Berkshire Hathaway 2014 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2014 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Management’s Discussion (Continued)

Manufacturing, Service and Retailing (Continued)

Service

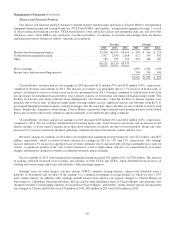

Our service businesses include NetJets, the world’s leading provider of fractional ownership programs for general aviation

aircraft and FlightSafety, a provider of high technology training to operators of aircraft. Among the other businesses included in

this group are: TTI, a leading electronic components distributor; Business Wire, a leading distributor of corporate news,

multimedia and regulatory filings; Dairy Queen, which licenses and services a system of over 6,500 stores that offer prepared

dairy treats and food; Buffalo News and the BH Media Group (“BH Media”), which includes the Omaha World-Herald, as well

as 28 other daily newspapers and numerous other publications; and WPLG (acquired June 30, 2014), which operates a television

station in Miami, Florida.

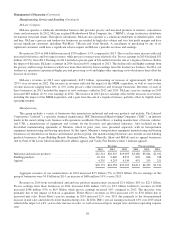

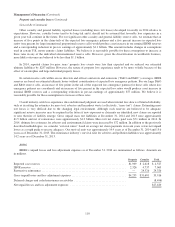

Revenues of our service businesses in 2014 were approximately $9.85 billion, representing an increase of $858 million

(9.5%) over 2013. The increase in revenues was primarily attributable to comparative increases generated by NetJets, TTI, and

FlightSafety. The revenue increase at NetJets reflected increased flight services revenues, which was attributable to increased

flight hours as well as increased fractional aircraft sales. TTI’s revenue increase was driven by higher unit volume and, to a

lesser extent, by bolt-on acquisitions. FlightSafety’s revenue increase was primarily due to increased simulator training hours.

Pre-tax earnings of our service businesses in 2014 aggregated $1.2 billion, an increase of $109 million (10%) versus 2013. The

increase in year-to-date earnings was primarily attributable to NetJets and TTI and was primarily due to the aforementioned

increases in revenues. In addition, NetJets’ earnings increase was also due to comparatively lower aircraft impairment and

restructuring charges and financing expenses, which were partially offset by higher depreciation expense, maintenance costs and

subcontracted flight expenses.

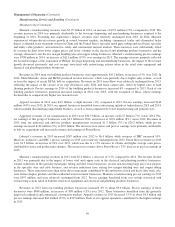

Revenues of our service businesses in 2013 were $9.0 billion, an increase of $821 million (10%) over revenues in 2012. In

2013, revenues of NetJets increased $288 million (7.5%), driven by higher sales of fractional aircraft shares, while TTI’s

revenues increased $255 million (11%) over 2012. Revenues of BH Media increased $207 million (66%), attributable to the

impact of business acquisitions. Pre-tax earnings of $1.1 billion in 2013 increased $127 million (13%) compared to 2012. The

increase in earnings was primarily attributable to BH Media, FlightSafety, TTI and NetJets. The earnings increase of BH Media

was due to bolt-on acquisitions. TTI’s earnings increased 10% due to higher sales and changes in product mix. FlightSafety’s

earnings increased 11%, reflecting increased training revenues and relatively unchanged operating expenses. NetJets’ earnings

increased 7% as improved flight operations margins, fractional sales margins and reduced net financing costs more than offset

an increase in aircraft impairment charges.

Retailing

Our retailing operations consist of four home furnishings businesses (Nebraska Furniture Mart, R.C. Willey, Star Furniture

and Jordan’s), three jewelry businesses (Borsheims, Helzberg and Ben Bridge), See’s Candies, Pampered Chef, a direct seller of

high quality kitchen tools and Oriental Trading Company (“OTC”), a direct retailer of party supplies, school supplies and toys

and novelties.

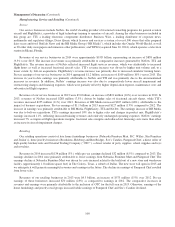

Revenues in 2014 increased $134 million (3%), while pre-tax earnings declined $32 million (8.5%) compared to 2013. The

earnings declines in 2014 were primarily attributable to lower earnings from Nebraska Furniture Mart and Pampered Chef. The

earnings decline at Nebraska Furniture Mart was driven by costs incurred related to the build-out of a new store and warehouse

facility (approximately 1.8 million square feet) in The Colony, Texas, a suburb of Dallas. The new store will open in 2015 and

we anticipate it will generate meaningful revenues and earnings in the future. The decline in earnings of Pampered Chef resulted

from lower sales.

Revenues of our retailing businesses in 2013 were $4.3 billion, an increase of $573 million (15%) over 2012. Pre-tax

earnings of these businesses increased $70 million (23%) as compared to earnings in 2012. The comparative increases in

revenues and earnings were primarily attributable to the inclusion of OTC for the full year in 2013. Otherwise, earnings of the

home furnishings and jewelry retail groups increased while earnings of Pampered Chef and See’s Candies declined.

100