Berkshire Hathaway 2014 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2014 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

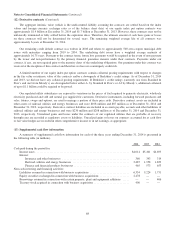

Notes to Consolidated Financial Statements (Continued)

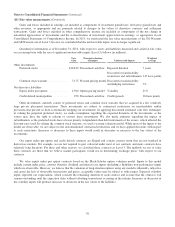

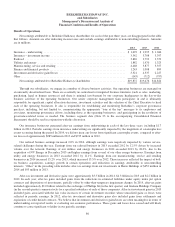

(20) Accumulated other comprehensive income

A summary of the net changes in after-tax accumulated other comprehensive income attributable to Berkshire Hathaway

shareholders for each of the three years ending December 31, 2014 and significant amounts reclassified out of accumulated

other comprehensive income for each of the years ending December 31, 2014 and 2013 follows (in millions).

Unrealized

appreciation of

investments, net

Foreign

currency

translation

Prior service

and actuarial

gains/losses of

defined benefit

pension plans Other

Accumulated

other

comprehensive

income

Balance at December 31, 2011 ......................... $19,626 $ (383) $(1,589) $— $17,654

Other comprehensive income, net ....................... 9,647 267 (21) (47) 9,846

Transactions with noncontrolling interests ................ (19) (4) 9 14 —

9,628 263 (12) (33) 9,846

Balance at December 31, 2012 ......................... 29,254 (120) (1,601) (33) 27,500

Other comprehensive income, net before reclassifications .... 16,379 25 1,534 106 18,044

Reclassifications from accumulated other comprehensive

income .......................................... (1,591) (31) 114 10 (1,498)

Transactions with noncontrolling interests ................ — (20) (1) — (21)

14,788 (26) 1,647 116 16,525

Balance at December 31, 2013 ......................... 44,042 (146) 46 83 44,025

Other comprehensive income, net before reclassifications .... 3,778 (1,877) (1,130) 31 802

Reclassifications from accumulated other comprehensive

income .......................................... (2,184) 66 45 (22) (2,095)

1,594 (1,811) (1,085) 9 (1,293)

Balance at December 31, 2014 ......................... $45,636 $(1,957) $(1,039) $ 92 $42,732

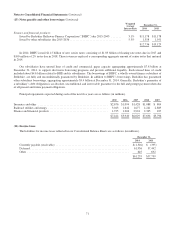

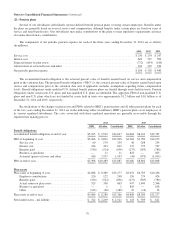

Reclassifications from other comprehensive income into net

earnings are included on the following line items:

Year ending December 31, 2013:

Investment gains/losses:

Insurance and other ...................... $(2,382) $ — $ — $— $ (2,382)

Finance and financial products ............. (65) — — — (65)

Other ..................................... — (31) 167 17 153

Reclassifications before income taxes ............ (2,447) (31) 167 17 (2,294)

Applicable income taxes ...................... (856) — 53 7 (796)

$ (1,591) $ (31) $ 114 $ 10 $ (1,498)

Year ending December 31, 2014:

Investment gains/losses:

Insurance and other ...................... $(3,288) $ — $ — $— $ (3,288)

Finance and financial products ............. (72) — — — (72)

Other ..................................... — 75 58 (39) 94

Reclassifications before income taxes ............ (3,360) 75 58 (39) (3,266)

Applicable income taxes ...................... (1,176) 9 13 (17) (1,171)

$ (2,184) $ 66 $ 45 $ (22) $ (2,095)

78