Berkshire Hathaway 2014 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2014 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Year at Berkshire

It was a good year for Berkshire on all major fronts, except one. Here are the important developments:

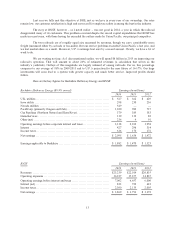

‹Our “Powerhouse Five” – a collection of Berkshire’s largest non-insurance businesses – had a record $12.4

billion of pre-tax earnings in 2014, up $1.6 billion from 2013.* The companies in this sainted group are

Berkshire Hathaway Energy (formerly MidAmerican Energy), BNSF, IMC (I’ve called it Iscar in the past),

Lubrizol and Marmon.

Of the five, only Berkshire Hathaway Energy, then earning $393 million, was owned by us a decade ago.

Subsequently we purchased another three of the five on an all-cash basis. In acquiring the fifth, BNSF, we

paid about 70% of the cost in cash and, for the remainder, issued Berkshire shares that increased the

number outstanding by 6.1%. In other words, the $12 billion gain in annual earnings delivered Berkshire by

the five companies over the ten-year span has been accompanied by only minor dilution. That satisfies our

goal of not simply increasing earnings, but making sure we also increase per-share results.

If the U.S. economy continues to improve in 2015, we expect earnings of our Powerhouse Five to improve

as well. The gain could reach $1 billion, in part because of bolt-on acquisitions by the group that have

already closed or are under contract.

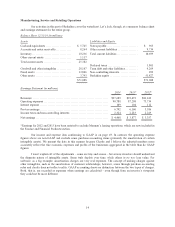

‹Our bad news from 2014 comes from our group of five as well and is unrelated to earnings. During the

year, BNSF disappointed many of its customers. These shippers depend on us, and service failures can

badly hurt their businesses.

BNSF is, by far, Berkshire’s most important non-insurance subsidiary and, to improve its performance, we

will spend $6 billion on plant and equipment in 2015. That sum is nearly 50% more than any other railroad

has spent in a single year and is a truly extraordinary amount, whether compared to revenues, earnings or

depreciation charges.

Though weather, which was particularly severe last year, will always cause railroads a variety of operating

problems, our responsibility is to do whatever it takes to restore our service to industry-leading levels. That

can’t be done overnight: The extensive work required to increase system capacity sometimes disrupts

operations while it is underway. Recently, however, our outsized expenditures are beginning to show

results. During the last three months, BNSF’s performance metrics have materially improved from last

year’s figures.

‹Our many dozens of smaller non-insurance businesses earned $5.1 billion last year, up from $4.7 billion in

2013. Here, as with our Powerhouse Five, we expect further gains in 2015. Within this group, we have two

companies that last year earned between $400 million and $600 million, six that earned between $250

million and $400 million, and seven that earned between $100 million and $250 million. This collection of

businesses will increase in both number and earnings. Our ambitions have no finish line.

‹Berkshire’s huge and growing insurance operation again operated at an underwriting profit in 2014 – that

makes 12 years in a row – and increased its float. During that 12-year stretch, our float – money that

doesn’t belong to us but that we can invest for Berkshire’s benefit – has grown from $41 billion to $84

billion. Though neither that gain nor the size of our float is reflected in Berkshire’s earnings, float

generates significant investment income because of the assets it allows us to hold.

* Throughout this letter, as well as in the “Golden Anniversary” letters included later in this report, all earnings are

stated on a pre-tax basis unless otherwise designated.

4