Berkshire Hathaway 2014 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2014 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (Continued)

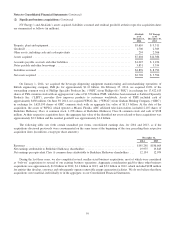

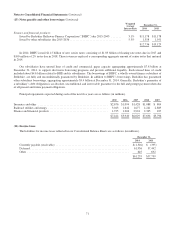

(3) Investments in fixed maturity securities (Continued)

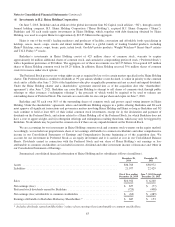

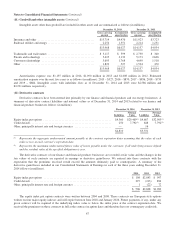

The amortized cost and estimated fair value of securities with fixed maturities at December 31, 2014 are summarized

below by contractual maturity dates. Actual maturities will differ from contractual maturities because issuers of certain of the

securities retain early call or prepayment rights. Amounts are in millions.

Due in one

year or less

Due after one

year through

five years

Due after five

years through

ten years

Due after

ten years

Mortgage-backed

securities Total

Amortized cost ........................... $7,650 $11,341 $2,782 $2,695 $1,555 $26,023

Fair value ............................... 7,585 11,994 3,009 3,295 1,753 27,636

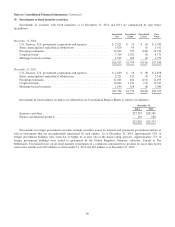

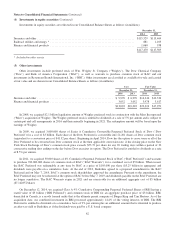

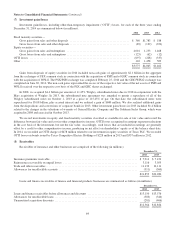

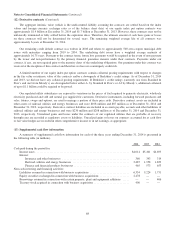

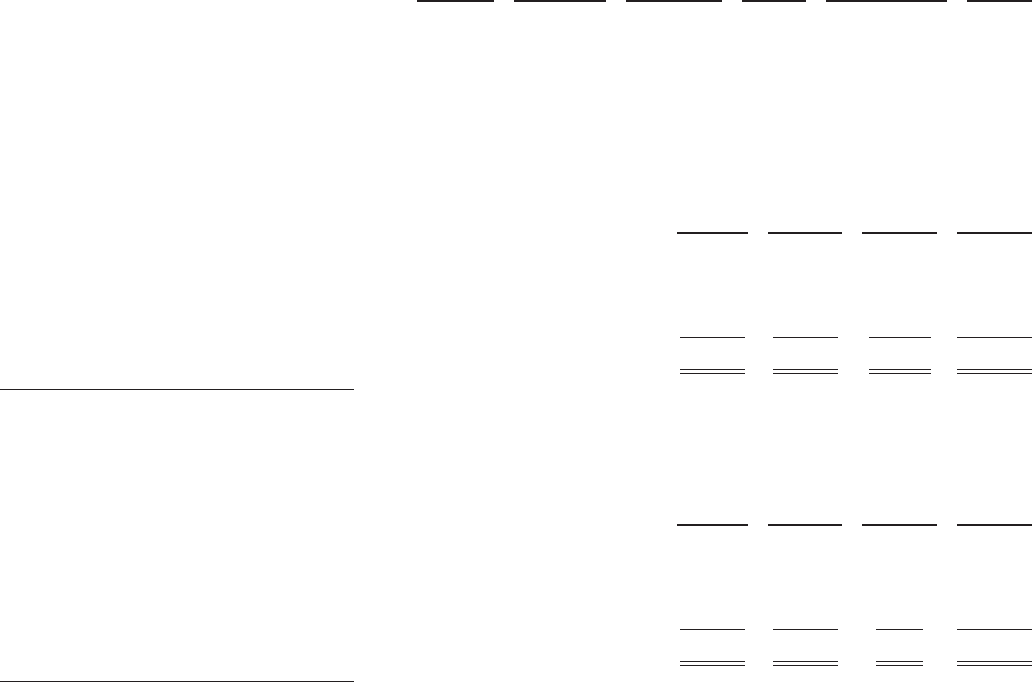

(4) Investments in equity securities

Investments in equity securities as of December 31, 2014 and 2013 are summarized based on the primary industry of the

investee in the table below (in millions).

Cost Basis

Unrealized

Gains

Unrealized

Losses

Fair

Value

December 31, 2014 *

Banks, insurance and finance .......................................... $22,495 $33,170 $ — $ 55,665

Consumer products .................................................. 6,951 18,389 (1) 25,339

Commercial, industrial and other ....................................... 28,924 8,578 (1,036) 36,466

$58,370 $60,137 $(1,037) $117,470

* Approximately 59% of the aggregate fair value was concentrated in the equity securities of four companies (American

Express Company – $14.1 billion; Wells Fargo & Company – $26.5 billion; International Business Machines Corporation –

$12.3 billion; and The Coca-Cola Company – $16.9 billion).

Cost Basis

Unrealized

Gains

Unrealized

Losses

Fair

Value

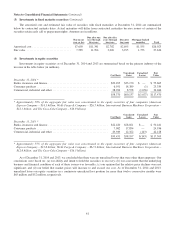

December 31, 2013 *

Banks, insurance and finance .......................................... $22,420 $28,021 $ — $ 50,441

Consumer products .................................................. 7,082 17,854 — 24,936

Commercial, industrial and other ....................................... 29,949 12,322 (143) 42,128

$59,451 $58,197 $(143) $117,505

* Approximately 55% of the aggregate fair value was concentrated in the equity securities of four companies (American

Express Company – $13.8 billion; Wells Fargo & Company – $21.9 billion; International Business Machines Corporation –

$12.8 billion; and The Coca-Cola Company – $16.5 billion).

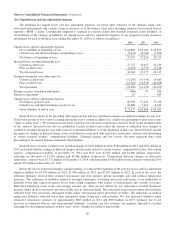

As of December 31, 2014 and 2013, we concluded that there were no unrealized losses that were other than temporary. Our

conclusions were based on: (a) our ability and intent to hold the securities to recovery; (b) our assessment that the underlying

business and financial condition of each of these issuers was favorable; (c) our opinion that the relative price declines were not

significant; and (d) our belief that market prices will increase to and exceed our cost. As of December 31, 2014 and 2013,

unrealized losses on equity securities in a continuous unrealized loss position for more than twelve consecutive months were

$65 million and $52 million, respectively.

61