Berkshire Hathaway 2014 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2014 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements (Continued)

(1) Significant accounting policies and practices (Continued)

(t) New accounting pronouncements adopted in 2014 (Continued)

Obligation Is Fixed at the Reporting Date.” ASU 2013-04 requires an entity to measure obligations resulting from joint

and several liability arrangements for which the total amount of the obligation is fixed at the reporting date as the

amount the reporting entity agreed to pay plus additional amounts the reporting entity expects to pay on behalf of its

co-obligors. We adopted ASU 2013-04 on January 1, 2014.

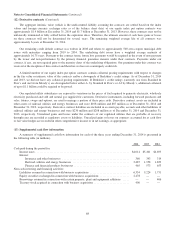

In January 2014, the FASB issued ASU 2014-01 “Accounting for Investments in Qualified Affordable Housing

Projects.” ASU 2014-01 permits an entity to elect the proportional amortization method of accounting for limited

liability investments in qualified affordable housing projects if certain criteria are met. Under the proportional

amortization method, the investment is amortized in proportion to the tax benefits received and the amortization charge

is reported as a component of income tax expense. We adopted ASU 2014-01 for eligible investments as of January 1,

2014. The adoption of ASU 2013-04 and ASU 2014-01 had an immaterial effect on our Consolidated Financial

Statements.

(u) New accounting pronouncements to be adopted subsequent to December 31, 2014

In April 2014, the FASB issued ASU 2014-08 “Reporting Discontinued Operations and Disclosures of Disposals of

Components of an Entity.” ASU 2014-08 provides a narrower definition of discontinued operations than under

previous U.S. GAAP. ASU 2014-08 requires that a disposal of components of an entity (or groups of components) be

reported as discontinued operations if the disposal represents a strategic shift that will have a major effect on the

reporting entity’s operations and financial results. ASU 2014-08 is effective prospectively for disposals (or

classifications of businesses as held-for-sale) of components of an entity that occur in annual or interim periods

beginning after December 15, 2014. We do not expect that the adoption of ASU 2014-08 will have a material effect on

our Consolidated Financial Statements.

In May 2014, the FASB issued ASU 2014-09 “Revenue from Contracts with Customers.” ASU 2014-09 applies to

most contracts with customers. However, insurance and leasing contracts are excluded from the scope of this

pronouncement. ASU 2014-09 prescribes a five step framework in accounting for revenues from contracts, including

(a) identification of the contract, (b) identification of the performance obligations under the contract, (c) determination

of the transaction price, (d) allocation of the transaction price to the identified performance obligations and

(e) recognition of revenues as the identified performance obligations are satisfied. ASU 2014-09 also prescribes

additional disclosures and financial statement presentations. ASU 2014-09 is effective for public entities in annual

reporting periods beginning after December 15, 2016. Early application is not permitted. ASU 2014-09 may be adopted

retrospectively or under a modified retrospective method where the cumulative effect is recognized at the date of initial

application. We are currently evaluating the effect the adoption of this standard will have on our Consolidated

Financial Statements.

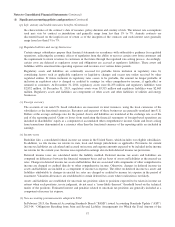

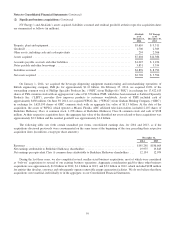

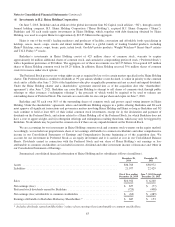

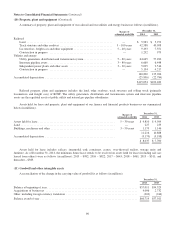

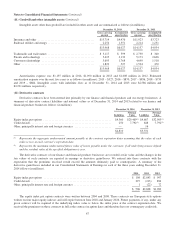

(2) Significant business acquisitions

Our long-held acquisition strategy is to acquire businesses at sensible prices that have consistent earning power, good

returns on equity and able and honest management.

On December 19, 2013, we acquired NV Energy, Inc. (“NV Energy”) through our 89.9% owned subsidiary, Berkshire

Hathaway Energy Company (“BHE”), for cash consideration of approximately $5.6 billion. NV Energy is an energy holding

company serving approximately 1.2 million electric and 0.2 million retail natural gas customers in Nevada. NV Energy’s

principal operating subsidiaries, Nevada Power Company and Sierra Pacific Power Company, are regulated utilities. NV

Energy’s financial results are included in our Consolidated Financial Statements beginning on the acquisition date.

On December 1, 2014, BHE acquired AltaLink, L.P. (“AltaLink”) for a cash purchase price of C$3.1 billion

(approximately $2.7 billion). AltaLink is a regulated electric transmission-only business, headquartered in Calgary, Alberta.

AltaLink’s financial results are included in our Consolidated Financial Statements beginning on the acquisition date.

58