Berkshire Hathaway 2014 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2014 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (Continued)

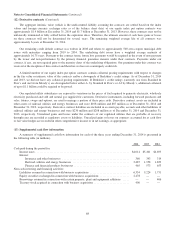

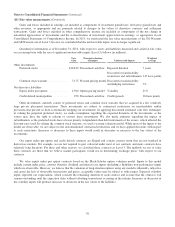

(15) Notes payable and other borrowings (Continued)

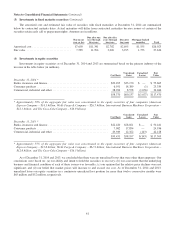

Weighted

Average

Interest Rate

December 31,

2014 2013

Finance and financial products:

Issued by Berkshire Hathaway Finance Corporation (“BHFC”) due 2015-2043 ....... 3.1% $11,178 $11,178

Issued by other subsidiaries due 2015-2036 .................................... 5.3% 1,558 1,951

$12,736 $13,129

In 2014, BHFC issued $1.15 billion of new senior notes consisting of $1.05 billion of floating rate notes due in 2017 and

$100 million of 2% notes due in 2018. These issuances replaced a corresponding aggregate amount of senior notes that matured

in 2014.

Our subsidiaries have unused lines of credit and commercial paper capacity aggregating approximately $7.8 billion at

December 31, 2014, to support short-term borrowing programs and provide additional liquidity. Such unused lines of credit

included about $4.6 billion related to BHE and its subsidiaries. The borrowings of BHFC, a wholly owned finance subsidiary of

Berkshire, are fully and unconditionally guaranteed by Berkshire. In addition to BHFC’s borrowings, Berkshire has guaranteed

other subsidiary borrowings, aggregating approximately $3.4 billion at December 31, 2014. Generally, Berkshire’s guarantee of

a subsidiary’s debt obligation is an absolute, unconditional and irrevocable guarantee for the full and prompt payment when due

of all present and future payment obligations.

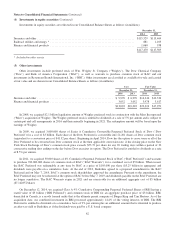

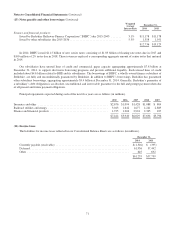

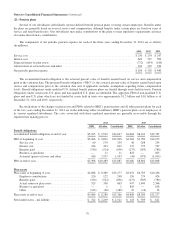

Principal repayments expected during each of the next five years are as follows (in millions).

2015 2016 2017 2018 2019

Insurance and other ................................................. $2,676 $1,094 $1,428 $1,088 $ 804

Railroad, utilities and energy .......................................... 3,043 1,642 1,677 4,241 2,885

Finance and financial products ......................................... 1,725 1,204 2,924 2,365 107

$7,444 $3,940 $6,029 $7,694 $3,796

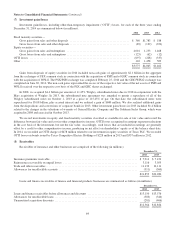

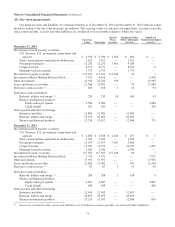

(16) Income taxes

The liabilities for income taxes reflected in our Consolidated Balance Sheets are as follows (in millions).

December 31,

2014 2013

Currently payable (receivable) ................................................... $(1,346) $ (395)

Deferred ..................................................................... 61,936 57,442

Other ....................................................................... 645 692

$61,235 $57,739

71