Berkshire Hathaway 2014 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2014 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Management’s Discussion (Continued)

Financial Condition (Continued)

On December 1, 2014, BHE completed its acquisition of AltaLink, a regulated electric transmission-only company serving

customers in Alberta, Canada. BHE purchased AltaLink for cash of approximately C$3.1 (approximately $2.7 billion). The

acquisition was funded through loans from Berkshire’s insurance subsidiaries and the issuance of $1.5 billion of senior

unsecured notes due in 2020, 2025 and 2045.

Our railroad, utilities and energy businesses (conducted by BNSF and BHE) maintain very large investments in capital

assets (property, plant and equipment) and will regularly make significant capital expenditures in the normal course of business.

In 2014, aggregate capital expenditures of these businesses were approximately $11.8 billion, including $6.6 billion by BHE and

$5.2 billion by BNSF. BNSF and BHE forecast aggregate capital expenditures of approximately $12.3 billion in 2015. Future

capital expenditures are expected to be funded from cash flows from operations and debt issuances.

In 2014, BNSF issued $3.0 billion of senior unsecured debentures with maturities in 2024 and 2044. BNSF’s outstanding

debt was $19.3 billion as of December 31, 2014. Outstanding borrowings of BHE and its subsidiaries were approximately $36.3

billion as of December 31, 2014, which excludes borrowings from Berkshire insurance subsidiaries. BNSF and BHE have

aggregate debt and capital lease maturities in 2015 of about $3 billion. Berkshire’s commitment to provide additional capital to

BHE to permit the repayment of its debt obligations or to fund its regulated utility subsidiaries expired in 2014. Berkshire does

not guarantee the repayment of debt issued by BNSF, BHE or any of their subsidiaries and is not committed to provide capital

to support BHE or BNSF or any of their subsidiaries.

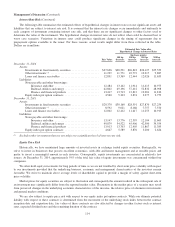

Finance and financial products assets were approximately $33.5 billion as of December 31, 2014 and $33.2 billion as of

December 31, 2013. Assets of these businesses consisted primarily of loans and finance receivables, cash and cash equivalents,

a portfolio of fixed maturity and equity investments, as well as a sizable portfolio of various types of equipment and furniture

held for lease. The carrying values of assets held for lease were approximately $7.3 billion at December 31, 2014 and $7.0

billion at December 31, 2013.

Finance and financial products liabilities were $18.9 billion as of December 31, 2014 and $19.8 billion as of December 31,

2013, which included notes payable and other borrowings of $12.7 billion and $13.1 billion, respectively. As of December 31,

2014, notes payable included $11.2 billion of notes issued by Berkshire Hathaway Finance Corporation (“BHFC”). In 2014,

BHFC issued $1.15 billion of senior unsecured notes to replace maturing notes. The new senior notes mature in 2017 and 2018.

An additional $1.0 billion of BHFC debt matured in January 2015 and at that time BHFC issued $1.0 billion of new senior notes

that mature in 2017 and 2018. The proceeds from the BHFC notes are used to fund originated loans and acquired loans of

Clayton Homes.

As described in Note 12 to the accompanying Consolidated Financial Statements, our finance and financial products

businesses are party to equity index put option and credit default contracts. With limited exception, these contracts contain no

collateral posting requirements under any circumstances, including changes in either the fair value or intrinsic value of the

contracts or a downgrade in Berkshire’s credit ratings. At December 31, 2014, the liabilities recorded for such contracts were

approximately $4.8 billion and we had no collateral posting requirements. The full and timely payment of principal and interest

on the BHFC notes and payment of amounts due at the expiration of the equity index put option and credit default contracts is

guaranteed by Berkshire.

We regularly access the credit markets, particularly through our railroad, utilities and energy and finance and financial

products businesses. Restricted access to credit markets at affordable rates in the future could have a significant negative impact

on our operations.

In 2010, the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Reform Act”) was signed into law. The

Reform Act reshapes financial regulations in the United States by creating new regulators, regulating new markets and market

participants and providing new enforcement powers to regulators. Virtually all major areas of the Reform Act have been subject

to extensive rulemaking proceedings being conducted both jointly and independently by multiple regulatory agencies, some of

which have been completed and others that are expected to be finalized during the next several months. Although the Reform

Act may adversely affect some of our business activities, it is not currently expected to have a material impact on our

consolidated financial results or financial condition.

104