Berkshire Hathaway 2014 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2014 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

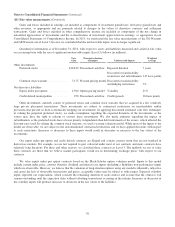

Notes to Consolidated Financial Statements (Continued)

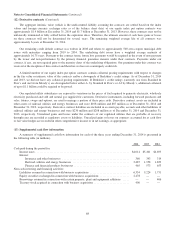

(19) Common stock

Changes in Berkshire’s issued, treasury and outstanding common stock during the three years ending December 31, 2014

are shown in the table below.

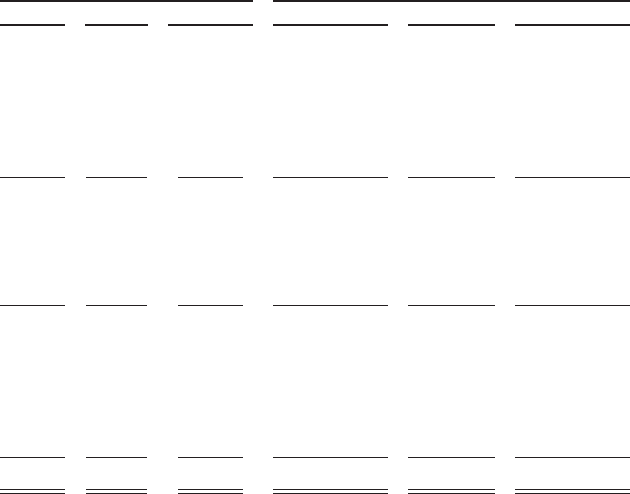

Class A, $5 Par Value

(1,650,000 shares authorized)

Class B, $0.0033 Par Value

(3,225,000,000 shares authorized)

Issued Treasury Outstanding Issued Treasury Outstanding

Balance at December 31, 2011 ............. 938,342 (98) 938,244 1,069,645,361 (801,985) 1,068,843,376

Conversions of Class A common stock to

Class B common stock and exercises of

replacement stock options issued in a

business acquisition .................... (33,814) — (33,814) 53,748,595 — 53,748,595

Treasury shares acquired .................. — (9,475) (9,475) — (606,499) (606,499)

Balance at December 31, 2012 ............. 904,528 (9,573) 894,955 1,123,393,956 (1,408,484) 1,121,985,472

Conversions of Class A common stock to

Class B common stock and exercises of

replacement stock options issued in a

business acquisition .................... (35,912) — (35,912) 55,381,136 — 55,381,136

Balance at December 31, 2013 ............. 868,616 (9,573) 859,043 1,178,775,092 (1,408,484) 1,177,366,608

Conversions of Class A common stock to

Class B common stock and exercises of

replacement stock options issued in a

business acquisition .................... (30,597) — (30,597) 47,490,158 — 47,490,158

Treasury shares acquired .................. — (2,107) (2,107) — (1,278) (1,278)

Balance at December 31, 2014 ............. 838,019 (11,680) 826,339 1,226,265,250 (1,409,762) 1,224,855,488

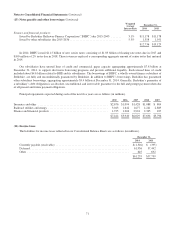

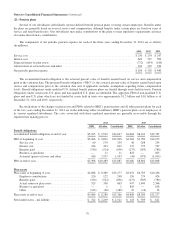

Each Class A common share is entitled to one vote per share. Class B common stock possesses dividend and distribution

rights equal to one-fifteen-hundredth (1/1,500) of such rights of Class A common stock. Each Class B common share possesses

voting rights equivalent to one-ten-thousandth (1/10,000) of the voting rights of a Class A share. Unless otherwise required

under Delaware General Corporation Law, Class A and Class B common shares vote as a single class. Each share of Class A

common stock is convertible, at the option of the holder, into 1,500 shares of Class B common stock. Class B common stock is

not convertible into Class A common stock. On an equivalent Class A common stock basis, there were 1,642,909 shares

outstanding as of December 31, 2014 and 1,643,954 shares outstanding as of December 31, 2013. In addition to our common

stock, 1,000,000 shares of preferred stock are authorized, but none are issued and outstanding.

Berkshire’s Board of Directors (“Berkshire’s Board”) has approved a common stock repurchase program under which

Berkshire may repurchase its Class A and Class B shares at prices no higher than a 20% premium over the book value of the

shares. Berkshire may repurchase shares in the open market or through privately negotiated transactions. Berkshire’s Board

authorization does not specify a maximum number of shares to be repurchased. However, repurchases will not be made if they

would reduce Berkshire’s consolidated cash and cash equivalent holdings below $20 billion. The repurchase program does not

obligate Berkshire to repurchase any dollar amount or number of Class A or Class B shares and there is no expiration date to the

program. There were no share repurchases under the program in 2014. However, on June 30, 2014, we exchanged

approximately 1.62 million shares of GHC common stock for WPLG, whose assets included 2,107 shares of Berkshire

Hathaway Class A Common Stock and 1,278 shares of Class B Common Stock. The Berkshire shares are reflected as treasury

stock in our Consolidated Financial Statements.

77