Berkshire Hathaway 2014 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2014 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

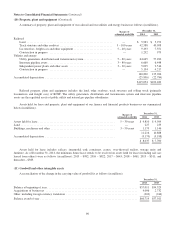

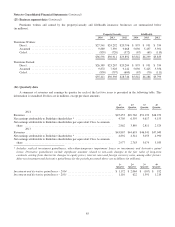

Notes to Consolidated Financial Statements (Continued)

(18) Fair value measurements (Continued)

Gains and losses included in earnings are included as components of investment gains/losses, derivative gains/losses and

other revenues, as appropriate and are primarily related to changes in the values of derivative contracts and settlement

transactions. Gains and losses included in other comprehensive income are included as components of the net change in

unrealized appreciation of investments and the reclassification of investment appreciation in earnings, as appropriate in our

Consolidated Statements of Comprehensive Income. In 2013, we transferred the fair value measurements of the GS Warrants

and GE Warrants out of Level 3 because we concluded that the unobservable inputs were no longer significant.

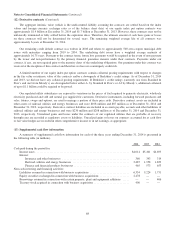

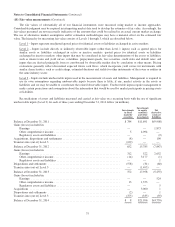

Quantitative information as of December 31, 2014, with respect to assets and liabilities measured and carried at fair value

on a recurring basis with the use of significant unobservable inputs (Level 3) follows (in millions).

Fair

value

Principal valuation

techniques Unobservable Inputs

Weighted

Average

Other investments:

Preferred stocks .................... $14,819 Discounted cash flow Expected duration 7 years

Discount for transferability

restrictions and subordination 147 basis points

Common stock warrants .............. 7,175 Warrant pricing model Discount for transferability

and hedging restrictions 7%

Net derivative liabilities:

Equity index put options ............. 4,560 Option pricing model Volatility 21%

Credit default municipalities .......... 250 Discounted cash flow Credit spreads 36 basis points

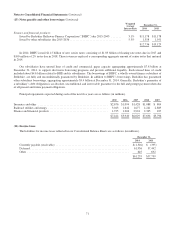

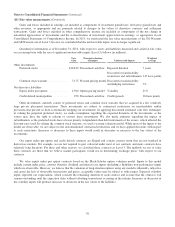

Other investments currently consist of preferred stocks and common stock warrants that we acquired in a few relatively

large private placement transactions. These investments are subject to contractual restrictions on transferability and/or

provisions that prevent us from economically hedging our investments. In applying discounted estimated cash flow techniques

in valuing the perpetual preferred stocks, we made assumptions regarding the expected durations of the investments, as the

issuers may have the right to redeem or convert these investments. We also made estimates regarding the impact of

subordination, as the preferred stocks have a lower priority in liquidation than debt instruments of the issuers, which affected the

discount rates used. In valuing the common stock warrants, we used a warrant valuation model. While most of the inputs to the

model are observable, we are subject to the aforementioned contractual restrictions and we have applied discounts with respect

to such restrictions. Increases or decreases to these inputs would result in decreases or increases to the fair values of the

investments.

Our equity index put option and credit default contracts are illiquid and contain contract terms that are not standard in

derivatives markets. For example, we are not required to post collateral under most of our contracts and many contracts have

relatively long durations. For these and other reasons, we classified these contracts as Level 3. The methods we use to value

these contracts are those that we believe market participants would use in determining exchange prices with respect to our

contracts.

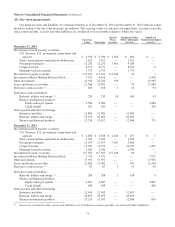

We value equity index put option contracts based on the Black-Scholes option valuation model. Inputs to this model

include current index price, contract duration, dividend and interest rate inputs (including a Berkshire non-performance input)

which are observable. However, we believe that the valuation of long-duration options using any model is inherently subjective

and, given the lack of observable transactions and prices, acceptable values may be subject to wide ranges. Expected volatility

inputs represent our expectations, which consider the remaining duration of each contract and assume that the contracts will

remain outstanding until the expiration dates without offsetting transactions occurring in the interim. Increases or decreases in

the volatility inputs will produce increases or decreases in the fair values of the liabilities.

76