Berkshire Hathaway 2014 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2014 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

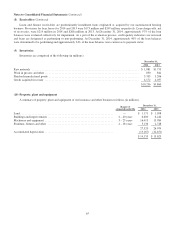

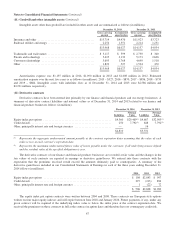

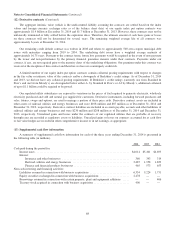

Notes to Consolidated Financial Statements (Continued)

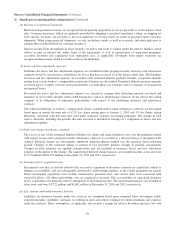

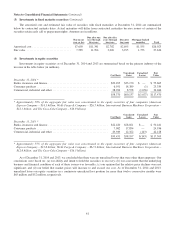

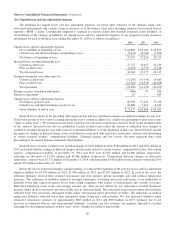

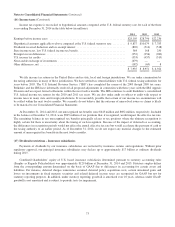

(7) Investment gains/losses

Investment gains/losses, including other-than-temporary impairment (“OTTI”) losses, for each of the three years ending

December 31, 2014 are summarized below (in millions).

2014 2013 2012

Fixed maturity securities—

Gross gains from sales and other disposals .......................................... $ 360 $1,783 $ 188

Gross losses from sales and other disposals .......................................... (89) (139) (354)

Equity securities—

Gross gains from sales and redemptions ............................................ 4,016 1,253 1,468

Gross losses from sales and redemptions ............................................ (125) (62) (12)

OTTI losses ...................................................................... (697) (228) (337)

Other ............................................................................ 110 1,458 509

$3,575 $4,065 $1,462

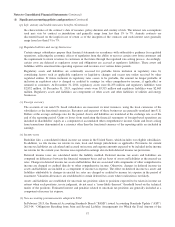

Gains from disposals of equity securities in 2014 included non-cash gains of approximately $2.1 billion in the aggregate

from the exchanges of PSX common stock in connection with the acquisition of PSPI and of GHC common stock in connection

with the acquisition of WPLG. The PSX/PSPI exchange was completed February 25, 2014 and the GHC/WPLG exchange was

completed on June 30, 2014. The non-cash gains represented the excess of the respective fair value of the net assets of PSPI and

WPLG received over the respective cost basis of the PSX and GHC shares exchanged.

In 2008, we acquired $4.4 billion par amount of 11.45% Wrigley subordinated notes due in 2018 in conjunction with the

Mars acquisition of Wrigley. In 2013, the subordinated note agreement was amended to permit a repurchase of all of the

Wrigley subordinated notes on October 1, 2013 at a price of 115.45% of par. On that date, the subordinated notes were

repurchased for $5.08 billion, plus accrued interest and we realized a gain of $680 million. We also realized additional gains

from the dispositions and conversions of corporate bonds in 2013. Other investment gains/losses in 2013 included $1.4 billion

related to the changes in the valuations of warrants of General Electric Company and The Goldman Sachs Group, which were

acquired in 2008 and exercised in October 2013.

We record investments in equity and fixed maturity securities classified as available-for-sale at fair value and record the

difference between fair value and cost in other comprehensive income. OTTI losses recognized in earnings represent reductions

in the cost basis of the investment, but not the fair value. Accordingly, such losses that are included in earnings are generally

offset by a credit to other comprehensive income, producing no net effect on shareholders’ equity as of the balance sheet date.

In 2014, we recorded an OTTI charge of $678 million related to our investment in equity securities of Tesco PLC. We recorded

OTTI losses on bonds issued by Texas Competitive Electric Holdings of $228 million in 2013 and $337 million in 2012.

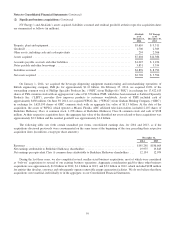

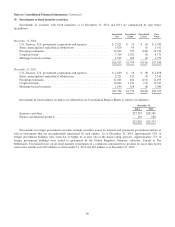

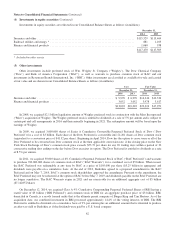

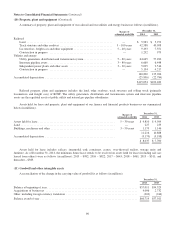

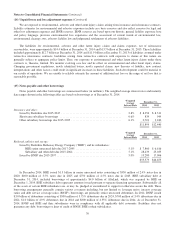

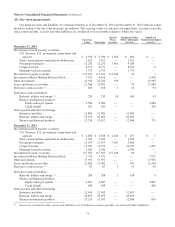

(8) Receivables

Receivables of insurance and other businesses are comprised of the following (in millions).

December 31,

2014 2013

Insurance premiums receivable ............................................................. $ 7,914 $ 7,474

Reinsurance recoverable on unpaid losses .................................................... 3,116 3,055

Trade and other receivables ................................................................ 11,133 10,111

Allowances for uncollectible accounts ....................................................... (311) (360)

$21,852 $20,280

Loans and finance receivables of finance and financial products businesses are summarized as follows (in millions).

December 31,

2014 2013

Loans and finance receivables before allowances and discounts ................................... $13,150 $13,576

Allowances for uncollectible loans .......................................................... (303) (344)

Unamortized acquisition discounts .......................................................... (281) (406)

$12,566 $12,826

64