result of significantly colder weather

conditions in the first quarter of 2014 in Northern Natural Gas Company’s service territory and system rebalancing activities

over the first half of 2014. EBIT in 2014 of $379 million were relatively unchanged from 2013. Revenues and EBIT in 2013

were $971 million and $385 million, respectively, and were relatively unchanged from 2012.

Other energy businesses

Revenues and EBIT in 2014 from other energy businesses increased $408 million and $232 million, respectively, over

revenues and EBIT in 2013. The increases were primarily attributable to increased revenues from new solar facilities as

additional assets were placed in service and from the inclusion of revenues and EBIT of AltaLink for the month of December.

The increase in revenues from other activities in 2013 was $81 million, which was primarily attributable to revenues from the

new solar and wind-powered facilities, partially offset by the impact of one-time customer refunds issued by NV Energy and

impairment losses associated with BHE’s interests in certain geothermal electricity generation projects. EBIT from other

activities declined $87 million in 2013 compared to 2012, as the impacts of the aforementioned losses associated with

geothermal projects and NV Energy acquisition costs and customer refunds, more than offset the increase in earnings from the

new solar and wind-powered electricity generation projects.

Real estate brokerage

Revenues of the real estate brokerage businesses increased $339 million (19%) in 2014 as compared to 2013. The increase

reflected the impact of revenues from acquired businesses, partially offset by lower revenues from existing operations, due to a

6% decline in closed units and lower franchise revenues. EBIT of $139 million in 2014 were unchanged from 2013 as the

increases in EBIT from acquired businesses were offset by lower EBIT from existing businesses and higher operating expenses

related to “Berkshire Hathaway HomeServices” rebranding activities.

Real estate brokerage revenues in 2013 increased $489 million (37%) over 2012, while EBIT increased $57 million

(70%) versus 2012. The increases in revenues and EBIT were attributable to increases in closed brokerage transactions and

higher average home sales prices from existing business and the impact of businesses acquired during the previous two years.

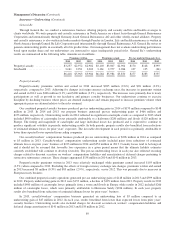

Corporate interest and income taxes

Corporate interest includes interest on unsecured debt issued by BHE and borrowings from certain Berkshire insurance

subsidiaries. In 2014, corporate interest expense increased due to new borrowings in connection with the NV Energy and

AltaLink acquisitions. BHE’s consolidated effective income tax rates were 23% in 2014, 7% in 2013 and 9% in 2012. In each

year, BHE’s income tax rates reflect significant production tax credits from wind-powered electricity generation in the United

States. In addition, pre-tax earnings of Northern Powergrid are taxed at a lower statutory tax rate in the United Kingdom

compared to the statutory tax rate in the United States. BHE’s effective rate was reduced in 2013 due to a reduction of deferred

income tax liabilities as a result of enacted statutory income tax rate decreases in the United Kingdom.

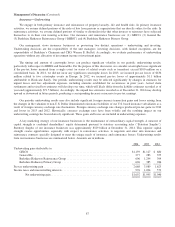

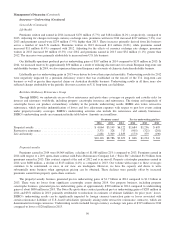

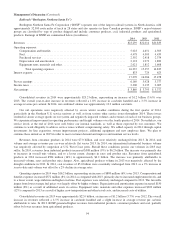

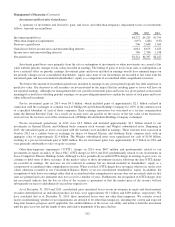

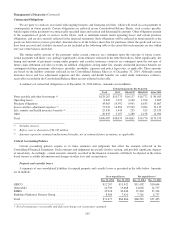

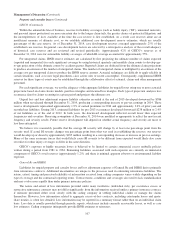

Manufacturing, Service and Retailing

A summary of revenues and earnings of our manufacturing, service and retailing businesses follows. Amounts are

in millions.

Revenues Earnings

2014 2013 2012 2014 2013 2012

McLane Company ........................................ $46,640 $45,930 $37,437 $ 435 $ 486 $ 403

Manufacturing ........................................... 36,773 34,258 32,105 4,811 4,205 3,911

Service ................................................. 9,854 8,996 8,175 1,202 1,093 966

Retailing ............................................... 4,422 4,288 3,715 344 376 306

$97,689 $93,472 $81,432

Pre-tax earnings .......................................... 6,792 6,160 5,586

Income taxes and noncontrolling interests ..................... 2,324 2,283 2,229

$4,468 $3,877 $3,357

97