Berkshire Hathaway 2014 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2014 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

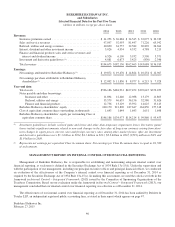

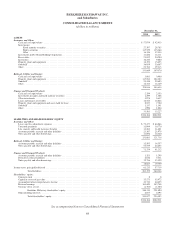

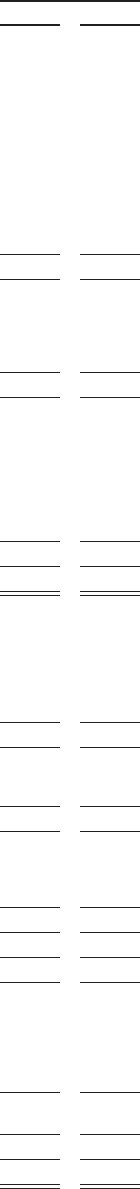

BERKSHIRE HATHAWAY INC.

and Subsidiaries

CONSOLIDATED BALANCE SHEETS

(dollars in millions)

December 31,

2014 2013

ASSETS

Insurance and Other:

Cash and cash equivalents ................................................................................... $ 57,974 $ 42,433

Investments:

Fixed maturity securities ................................................................................. 27,397 28,785

Equity securities ....................................................................................... 115,529 115,464

Other ................................................................................................ 16,346 12,334

Investments in H.J. Heinz Holding Corporation ................................................................... 11,660 12,111

Receivables ............................................................................................... 21,852 20,280

Inventories ................................................................................................ 10,236 9,860

Property, plant and equipment ................................................................................ 14,153 13,623

Goodwill ................................................................................................. 34,959 33,067

Other .................................................................................................... 23,763 19,113

333,869 307,070

Railroad, Utilities and Energy:

Cash and cash equivalents ................................................................................... 3,001 3,400

Property, plant and equipment ................................................................................ 115,054 102,482

Goodwill ................................................................................................. 24,418 22,603

Other .................................................................................................... 16,343 16,149

158,816 144,634

Finance and Financial Products:

Cash and cash equivalents ................................................................................... 2,294 2,353

Investments in equity and fixed maturity securities ................................................................ 1,299 1,506

Other investments .......................................................................................... 5,978 5,617

Loans and finance receivables ................................................................................ 12,566 12,826

Property, plant and equipment and assets held for lease ............................................................. 8,037 7,700

Goodwill ................................................................................................. 1,337 1,341

Other .................................................................................................... 1,990 1,884

33,501 33,227

$526,186 $484,931

LIABILITIES AND SHAREHOLDERS’ EQUITY

Insurance and Other:

Losses and loss adjustment expenses ........................................................................... $ 71,477 $ 64,866

Unearned premiums ........................................................................................ 11,944 10,770

Life, annuity and health insurance benefits ...................................................................... 13,261 11,681

Accounts payable, accruals and other liabilities ................................................................... 23,307 21,979

Notes payable and other borrowings ............................................................................ 11,894 12,440

131,883 121,736

Railroad, Utilities and Energy:

Accounts payable, accruals and other liabilities ................................................................... 15,595 14,557

Notes payable and other borrowings ............................................................................ 55,579 46,655

71,174 61,212

Finance and Financial Products:

Accounts payable, accruals and other liabilities ................................................................... 1,321 1,299

Derivative contract liabilities ................................................................................. 4,810 5,331

Notes payable and other borrowings ............................................................................ 12,736 13,129

18,867 19,759

Income taxes, principally deferred ................................................................................. 61,235 57,739

Total liabilities .................................................................................... 283,159 260,446

Shareholders’ equity:

Common stock ............................................................................................ 8 8

Capital in excess of par value ................................................................................. 35,573 35,472

Accumulated other comprehensive income ...................................................................... 42,732 44,025

Retained earnings .......................................................................................... 163,620 143,748

Treasury stock, at cost ....................................................................................... (1,763) (1,363)

Berkshire Hathaway shareholders’ equity ............................................................... 240,170 221,890

Noncontrolling interests ..................................................................................... 2,857 2,595

Total shareholders’ equity ............................................................................ 243,027 224,485

$526,186 $484,931

See accompanying Notes to Consolidated Financial Statements

48