Berkshire Hathaway 2014 Annual Report Download - page 7

Download and view the complete annual report

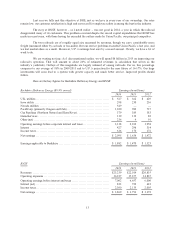

Please find page 7 of the 2014 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Meanwhile, our underwriting profit totaled $24 billion during the twelve-year period, including $2.7 billion

earned in 2014. And all of this began with our 1967 purchase of National Indemnity for $8.6 million.

‹While Charlie and I search for new businesses to buy, our many subsidiaries are regularly making bolt-on

acquisitions. Last year was particularly fruitful: We contracted for 31 bolt-ons, scheduled to cost $7.8

billion in aggregate. The size of these transactions ranged from $400,000 to $2.9 billion. However, the

largest acquisition, Duracell, will not close until the second half of this year. It will then be placed under

Marmon’s jurisdiction.

Charlie and I encourage bolt-ons, if they are sensibly-priced. (Most deals offered us aren’t.) They deploy

capital in activities that fit with our existing businesses and that will be managed by our corps of expert

managers. This means no more work for us, yet more earnings, a combination we find particularly

appealing. We will make many more of these bolt-on deals in future years.

‹Two years ago my friend, Jorge Paulo Lemann, asked Berkshire to join his 3G Capital group in the

acquisition of Heinz. My affirmative response was a no-brainer: I knew immediately that this partnership

would work well from both a personal and financial standpoint. And it most definitely has.

I’m not embarrassed to admit that Heinz is run far better under Alex Behring, Chairman, and Bernardo

Hees, CEO, than would be the case if I were in charge. They hold themselves to extraordinarily high

performance standards and are never satisfied, even when their results far exceed those of competitors.

We expect to partner with 3G in more activities. Sometimes our participation will only involve a financing

role, as was the case in the recent acquisition of Tim Hortons by Burger King. Our favored arrangement,

however, will usually be to link up as a permanent equity partner (who, in some cases, contributes to the

financing of the deal as well). Whatever the structure, we feel good when working with Jorge Paulo.

Berkshire also has fine partnerships with Mars and Leucadia, and we may form new ones with them or with

other partners. Our participation in any joint activities, whether as a financing or equity partner, will be

limited to friendly transactions.

‹In October, we contracted to buy Van Tuyl Automotive, a group of 78 automobile dealerships that is

exceptionally well-run. Larry Van Tuyl, the company’s owner, and I met some years ago. He then decided

that if he were ever to sell his company, its home should be Berkshire. Our purchase was recently

completed, and we are now “car guys.”

Larry and his dad, Cecil, spent 62 years building the group, following a strategy that made owner-partners

of all local managers. Creating this mutuality of interests proved over and over to be a winner. Van Tuyl is

now the fifth-largest automotive group in the country, with per-dealership sales figures that are

outstanding.

In recent years, Jeff Rachor has worked alongside Larry, a successful arrangement that will continue. There

are about 17,000 dealerships in the country, and ownership transfers always require approval by the

relevant auto manufacturer. Berkshire’s job is to perform in a manner that will cause manufacturers to

welcome further purchases by us. If we do this – and if we can buy dealerships at sensible prices – we will

build a business that before long will be multiples the size of Van Tuyl’s $9 billion of sales.

With the acquisition of Van Tuyl, Berkshire now owns 9

1

⁄

2

companies that would be listed on the Fortune

500 were they independent (Heinz is the

1

⁄

2

). That leaves 490

1

⁄

2

fish in the sea. Our lines are out.

5