Berkshire Hathaway 2014 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2014 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

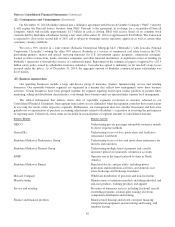

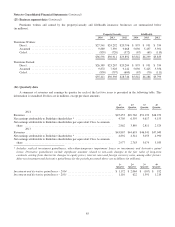

Notes to Consolidated Financial Statements (Continued)

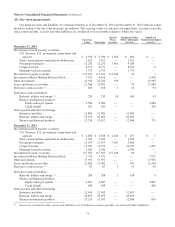

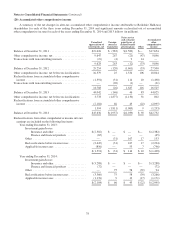

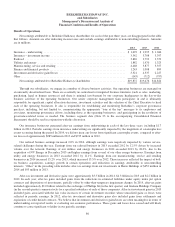

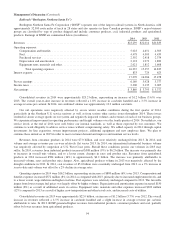

(23) Business segment data (Continued)

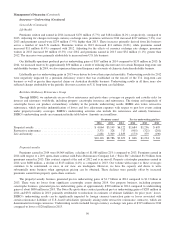

Goodwill

at year-end

Identifiable assets

at year-end

2014 2013 2014 2013 2012

Operating Businesses:

Insurance group:

GEICO ............................................... $ 1,370 $ 1,372 $ 45,439 $ 39,568 $ 30,986

General Re ............................................ 13,527 13,532 28,692 29,956 30,477

Berkshire Hathaway Reinsurance and Primary Groups .......... 650 607 151,301 138,480 118,819

Total insurance group ........................................ 15,547 15,511 225,432 208,004 180,282

BNSF .................................................... 14,819 14,819 62,916 59,842 56,839

Berkshire Hathaway Energy ................................... 9,599 7,784 71,482 62,189 46,856

McLane Company .......................................... 657 701 5,419 5,209 5,090

Manufacturing ............................................. 14,818 13,341 34,509 34,100 32,097

Service and retailing ......................................... 3,937 3,514 11,303 10,051 9,566

Finance and financial products ................................. 1,337 1,341 32,164 31,886 30,854

$60,714 $57,011 443,225 411,281 361,584

Reconciliation of segments to consolidated amount:

Corporate and other ..................................... 22,247 16,639 11,345

Goodwill .............................................. 60,714 57,011 54,523

$526,186 $484,931 $427,452

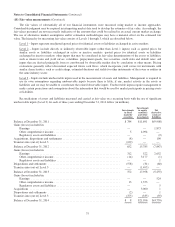

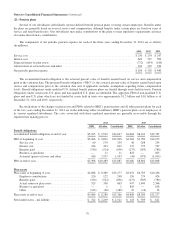

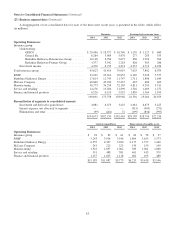

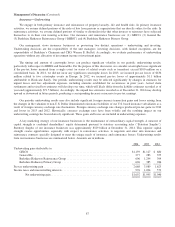

Insurance premiums written by geographic region (based upon the domicile of the insured or reinsured) are summarized

below. Dollars are in millions.

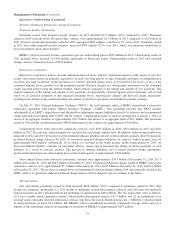

Property/Casualty Life/Health

2014 2013 2012 2014 2013 2012

United States ............................................ $31,362 $25,704 $23,186 $3,402 $3,934 $3,504

Western Europe .......................................... 2,424 2,234 4,387 1,135 1,339 1,114

All other ................................................ 2,805 2,973 2,319 1,305 1,026 1,217

$36,591 $30,911 $29,892 $5,842 $6,299 $5,835

In 2014 and 2013, premiums written and earned attributable to Western Europe were primarily in the United Kingdom and

Germany. In 2012, premiums written and earned also included meaningful amounts attributable to Switzerland and

Luxembourg. Life/health insurance premiums written and earned in the United States included approximately $1.5 billion in

2012 from a single contract with Swiss Re Life & Health America Inc., an affiliate of Swiss Reinsurance Company Ltd. This

contract was amended in 2013 which resulted in a significant return of premiums.

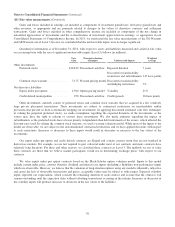

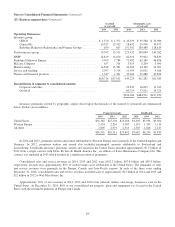

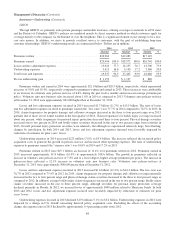

Consolidated sales and service revenues in 2014, 2013 and 2012 were $102.2 billion, $97.6 billion and $85.8 billion,

respectively. In each year, approximately 85% of such revenues were attributable to the United States. The remainder of sales

and service revenues were primarily in the Europe, Canada and Asia-Pacific regions. In each of the three years ending

December 31, 2014, consolidated sales and service revenues included sales of approximately $13 billion in 2014 and 2013 and

$12 billion in 2012 to Wal-Mart Stores, Inc.

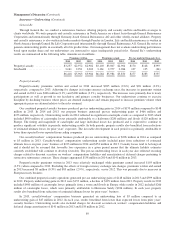

Approximately 96% of our revenues in 2014, 2013 and 2012 from railroad, utilities and energy businesses were in the

United States. At December 31, 2014, 88% of our consolidated net property, plant and equipment was located in the United

States with the remainder primarily in Europe and Canada.

84