Berkshire Hathaway 2014 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2014 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (Continued)

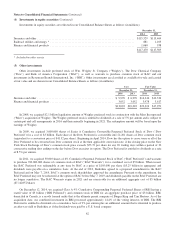

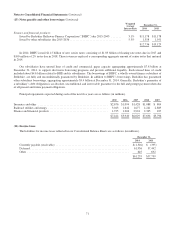

(8) Receivables (Continued)

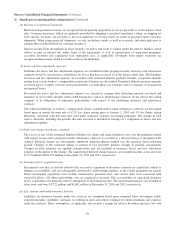

Loans and finance receivables are predominantly installment loans originated or acquired by our manufactured housing

business. Provisions for loan losses for 2014 and 2013 were $173 million and $249 million, respectively. Loan charge-offs, net

of recoveries, were $214 million in 2014 and $266 million in 2013. At December 31, 2014, approximately 97% of the loan

balances were evaluated collectively for impairment. As a part of the evaluation process, credit quality indicators are reviewed

and loans are designated as performing or non-performing. At December 31, 2014, approximately 98% of the loan balances

were determined to be performing and approximately 94% of the loan balances were current as to payment status.

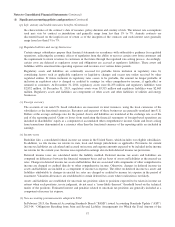

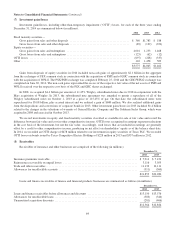

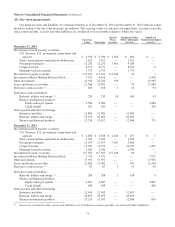

(9) Inventories

Inventories are comprised of the following (in millions).

December 31,

2014 2013

Raw materials ........................................................................... $ 1,881 $1,755

Work in process and other .................................................................. 850 842

Finished manufactured goods ............................................................... 3,333 3,206

Goods acquired for resale .................................................................. 4,172 4,057

$10,236 $9,860

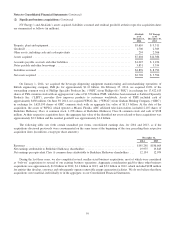

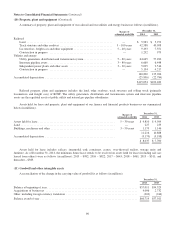

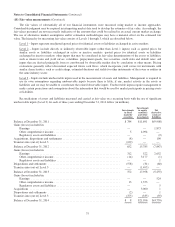

(10) Property, plant and equipment

A summary of property, plant and equipment of our insurance and other businesses follows (in millions).

Ranges of

estimated useful life

December 31,

2014 2013

Land ................................................................. — $ 1,171 $ 1,098

Buildings and improvements .............................................. 2–40years 6,600 6,244

Machinery and equipment ................................................ 3–25years 16,413 15,984

Furniture, fixtures and other .............................................. 2–18years 3,136 2,748

27,320 26,074

Accumulated depreciation ................................................ (13,167) (12,451)

$ 14,153 $ 13,623

65