Berkshire Hathaway 2014 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2014 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion (Continued)

Manufacturing, Service and Retailing (Continued)

McLane Company

McLane operates a wholesale distribution business that provides grocery and non-food products to retailers, convenience

stores and restaurants. In 2012, McLane acquired Meadowbrook Meat Company, Inc. (“MBM”), a large foodservice distributor

for national restaurant chains. Through its subsidiaries, McLane also operates as a wholesale distributor of distilled spirits, wine

and beer. McLane’s grocery and foodservice businesses are marked by high sales volume and very low profit margins and have

several significant customers, including Wal-Mart, 7-Eleven and Yum! Brands. A curtailment of purchasing by any of its

significant customers could have a significant adverse impact on McLane’s periodic revenues and earnings.

Revenues in 2014 of $46.6 billion increased $710 million (1.5%) compared to 2013. The overall revenue increase reflected

increased foodservice and beverage revenues, while grocery revenues were relatively flat. Pre-tax earnings in 2014 declined $51

million (10.5%) from 2013. Earnings in 2013 included a pre-tax gain of $24 million from the sale of a logistics business. Before

the impact of this gain, McLane’s earnings in 2014 decreased 6% compared to 2013. The decline reflected higher earnings from

the grocery and beverage businesses which was more than offset by lower earnings from the foodservice business. In 2014, our

foodservice operations experienced higher per unit processing costs and higher other operating costs which more than offset the

increase in revenues.

McLane’s revenues in 2013 were approximately $45.9 billion, representing an increase of approximately $8.5 billion

(23%) over revenues in 2012. The increase in revenues reflected the impact of the MBM acquisition, as well as year-to-date

revenue increases ranging from 10% to 15% in the grocery, other foodservice and beverage businesses. Revenues of each of

these businesses in 2013 included the impact of new customers added in 2012 and 2013. McLane’s pre-tax earnings in 2013

increased $83 million (21%) over earnings in 2012. The increase in 2013 pre-tax earnings reflected the increases in revenues,

including the impact of the MBM acquisition, and a gain from the sale of a logistics business, partially offset by slightly lower

operating margins.

Manufacturing

This group includes a variety of businesses that manufacture industrial and end-user products and include: The Lubrizol

Corporation (“Lubrizol”), a specialty chemical manufacturer; IMC International Metalworking Companies (“IMC”), an industry

leader in the metal cutting tools business with operations worldwide; Forest River, a leading manufacturer of leisure vehicles;

and CTB, a manufacturer of equipment and systems for the livestock and agricultural industries. Also included are the

diversified manufacturing operations of Marmon, which in prior years were presented separately with its transportation

equipment manufacturing and leasing operations. In this report, Marmon’s transportation equipment manufacturing and leasing

businesses are included in our finance and financial products group. Our manufacturing businesses also include several building

products businesses (Acme Building Brands, Benjamin Moore, Johns Manville, Shaw and MiTek) and six apparel businesses

(led by Fruit of the Loom which includes Russell athletic apparel and Vanity Fair Brands women’s intimate apparel).

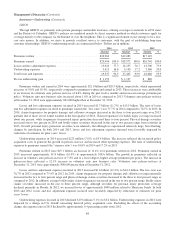

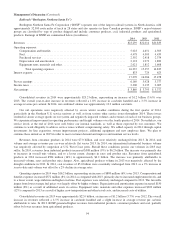

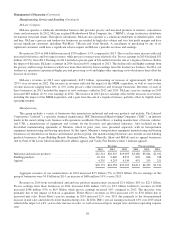

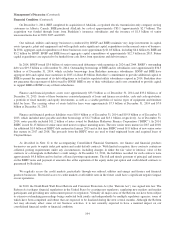

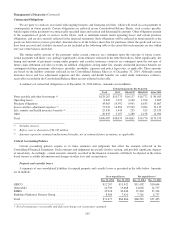

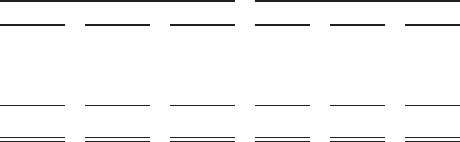

Revenues Pre-tax earnings

2014 2013 2012 2014 2013 2012

Industrial and end-user products ............................. $22,314 $20,325 $19,003 $3,460 $3,044 $2,912

Building products ........................................ 10,124 9,640 8,953 896 846 748

Apparel ................................................ 4,335 4,293 4,149 455 315 251

$36,773 $34,258 $32,105 $4,811 $4,205 $3,911

Aggregate revenues of our manufacturers in 2014 increased $2.5 billion (7%) to $36.8 billion. Pre-tax earnings of this

group of businesses were $4.8 billion in 2014, an increase of $606 million (14%) versus 2013.

Revenues in 2014 from our industrial and end-user products manufacturers increased $2.0 billion (10%) to $22.3 billion.

Pre-tax earnings from these businesses in 2014 increased $416 million (14%) to $3.5 billion. Lubrizol’s revenues in 2014

increased $546 million (9%) to $6.9 billion, while pre-tax earnings increased 10% compared to 2013. The increases were

primarily due to the impact of bolt-on acquisitions. Forest River’s revenues in 2014 increased 14% to $3.8 billion due to

increased unit sales. Forest River’s pre-tax earnings in 2014 increased 21% over 2013 due primarily to the aforementioned

increase in unit sales and relatively lower manufacturing costs. In 2014, IMC’s pre-tax earnings increased 18% over 2013 which

reflected the impact of a 6% year-to-date increase in sales, as well as increased gross margin rates and lower operating expense

rates.

98