Berkshire Hathaway 2014 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2014 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GEICO’s cost advantage is the factor that has enabled the company to gobble up market share year after

year. (We ended 2014 at 10.8% compared to 2.5% in 1995, when Berkshire acquired control of GEICO.) The

company’s low costs create a moat – an enduring one – that competitors are unable to cross. Our gecko never tires

of telling Americans how GEICO can save them important money. The gecko, I should add, has one particularly

endearing quality – he works without pay. Unlike a human spokesperson, he never gets a swelled head from his

fame nor does he have an agent to constantly remind us how valuable he is. I love the little guy.

************

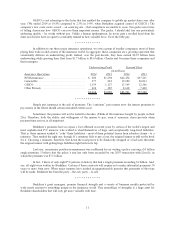

In addition to our three major insurance operations, we own a group of smaller companies, most of them

plying their trade in odd corners of the insurance world. In aggregate, these companies are a growing operation that

consistently delivers an underwriting profit. Indeed, over the past decade, they have earned $2.95 billion from

underwriting while growing their float from $1.7 billion to $8.6 billion. Charlie and I treasure these companies and

their managers.

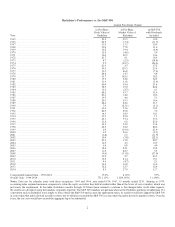

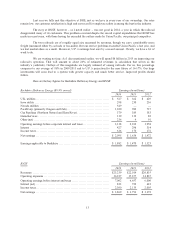

Underwriting Profit Yearend Float

(in millions)

Insurance Operations 2014 2013 2014 2013

BH Reinsurance .................................... $ 606 $1,294 $42,454 $37,231

General Re ......................................... 277 283 19,280 20,013

GEICO ............................................ 1,159 1,127 13,569 12,566

Other Primary ...................................... 626 385 8,618 7,430

$2,668 $3,089 $83,921 $77,240

************

Simply put, insurance is the sale of promises. The “customer” pays money now; the insurer promises to

pay money in the future should certain unwanted events occur.

Sometimes, the promise will not be tested for decades. (Think of life insurance bought by people in their

20s.) Therefore, both the ability and willingness of the insurer to pay, even if economic chaos prevails when

payment time arrives, is all-important.

Berkshire’s promises have no equal, a fact affirmed in recent years by certain of the world’s largest and

most sophisticated P/C insurers, who wished to shed themselves of huge and exceptionally long-lived liabilities.

That is, these insurers wished to “cede” these liabilities – most of them potential losses from asbestos claims – to a

reinsurer. They needed the right one, though: If a reinsurer fails to pay a loss, the original insurer is still on the hook

for it. Choosing a reinsurer, therefore, that down the road proves to be financially strapped or a bad actor threatens

the original insurer with getting huge liabilities right back in its lap.

Last year, our premier position in reinsurance was reaffirmed by our writing a policy carrying a $3 billion

single premium. I believe that the policy’s size has only been exceeded by our 2007 transaction with Lloyd’s, in

which the premium was $7.1 billion.

In fact, I know of only eight P/C policies in history that had a single premium exceeding $1 billion. And,

yes, all eight were written by Berkshire. Certain of these contracts will require us to make substantial payments 50

years or more from now. When major insurers have needed an unquestionable promise that payments of this type

will be made, Berkshire has been the party – the only party – to call.

************

Berkshire’s great managers, premier financial strength and a variety of business models protected by

wide moats amount to something unique in the insurance world. This assemblage of strengths is a huge asset for

Berkshire shareholders that will only get more valuable with time.

11