Berkshire Hathaway 2014 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2014 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Management’s Discussion (Continued)

Insurance—Underwriting (Continued)

Berkshire Hathaway Reinsurance Group (Continued)

Property/casualty (Continued)

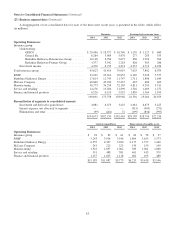

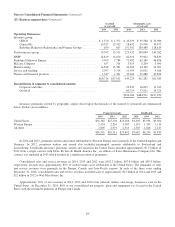

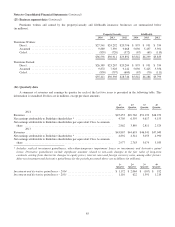

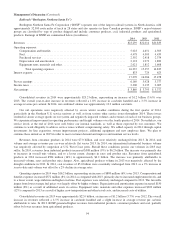

Premiums earned from property/casualty business in 2013 declined $973 million (16%) compared to 2012. Premiums

earned in 2013 from the Swiss Re quota-share contract were approximately $1.5 billion in 2013 compared to $3.4 billion in

2012. Property catastrophe premiums earned in 2013 aggregated $801 million, a decline of 2% versus 2012. Premiums earned

in 2013 from other property/casualty business, increased $981 million (52%) over 2012, which was primarily attributable to

increased property quota-share business.

BHRG’s property/casualty business generated a pre-tax underwriting gain of $695 million in 2012. Underwriting results in

2012 included losses incurred of $364 million attributable to Hurricane Sandy. Underwriting results in 2012 also included

foreign currency transaction losses of $123 million.

Retroactive reinsurance

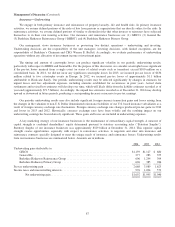

Retroactive reinsurance policies provide indemnification of losses and loss adjustment expenses with respect to past loss

events, and related claims are generally expected to be paid over long periods of time. Premiums and limits of indemnification

are often very large in amount. At the inception of a contract, deferred charge assets are recorded for the excess, if any, of the

estimated ultimate losses payable over the premiums earned. Deferred charges are subsequently amortized over the estimated

claims payment period using the interest method, which reflects estimates of the timing and amount of loss payments. The

original estimates of the timing and amount of loss payments are periodically analyzed against actual experience and revised

based on an actuarial evaluation of the expected remaining losses. Amortization charges and deferred charge adjustments

resulting from changes to the estimated timing and amount of future loss payments are included in periodic earnings.

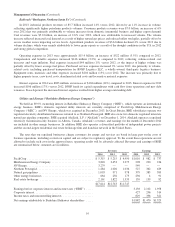

On July 17, 2014, National Indemnity Company (“NICO”), the lead insurance entity of BHRG, entered into a retroactive

reinsurance agreement with Liberty Mutual Insurance Company (“LMIC”). The agreement provides that NICO reinsure

substantially all of LMIC’s unpaid losses and allocated loss adjustment expense liabilities related to (a) asbestos and environmental

claims from policies incepting prior to 2005 and (b) workers’ compensation claims occurrences arising prior to January 1, 2014, in

excess of an aggregate retention of approximately $12.5 billion and subject to an aggregate limit of $6.5 billion. The premiums

earned in 2014 and the consideration paid to NICO with respect to this contract was approximately $3.0 billion.

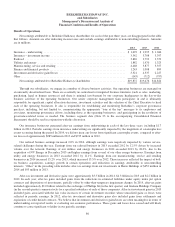

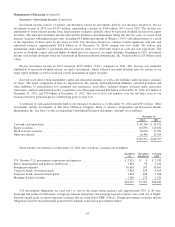

Underwriting losses from retroactive reinsurance policies were $905 million in 2014, $321 million in 2013 and $201

million in 2012. In each year, underwriting losses included deferred charge amortization. In addition, underwriting results were

impacted in 2014 and 2013 by increases in the estimated ultimate liabilities related to these policies, partially offset by increases

in related deferred charge balances. In 2014, we increased estimated ultimate liabilities for contracts written in prior years by

approximately $825 million, substantially all of which was recorded in the fourth quarter. In the fourth quarter of 2014, we

increased ultimate liability estimates on remaining asbestos claims and re-estimated the timing of future payments of such

liabilities as a result of actuarial analysis. The increase in ultimate liabilities, net of related deferred charge adjustments,

produced incremental pre-tax underwriting losses in the fourth quarter of approximately $500 million.

Gross unpaid losses from retroactive reinsurance contracts were approximately $24.3 billion at December 31, 2014, $17.7

billion at December 31, 2013 and $18.0 billion at December 31, 2012. Unamortized deferred charges related to BHRG’s retroactive

reinsurance contracts were approximately $7.7 billion at December 31, 2014, $4.25 billion at December 31, 2013 and $3.9 billion

at December 31, 2012. The increases in unpaid losses and unamortized deferred charges during 2014 were primarily related to the

LMIC contract. As previously indicated, deferred charge balances will be charged to pre-tax earnings in the future.

Life and annuity

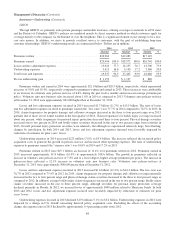

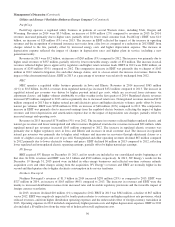

Life and annuity premiums earned in 2014 declined $628 million (19%) compared to premiums earned in 2013. The

decline was primarily attributable to a 22% decline in premiums earned from annuity contracts and also from two unusually

large transactions in 2013 which produced net premiums of approximately $400 million. The two transactions were as follows:

(1) a new variable annuity guarantee contract, which produced premiums earned of $1.7 billion, and (2) an amendment of an

existing yearly renewable term life reinsurance contract with Swiss Re Life & Health America Inc. (“SRLHA”), which resulted

in return premiums of about $1.3 billion. The SRLHA contract amendment essentially commuted coverage with respect to a

number of the underlying contracts in exchange for payments to SRLHA of approximately $675 million.

91