Berkshire Hathaway 2014 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2014 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

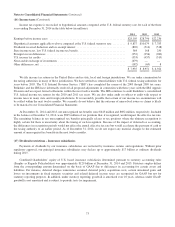

Notes to Consolidated Financial Statements (Continued)

(16) Income taxes (Continued)

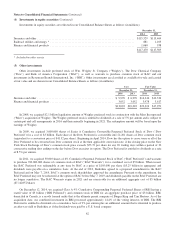

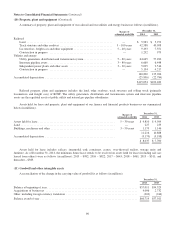

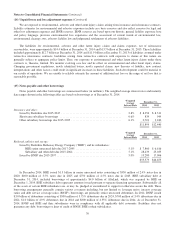

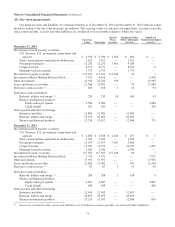

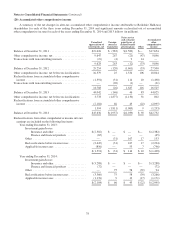

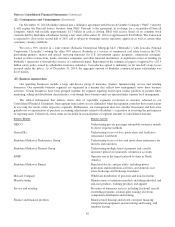

The tax effects of temporary differences that give rise to significant portions of deferred tax assets and deferred tax

liabilities are shown below (in millions).

December 31,

2014 2013

Deferred tax liabilities:

Investments – unrealized appreciation and cost basis differences .................... $26,633 $25,660

Deferred charges reinsurance assumed ......................................... 2,721 1,526

Property, plant and equipment ............................................... 34,618 32,409

Other ................................................................... 6,396 6,278

70,368 65,873

Deferred tax assets:

Unpaid losses and loss adjustment expenses .................................... (933) (817)

Unearned premiums ....................................................... (773) (682)

Accrued liabilities ......................................................... (3,575) (3,398)

Derivative contract liabilities ................................................ (206) (374)

Other ................................................................... (2,945) (3,160)

(8,432) (8,431)

Net deferred tax liability ........................................................ $61,936 $57,442

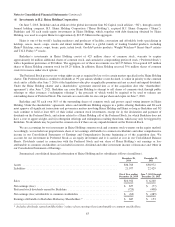

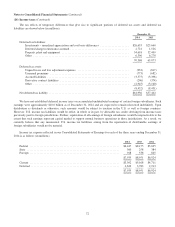

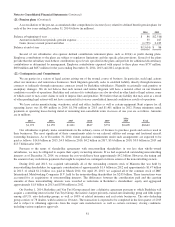

We have not established deferred income taxes on accumulated undistributed earnings of certain foreign subsidiaries. Such

earnings were approximately $10.0 billion as of December 31, 2014 and are expected to remain reinvested indefinitely. Upon

distribution as dividends or otherwise, such amounts would be subject to taxation in the U.S. as well as foreign countries.

However, U.S. income tax liabilities would be offset, in whole or in part, by allowable tax credits deriving from income taxes

previously paid to foreign jurisdictions. Further, repatriation of all earnings of foreign subsidiaries would be impracticable to the

extent that such earnings represent capital needed to support normal business operations in those jurisdictions. As a result, we

currently believe that any incremental U.S. income tax liabilities arising from the repatriation of distributable earnings of

foreign subsidiaries would not be material.

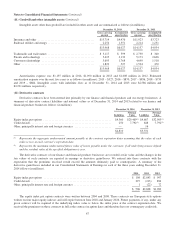

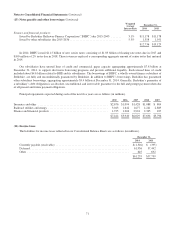

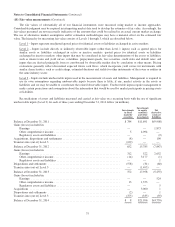

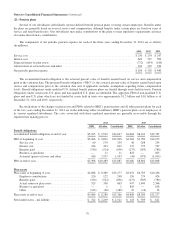

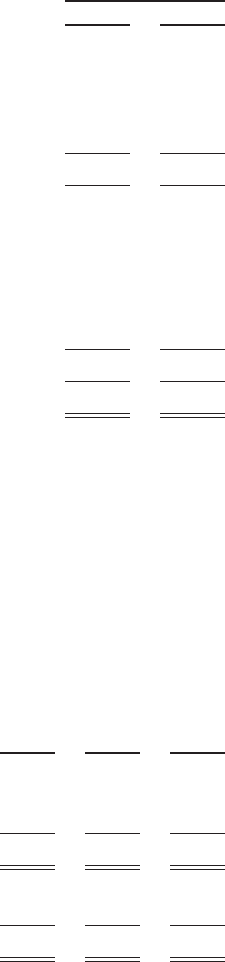

Income tax expense reflected in our Consolidated Statements of Earnings for each of the three years ending December 31,

2014 is as follows (in millions).

2014 2013 2012

Federal ............................................................... $6,447 $8,155 $5,695

State ................................................................. 560 258 384

Foreign ............................................................... 928 538 845

$7,935 $8,951 $6,924

Current ............................................................... $3,302 $5,168 $4,711

Deferred .............................................................. 4,633 3,783 2,213

$7,935 $8,951 $6,924

72