Berkshire Hathaway 2014 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2014 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (Continued)

(2) Significant business acquisitions (Continued)

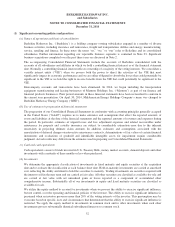

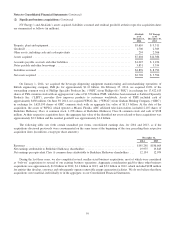

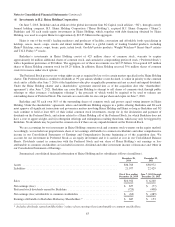

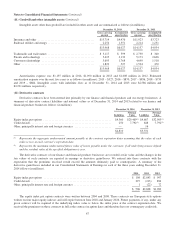

NV Energy’s and AltaLink’s assets acquired, liabilities assumed and residual goodwill at their respective acquisition dates

are summarized as follows (in millions).

AltaLink

as of

December 1,

2014

NV Energy

as of

December 19,

2013

Property, plant and equipment ......................................................... $5,610 $ 9,511

Goodwill ......................................................................... 1,700 2,369

Other assets, including cash and cash equivalents ......................................... 294 2,506

Assets acquired .................................................................... $7,604 $14,386

Accounts payable, accruals and other liabilities ........................................... $1,025 $ 3,456

Notes payable and other borrowings .................................................... 3,851 5,334

Liabilities assumed ................................................................. $4,876 $ 8,790

Net assets acquired ................................................................. $2,728 $ 5,596

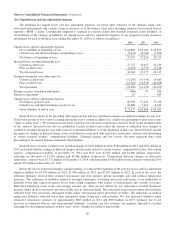

On January 1, 2014, we acquired the beverage dispensing equipment manufacturing and merchandising operations of

British engineering company, IMI plc for approximately $1.12 billion. On February 25, 2014, we acquired 100% of the

outstanding common stock of Phillips Specialty Products Inc. (“PSPI”) from Phillips 66 (“PSX”) in exchange for 17,422,615

shares of PSX common stock with an aggregate fair value of $1.35 billion. PSPI, which has been renamed as Lubrizol Specialty

Products Inc. (“LSPI”), provides flow improver products to customers worldwide. Assets of PSPI included cash of

approximately $450 million. On June 30, 2014, we acquired WPLG, Inc. (“WPLG”) from Graham Holding Company (“GHC”)

in exchange for 1,620,190 shares of GHC common stock with an aggregate fair value of $1.13 billion. At the date of the

acquisition, the assets of WPLG, which operates a Miami, Florida, ABC affiliated television station, included 2,107 shares of

Berkshire Hathaway Class A common stock, 1,278 shares of Berkshire Hathaway Class B common stock and cash of $328

million. At their respective acquisition dates, the aggregate fair value of the identified net assets related to these acquisitions was

approximately $2.2 billion and the residual goodwill was approximately $1.4 billion.

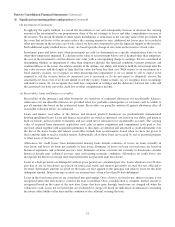

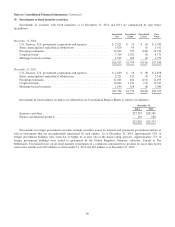

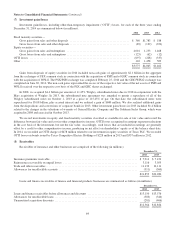

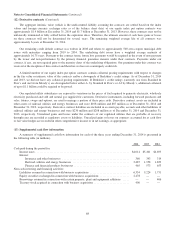

The following table sets forth certain unaudited pro forma consolidated earnings data for 2014 and 2013, as if the

acquisitions discussed previously were consummated on the same terms at the beginning of the year preceding their respective

acquisition dates (in millions, except per share amounts).

December 31,

2014 2013

Revenues ............................................................................ $195,298 $186,664

Net earnings attributable to Berkshire Hathaway shareholders .................................. 19,975 19,845

Net earnings per equivalent Class A common share attributable to Berkshire Hathaway shareholders . . . 12,154 12,074

During the last three years, we also completed several smaller-sized business acquisitions, most of which were considered

as “bolt-on” acquisitions to several of our existing business operations. Aggregate consideration paid for these other business

acquisitions was approximately $1.8 billion in 2014; $1.1 billion in 2013; and $3.2 billion in 2012, which included $438 million

for entities that develop, construct and subsequently operate renewable energy generation facilities. We do not believe that these

acquisitions were material, individually or in the aggregate, to our Consolidated Financial Statements.

59