Berkshire Hathaway 2014 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2014 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion (Continued)

Property and casualty losses (Continued)

General Re (Continued)

Other casualty and general liability reported losses (excluding mass tort losses) developed favorably in 2014 relative to

expectations. However, casualty losses tend to be long-tail and it should not be assumed that favorable loss experience in a

given year will continue in the future. For our significant other casualty and general liability reserve cells, we estimate that an

increase of five points in the claim-tails of the expected loss emergence patterns and a five percent increase in expected loss

ratios (one percent for large international proportional reserve cells) would produce a net increase in our nominal IBNR reserves

and a corresponding reduction in pre-tax earnings of approximately $1.1 billion. This amount includes changes in assumptions

used in certain U.K. motor annuity claims liabilities. We believe it is reasonably possible for these assumptions to increase at

these rates in any of the individual aforementioned reserve cells. However, given the diversification in worldwide business,

more likely outcomes are believed to be less than $1.1 billion.

In 2014, reported claims for prior years’ property loss events were less than expected and we reduced our estimated

ultimate liabilities by $287 million. However, the nature of property loss experience tends to be more volatile because of the

effect of catastrophes and large individual property losses.

In certain reserve cells within excess directors and officers and errors and omissions (“D&O and E&O”) coverages, IBNR

reserves are based on estimated ultimate losses without consideration of expected loss emergence patterns. For our large D&O

and E&O reserve cells, an increase of five points in the tail of the expected loss emergence pattern (for those cells where loss

emergence patterns are considered) and an increase of five percent in the expected loss ratios would produce a net increase in

nominal IBNR reserves and a corresponding reduction in pre-tax earnings of approximately $77 million. We believe it is

reasonably possible for these assumptions to increase at these rates.

Overall industry-wide loss experience data and informed judgment are used when internal loss data is of limited reliability,

such as in setting the estimates for mass tort, asbestos and hazardous waste (collectively, “mass tort”) claims. Estimating mass

tort losses is very difficult due to the changing legal environment. Although such reserves are believed to be adequate,

significant reserve increases may be required in the future if new exposures or claimants are identified, new claims are reported

or new theories of liability emerge. Gross unpaid mass tort liabilities at December 31, 2014 and 2013 were approximately

$1.5 billion and net of reinsurance were approximately $1.2 billion. Mass tort net claims paid were $71 million in 2014. In

2014, ultimate loss estimates for asbestos and environmental claims were increased by $72 million. In addition to the previously

described methodologies, we consider “survival ratios” based on average net claim payments in recent years versus net unpaid

losses as a rough guide to reserve adequacy. Our survival ratio was approximately 14.9 years as of December 31, 2014 and 15.6

years as of December 31, 2013. The reinsurance industry’s survival ratio for asbestos and pollution liabilities was approximately

14.2 years as of December 31, 2013.

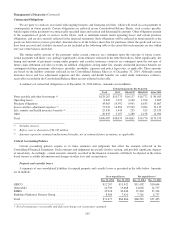

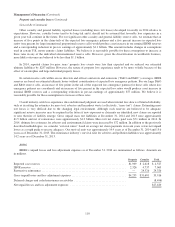

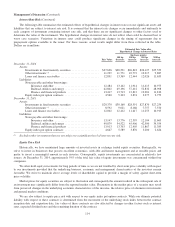

BHRG

BHRG’s unpaid losses and loss adjustment expenses as of December 31, 2014 are summarized as follows. Amounts are

in millions.

Property Casualty Total

Reported case reserves ........................................................... $1,909 $ 2,618 $ 4,527

IBNR reserves .................................................................. 2,326 4,737 7,063

Retroactive reinsurance ........................................................... — 24,326 24,326

Gross unpaid losses and loss adjustment expenses ...................................... $4,235 $31,681 35,916

Deferred charges and ceded reinsurance receivables .................................... (8,496)

Net unpaid losses and loss adjustment expenses ....................................... $27,420

110