Berkshire Hathaway 2014 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2014 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

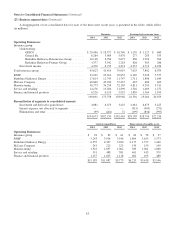

Management’s Discussion (Continued)

Insurance—Investment Income (Continued)

Investment income consists of interest and dividends earned on investments held by our insurance businesses. Pre-tax

investment income in 2014 was $4,357 million, representing a decline of $356 million (8%) versus 2013. The decline was

attributable to lower interest income from fixed maturity securities, partially offset by increased dividend income from equity

securities. The reduction in interest income reflected the maturities and dispositions during the last two years of several fixed

maturity securities with higher interest rates, including $4.4 billion par amount of Wrigley 11.45% subordinated notes as a result

of the repurchase of those notes by the issuer in 2013. Our insurance businesses continue to hold significant cash and cash

equivalent balances (approximately $42.8 billion as of December 31, 2014) earning very low yields. We believe that

maintaining ample liquidity is paramount and we insist on safety over yield with respect to cash and cash equivalents. The

increase in dividends earned reflected higher dividend rates for certain of our equity holdings. Beginning in 2015, investment

income will include dividends from our investment in Restaurant Brands International, Inc. Preferred Stock ($3 billion stated

value).

Pre-tax investment income in 2013 increased $259 million (5.8%) compared to 2012. The increase was primarily

attributable to increased dividend income on equity investments, which reflected increased dividend rates for certain of our

larger equity holdings as well as increased overall investments in equity securities.

Invested assets derive from shareholder capital and reinvested earnings as well as net liabilities under insurance contracts

or “float.” The major components of float are unpaid losses, life, annuity and health benefit liabilities, unearned premiums and

other liabilities to policyholders less premium and reinsurance receivables, deferred charges assumed under retroactive

reinsurance contracts and deferred policy acquisition costs. Float approximated $84 billion at December 31, 2014, $77 billion at

December 31, 2013, and $73 billion at December 31, 2012. The cost of float was negative over the last three years as our

insurance business generated pre-tax underwriting gains in each year.

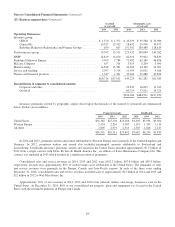

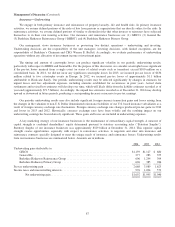

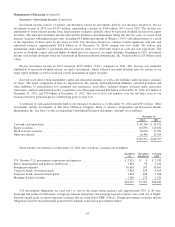

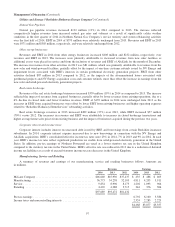

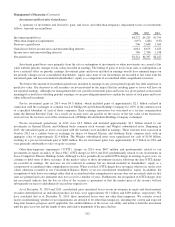

A summary of cash and investments held in our insurance businesses as of December 31, 2014 and 2013 follows. Other

investments include investments in The Dow Chemical Company, Bank of America Corporation and Restaurant Brands

International, Inc. See Note 5 to the accompanying Consolidated Financial Statements. Amounts are in millions.

December 31,

2014 2013

Cash and cash equivalents ............................................................... $ 42,760 $ 32,572

Equity securities ...................................................................... 114,876 114,832

Fixed maturity securities ................................................................ 26,010 27,059

Other investments ..................................................................... 16,346 12,334

$199,992 $186,797

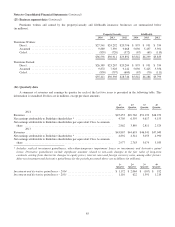

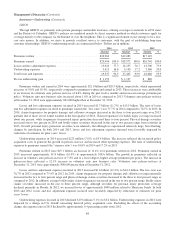

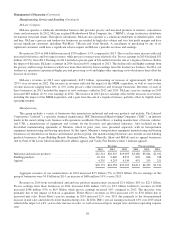

Fixed maturity investments as of December 31, 2014 were as follows. Amounts are in millions.

Amortized

cost

Unrealized

gains/losses

Carrying

value

U.S. Treasury, U.S. government corporations and agencies ............................ $ 2,921 $ 9 $ 2,930

States, municipalities and political subdivisions ..................................... 1,820 92 1,912

Foreign governments .......................................................... 10,620 247 10,867

Corporate bonds, investment grade ............................................... 5,826 639 6,465

Corporate bonds, non-investment grade ........................................... 1,878 428 2,306

Mortgage-backed securities ..................................................... 1,360 170 1,530

$24,425 $1,585 $26,010

U.S. government obligations are rated AA+ or Aaa by the major rating agencies and approximately 87% of all state,

municipal and political subdivisions, foreign government obligations and mortgage-backed securities were rated AA or higher.

Non-investment grade securities represent securities that are rated below BBB- or Baa3. Foreign government securities include

obligations issued or unconditionally guaranteed by national or provincial government entities.

93