Berkshire Hathaway 2014 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2014 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.If our premiums exceed the total of our expenses and eventual losses, we register an underwriting profit

that adds to the investment income our float produces. When such a profit is earned, we enjoy the use of free money

– and, better yet, get paid for holding it.

Unfortunately, the wish of all insurers to achieve this happy result creates intense competition, so

vigorous indeed that it frequently causes the P/C industry as a whole to operate at a significant underwriting loss.

This loss, in effect, is what the industry pays to hold its float. Competitive dynamics almost guarantee that the

insurance industry, despite the float income all its companies enjoy, will continue its dismal record of earning

subnormal returns on tangible net worth as compared to other American businesses. The prolonged period of low

interest rates our country is now dealing with causes earnings on float to decrease, thereby exacerbating the profit

problems of the industry.

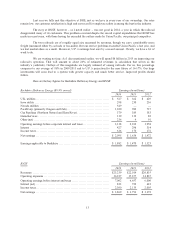

As noted in the first section of this report, Berkshire has now operated at an underwriting profit for

twelve consecutive years, our pre-tax gain for the period having totaled $24 billion. Looking ahead, I believe we

will continue to underwrite profitably in most years. Doing so is the daily focus of all of our insurance managers,

who know that while float is valuable, its benefits can be drowned by poor underwriting results. That message is

given at least lip service by all insurers; at Berkshire it is a religion.

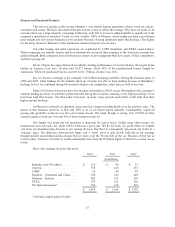

So how does our float affect intrinsic value? When Berkshire’s book value is calculated, the full amount

of our float is deducted as a liability, just as if we had to pay it out tomorrow and could not replenish it. But to think

of float as strictly a liability is incorrect; it should instead be viewed as a revolving fund. Daily, we pay old claims

and related expenses – a huge $22.7 billion to more than six million claimants in 2014 – and that reduces float. Just

as surely, we each day write new business and thereby generate new claims that add to float.

If our revolving float is both costless and long-enduring, which I believe it will be, the true value of this

liability is dramatically less than the accounting liability. Owing $1 that in effect will never leave the premises –

because new business is almost certain to deliver a substitute – is worlds different from owing $1 that will go out the

door tomorrow and not be replaced. The two types of liabilities are treated as equals, however, under GAAP.

A partial offset to this overstated liability is a $15.5 billion “goodwill” asset that we incurred in buying

our insurance companies and that increases book value. In very large part, this goodwill represents the price we paid

for the float-generating capabilities of our insurance operations. The cost of the goodwill, however, has no bearing

on its true value. For example, if an insurance company sustains large and prolonged underwriting losses, any

goodwill asset carried on the books should be deemed valueless, whatever its original cost.

Fortunately, that does not describe Berkshire. Charlie and I believe the true economic value of our

insurance goodwill – what we would happily pay for float of similar quality were we to purchase an insurance

operation possessing it – to be far in excess of its historic carrying value. Under present accounting rules (with

which we agree) this excess value will never be entered on our books. But I can assure you that it’s real. That’s one

reason – a huge reason – why we believe Berkshire’s intrinsic business value substantially exceeds its book value.

************

Berkshire’s attractive insurance economics exist only because we have some terrific managers running

disciplined operations that possess hard-to-replicate business models. Let me tell you about the major units.

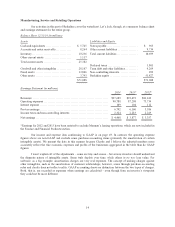

First by float size is the Berkshire Hathaway Reinsurance Group, managed by Ajit Jain. Ajit insures risks

that no one else has the desire or the capital to take on. His operation combines capacity, speed, decisiveness and,

most important, brains in a manner unique in the insurance business. Yet he never exposes Berkshire to risks that

are inappropriate in relation to our resources.

9