Berkshire Hathaway 2014 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2014 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (Continued)

(22) Contingencies and Commitments (Continued)

On November 13, 2014 Berkshire entered into a definitive agreement with Procter & Gamble Company (“P&G”) whereby

it will acquire the Duracell battery business from P&G. Pursuant to the agreement, in exchange for a recapitalized Duracell

Company, which will include approximately $1.7 billion in cash at closing, P&G will receive shares of its common stock

currently held by Berkshire subsidiaries having a fair value at December 31, 2014 of approximately $4.8 billion. The transaction

is expected to close in the second half of 2015 and is subject to obtaining various regulatory approvals as well as certain other

customary closing conditions.

We own a 50% interest in a joint venture, Berkadia Commercial Mortgage LLC (“Berkadia”), with Leucadia National

Corporation (“Leucadia”) owning the other 50% interest. Berkadia is a servicer of commercial real estate loans in the U.S.,

performing primary, master and special servicing functions for U.S. government agency programs, commercial mortgage-

backed securities transactions, banks, insurance companies and other financial institutions. A significant source of funding for

Berkadia’s operations is through the issuance of commercial paper. Repayment of the commercial paper is supported by a $2.5

billion surety policy issued by a Berkshire insurance subsidiary. Leucadia has agreed to indemnify us for one-half of any losses

incurred under the policy. As of December 31, 2014, the aggregate amount of Berkadia commercial paper outstanding was

$2.47 billion.

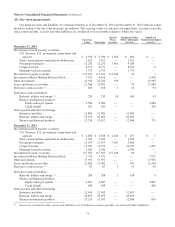

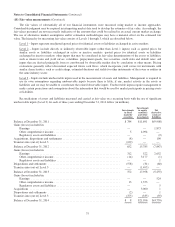

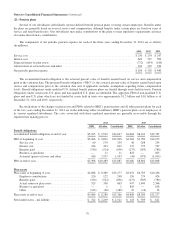

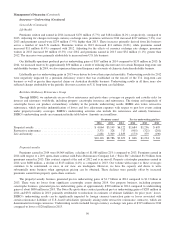

(23) Business segment data

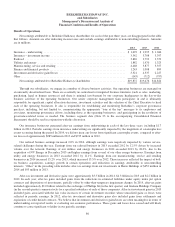

Our operating businesses include a large and diverse group of insurance, finance, manufacturing, service and retailing

businesses. Our reportable business segments are organized in a manner that reflects how management views those business

activities. Certain businesses have been grouped together for segment reporting based upon similar products or product lines,

marketing, selling and distribution characteristics, even though those business units are operated under separate local management.

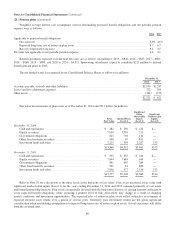

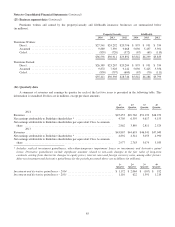

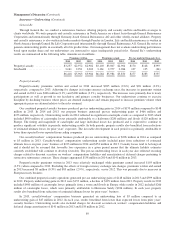

The tabular information that follows shows data of reportable segments reconciled to amounts reflected in our

Consolidated Financial Statements. Intersegment transactions are not eliminated when management considers those transactions

in assessing the results of the respective segments. Furthermore, our management does not consider investment and derivative

gains/losses or amortization of purchase accounting adjustments related to Berkshire’s acquisition in assessing the performance

of reporting units. Collectively, these items are included in reconciliations of segment amounts to consolidated amounts.

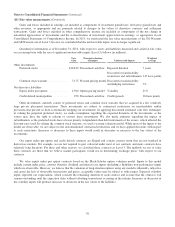

Business Identity Business Activity

GEICO Underwriting private passenger automobile insurance mainly

by direct response methods

General Re Underwriting excess-of-loss, quota-share and facultative

reinsurance worldwide

Berkshire Hathaway Reinsurance Group Underwriting excess-of-loss and quota-share reinsurance for

insurers and reinsurers

Berkshire Hathaway Primary Group Underwriting multiple lines of property and casualty

insurance policies for primarily commercial accounts

BNSF Operates one of the largest railroad systems in North

America

Berkshire Hathaway Energy Regulated electric and gas utility, including power

generation and distribution activities, and domestic real

estate brokerage and brokerage franchisor

McLane Company Wholesale distribution of groceries and non-food items

Manufacturing Manufacturers of numerous products including industrial and

end-user products, building products and apparel

Service and retailing Providers of numerous services including fractional aircraft

ownership programs, aviation pilot training, electronic

components distribution and retailing

Finance and financial products Manufactured housing and related consumer financing;

transportation equipment, manufacturing and leasing; and

furniture leasing

82