Berkshire Hathaway 2014 Annual Report Download - page 59

Download and view the complete annual report

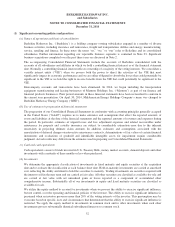

Please find page 59 of the 2014 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements (Continued)

(1) Significant accounting policies and practices (Continued)

(p) Life, annuity and health insurance benefits (Continued)

the characteristics of the contract’s date of issuance, policy duration and country of risk. The interest rate assumptions

used may vary by contract or jurisdiction and generally range from less than 1% to 7%. Annuity contracts are

discounted based on the implicit rate of return as of the inception of the contracts and such interest rates generally

range from less than 1% to 7%.

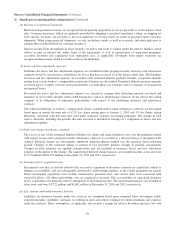

(q) Regulated utilities and energy businesses

Certain energy subsidiaries prepare their financial statements in accordance with authoritative guidance for regulated

operations, reflecting the economic effects of regulation from the ability to recover certain costs from customers and

the requirement to return revenues to customers in the future through the regulated rate-setting process. Accordingly,

certain costs are deferred as regulatory assets and obligations are accrued as regulatory liabilities. These assets and

liabilities will be amortized into operating expenses and revenues over various future periods.

Regulatory assets and liabilities are continually assessed for probable future inclusion in regulatory rates by

considering factors such as applicable regulatory or legislative changes and recent rate orders received by other

regulated entities. If future inclusion in regulatory rates ceases to be probable, the amount no longer probable of

inclusion in regulatory rates is charged or credited to earnings (or other comprehensive income, if applicable) or

returned to customers. At December 31, 2014, regulatory assets were $4,253 million and regulatory liabilities were

$2,832 million. At December 31, 2013, regulatory assets were $3,515 million and regulatory liabilities were $2,665

million. Regulatory assets and liabilities are components of other assets and other liabilities of utilities and energy

businesses.

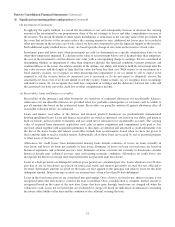

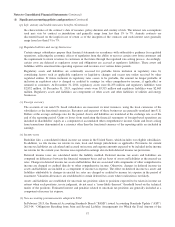

(r) Foreign currency

The accounts of our non-U.S. based subsidiaries are measured, in most instances, using the local currencies of the

subsidiaries as the functional currencies. Revenues and expenses of these businesses are generally translated into U.S.

Dollars at the average exchange rate for the period. Assets and liabilities are translated at the exchange rate as of the

end of the reporting period. Gains or losses from translating the financial statements of foreign-based operations are

included in shareholders’ equity as a component of accumulated other comprehensive income. Gains and losses arising

from transactions denominated in a currency other than the functional currency of the reporting entity are included in

earnings.

(s) Income taxes

Berkshire files a consolidated federal income tax return in the United States, which includes our eligible subsidiaries.

In addition, we file income tax returns in state, local and foreign jurisdictions as applicable. Provisions for current

income tax liabilities are calculated and accrued on income and expense amounts expected to be included in the income

tax returns for the current year. Income taxes reported in earnings also include deferred income tax provisions.

Deferred income taxes are calculated under the liability method. Deferred income tax assets and liabilities are

computed on differences between the financial statement bases and tax bases of assets and liabilities at the enacted tax

rates. Changes in deferred income tax assets and liabilities that are associated with components of other comprehensive

income are charged or credited directly to other comprehensive income. Otherwise, changes in deferred income tax

assets and liabilities are included as a component of income tax expense. The effect on deferred income tax assets and

liabilities attributable to changes in enacted tax rates are charged or credited to income tax expense in the period of

enactment. Valuation allowances are established for certain deferred tax assets where realization is not likely.

Assets and liabilities are established for uncertain tax positions taken or positions expected to be taken in income tax

returns when such positions, in our judgment, do not meet a “more-likely-than-not” threshold based on the technical

merits of the positions. Estimated interest and penalties related to uncertain tax positions are generally included as a

component of income tax expense.

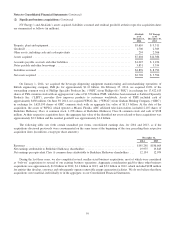

(t) New accounting pronouncements adopted in 2014

In February 2013, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”)

2013-04, “Obligations Resulting from Joint and Several Liability Arrangements for Which the Total Amount of the

57