Berkshire Hathaway 2014 Annual Report Download

Download and view the complete annual report

Please find the complete 2014 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

B

ERKSHIRE

H

ATHAWAY

INC.

2014

ANNUAL REPORT

Table of contents

-

Page 1

BERKSHIRE HATHAWAY INC. 2014 ANNUAL REPORT -

Page 2

-

Page 3

... Public Accounting Firm ...Consolidated Financial Statements ...Management's Discussion ... 2 3 23 24 39 45 46 46 47 48 86 Owner's Manual ...117 Intrinsic Value ...123 Common Stock Data ...124 Operating Companies ...125 Real Estate Brokerage Businesses ...126 Daily Newspapers ...127 Purchase... -

Page 4

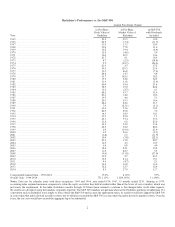

...: 1965 and 1966, year ended 9/30; 1967, 15 months ended 12/31. Starting in 1979, accounting rules required insurance companies to value the equity securities they hold at market rather than at the lower of cost or market, which was previously the requirement. In this table, Berkshire's results... -

Page 5

... new ones, may find it useful to read those letters before reading the report on 2014, which begins below. BERKSHIRE HATHAWAY INC. To the Shareholders of Berkshire Hathaway Inc.: Berkshire's gain in net worth during 2014 was $18.3 billion, which increased the per-share book value of both our Class... -

Page 6

...Here are the important developments: ‹ Our "Powerhouse Five" - a collection of Berkshire's largest non-insurance businesses - had a record $12.4 billion of pre-tax earnings in 2014, up $1.6 billion from 2013.* The companies in this sainted group are Berkshire Hathaway Energy (formerly MidAmerican... -

Page 7

... purchases by us. If we do this - and if we can buy dealerships at sensible prices - we will build a business that before long will be multiples the size of Van Tuyl's $9 billion of sales. With the acquisition of Van Tuyl, Berkshire now owns 9 1â„ 2 companies that would be listed on the Fortune 500... -

Page 8

...25 people work). No sense going crazy. Berkshire increased its ownership interest last year in each of its "Big Four" investments - American Express, Coca-Cola, IBM and Wells Fargo. We purchased additional shares of IBM (increasing our ownership to 7.8% versus 6.3% at yearend 2013). Meanwhile, stock... -

Page 9

... Combs and Ted Weschler, our two investment managers, to each have oversight of at least one of our businesses. A sensible opportunity for them to do so opened up a few months ago when we agreed to purchase two companies that, though smaller than we would normally acquire, have excellent economic... -

Page 10

... (generally accepted accounting principles) net worth of $111 billion, which exceeds that of any other insurer in the world. One reason we were attracted to the property-casualty business was its financial characteristics: P/C insurers receive premiums upfront and pay claims later. In extreme cases... -

Page 11

..., in effect, is what the industry pays to hold its float. Competitive dynamics almost guarantee that the insurance industry, despite the float income all its companies enjoy, will continue its dismal record of earning subnormal returns on tangible net worth as compared to other American businesses... -

Page 12

... more lines of business he can add to his current assortment. Last year I told you about his formation of Berkshire Hathaway Specialty Insurance ("BHSI"). This initiative took us into commercial insurance, where we were instantly welcomed by both major insurance brokers and corporate risk managers... -

Page 13

... of life insurance bought by people in their 20s.) Therefore, both the ability and willingness of the insurer to pay, even if economic chaos prevails when payment time arrives, is all-important. Berkshire's promises have no equal, a fact affirmed in recent years by certain of the world's largest and... -

Page 14

... long-lived, regulated assets, with these partially funded by large amounts of long-term debt that is not guaranteed by Berkshire. Our credit is in fact not needed because each company has earning power that even under terrible economic conditions will far exceed its interest requirements. Last year... -

Page 15

... Hathaway Energy and BNSF: Berkshire Hathaway Energy (89.9% owned) U.K. utilities ...Iowa utility ...Nevada utilities ...PacifiCorp (primarily Oregon and Utah) ...Gas Pipelines (Northern Natural and Kern River) ...HomeServices ...Other (net) ...Operating earnings before corporate interest and taxes... -

Page 16

... adjusted numbers more accurately reflect the true economic expenses and profits of the businesses aggregated in the table than do GAAP figures. I won't explain all of the adjustments - some are tiny and arcane - but serious investors should understand the disparate nature of intangible assets. Some... -

Page 17

... of excess cash and using little leverage, earned 18.7% after-tax on that capital. Of course, a business with terrific economics can be a bad investment if it is bought for too high a price. We have paid substantial premiums to net tangible assets for most of our businesses, a cost that is reflected... -

Page 18

... year, Clayton sold 30,871 homes, about 45% of the manufactured homes bought by Americans. When we purchased Clayton in 2003 for $1.7 billion, its share was 14%. Key to Clayton's earnings is the company's $13 billion mortgage portfolio. During the financial panic of 2008 and 2009, when funding for... -

Page 19

...Deere & Company ...DIRECTV ...The Goldman Sachs Group, Inc...International Business Machines Corp...Moody's Corporation ...Munich Re ...The Procter & Gamble Company ...Sanofi ...U.S. Bancorp ...USG Corporation ...Wal-Mart Stores, Inc...Wells Fargo & Company ...Others ...Total Common Stocks Carried... -

Page 20

... go by, you meet his relatives. We sold Tesco shares throughout the year and are now out of the position. (The company, we should mention, has hired new management, and we wish them well.) Our after-tax loss from this investment was $444 million, about 1/5 of 1% of Berkshire's net worth. In the past... -

Page 21

... 2,100.) If not for their fear of meaningless price volatility, these investors could have assured themselves of a good income for life by simply buying a very low-cost index fund whose dividends would trend upward over the years and whose principal would grow as well (with many ups and downs, to be... -

Page 22

... product, so both mustard and ketchup will be available this year. (Buy both!) Now that we are open for business on Friday as well, we expect new records in every precinct. Brooks, our running-shoe company, will again have a special commemorative shoe to offer at the meeting. After you purchase... -

Page 23

...from 6 p.m. to 9 p.m. on Friday, May 1st. The second, the main gala, will be held on Sunday, May 3rd, from 9 a.m. to 4 p.m. On Saturday, we will remain open until 6 p.m. In recent years, our three-day volume has far exceeded our sales in all of December, normally a jeweler's best month. We will have... -

Page 24

... (smothered in Heinz ketchup, of course) for lunch. No CEO has it better; I truly do feel like tap dancing to work every day. Last year, for the annual report, we dropped our 48-year-old "no pictures" policy - who says I'm not flexible? - and ran a photo of our remarkable home-office crew that was... -

Page 25

... of pre-tax earnings unless the business will fit into one of our existing units), Demonstrated consistent earning power (future projections are of no interest to us, nor are "turnaround" situations), Businesses earning good returns on equity while employing little or no debt, Management in place... -

Page 26

...was unable to change course. That was true even though the industry's problems had long been widely understood. Berkshire's own Board minutes of July 29, 1954, laid out the grim facts: "The textile industry in New England started going out of business forty years ago. During the war years this trend... -

Page 27

... and share repurchases, its net worth at the end of fiscal 1964 had fallen to $22 million from $55 million at the time of the 1955 merger. The full $22 million was required by the textile operation: The company had no excess cash and owed its bank $2.5 million. (Berkshire's 1964 annual report is... -

Page 28

.... With large sums, it would never work well. In addition, though marginal businesses purchased at cheap prices may be attractive as short-term investments, they are the wrong foundation on which to build a large and enduring enterprise. Selecting a marriage partner clearly requires more demanding... -

Page 29

... chocolates, then annually earning about $4 million pre-tax while utilizing only $8 million of net tangible assets. Moreover, the company had a huge asset that did not appear on its balance sheet: a broad and durable competitive advantage that gave it significant pricing power. That strength was... -

Page 30

... you an expensive "fairness" opinion endorsing that swap Overall, Berkshire's acquisitions have worked out well - and very well in the case of a few large ones. So, too, have our investments in marketable securities. The latter are always valued on our balance sheet at their market prices so any... -

Page 31

... these managers drove a fledgling conglomerate's stock to, say, 20 times earnings and then issued shares as fast as possible to acquire another business selling at ten-or-so times earnings. They immediately applied "pooling" accounting to the acquisition, which - with not a dime's worth of change in... -

Page 32

... CEO would be the manager you would wish to handle the redeployment job even if he or she was inclined to undertake it. At the shareholder level, taxes and frictional costs weigh heavily on individual investors when they attempt to reallocate capital among businesses and industries. Even tax-free... -

Page 33

... taxes and, almost always, by significant frictional and agency costs Berkshire has one further advantage that has become increasingly important over the years: We are now the home of choice for the owners and managers of many outstanding businesses. Families that own successful businesses have... -

Page 34

...operations. That gives Berkshire Hathaway Energy a major advantage over most public-utility companies in developing wind and solar projects. Investment bankers, being paid as they are for action, constantly urge acquirers to pay 20% to 50% premiums over market price for publicly-held businesses. The... -

Page 35

... control value, capital-allocation flexibility and, in some cases, important tax advantages. The CEOs who brilliantly run our subsidiaries now would have difficulty in being as effective if running a spun-off operation, given the operating and financial advantages derived from Berkshire's ownership... -

Page 36

... the general stock market during such abbreviated periods will likely be far more important in determining your results than the concomitant change in the intrinsic value of your Berkshire shares. As Ben Graham said many decades ago: "In the short-term the market is a voting machine; in the long-run... -

Page 37

... right to cash out at their option. Many life insurance products contain redemption features that make them susceptible to a "run" in times of extreme panic. Contracts of that sort, however, do not exist in the property-casualty world that we inhabit. If our premium volume should shrink, our float... -

Page 38

... their families own - which, in many cases, are worth very substantial sums - were purchased in the market (rather than their materializing through options or grants). In addition, unlike almost all other sizable public companies, we carry no directors and officers liability insurance. At Berkshire... -

Page 39

... a long run in the job. Berkshire will operate best if its CEOs average well over ten years at the helm. (It's hard to teach a new dog old tricks.) And they are not likely to retire at 65 either (or have you noticed?). In both Berkshire's business acquisitions and large, tailored investment moves... -

Page 40

... spades at last year's annual meeting, where the shareholders were offered a proxy resolution: RESOLVED: Whereas the corporation has more money than it needs and since the owners unlike Warren are not multi billionaires, the board shall consider paying a meaningful annual dividend on the shares. The... -

Page 41

...iii) (iv) (v) He would manage almost all security investments, with these normally residing in Berkshire's casualty insurers. He would choose all CEOs of important subsidiaries, and he would fix their compensation and obtain from each a private recommendation for a successor in case one was suddenly... -

Page 42

.... (9) In buying a new subsidiary, Berkshire would seek to pay a fair price for a good business that the Chairman could pretty well understand. Berkshire would also want a good CEO in place, one expected to remain for a long time and to manage well without need for help from headquarters. (10) In... -

Page 43

... as important subsidiaries? Marvelously well. Berkshire's ambitions were unreasonably extreme and, even so, it got what it wanted. Casualty insurers often invest in common stocks with a value amounting roughly to their shareholders' equity, as did Berkshire's insurance subsidiaries. And the S&P 500... -

Page 44

... in much durable competitive advantage. Moreover, its railroad and utility subsidiaries now provide much desirable opportunity to invest large sums in new fixed assets. And many subsidiaries are now engaged in making wise "bolt-on" acquisitions. Provided that most of the Berkshire system remains in... -

Page 45

.... The answer is plainly yes. In its early Buffett years, Berkshire had a big task ahead: turning a tiny stash into a large and useful company. And it solved that problem by avoiding bureaucracy and relying much on one thoughtful leader for a long, long time as he kept improving and brought in more... -

Page 46

-

Page 47

...'s finance and financial products businesses primarily engage in proprietary investing strategies, consumer lending (Clayton Homes) and transportation equipment and furniture leasing (UTLX, XTRA and CORT). Shaw Industries is the world's largest manufacturer of tufted broadloom carpet. Benjamin Moore... -

Page 48

... Selected Financial Data for the Past Five Years (dollars in millions except per-share data) 2014 2013 2012 2011 2010 Revenues: Insurance premiums earned ...$ 41,253 $ 36,684 $ 34,545 $ 32,075 $ 30,749 Sales and service revenues ...97,097 92,993 81,447 71,226 65,942 Railroad, utilities and energy... -

Page 49

... PUBLIC ACCOUNTING FIRM To the Board of Directors and Shareholders of Berkshire Hathaway Inc. Omaha, Nebraska We have audited the accompanying consolidated balance sheets of Berkshire Hathaway Inc. and subsidiaries (the "Company") as of December 31, 2014 and 2013, and the related consolidated... -

Page 50

BERKSHIRE HATHAWAY INC. and Subsidiaries CONSOLIDATED BALANCE SHEETS (dollars in millions) December 31, 2014 2013 ASSETS Insurance and Other: Cash and cash equivalents ...Investments: Fixed maturity securities ...Equity securities ...Other ...Investments in H.J. Heinz Holding Corporation ...... -

Page 51

...per-share amounts) Year Ended December 31, 2014 2013 2012 Revenues: Insurance and Other: Insurance premiums earned ...Sales and service revenues ...Interest, dividend and other investment income ...Investment gains/losses ...Railroad, Utilities and Energy: Revenues ...Finance and Financial Products... -

Page 52

... STATEMENTS OF CHANGES IN SHAREHOLDERS' EQUITY (dollars in millions) Berkshire Hathaway shareholders' equity Common stock and capital in excess of par value Accumulated other comprehensive income Noncontrolling interests Retained earnings Treasury stock Total Balance at December 31, 2011 ...Net... -

Page 53

... borrowings of insurance and other businesses ...Repayments of borrowings of railroad, utilities and energy businesses ...Repayments of borrowings of finance businesses ...Changes in short term borrowings, net ...Acquisitions of noncontrolling interests and treasury stock ...Other ...Net cash flows... -

Page 54

... and leasing businesses of Marmon Holdings, Inc. ("Marmon") as part of our finance and financial products businesses. Prior period amounts in these financial statements have been reclassified to conform to the current year presentation. On April 30, 2014, MidAmerican Energy Holdings Company's name... -

Page 55

...Financial Statements (Continued) (1) Significant accounting policies and practices (Continued) (d) Investments (Continued) In applying the equity method, we record the investment at cost and subsequently increase or decrease the carrying amount of the investment by our proportionate share of the net... -

Page 56

... rate is applied to the gross investment in a particular class of property, despite differences in the service life or salvage value of individual property units within the same class. When our regulated utilities or railroad retires or sells a component of the assets accounted for using group... -

Page 57

...Financial Statements (Continued) (1) Significant accounting policies and practices (Continued) (i) Property, plant and equipment and leased assets (Continued) Our businesses evaluate property, plant and equipment for impairment when events or changes in circumstances indicate that the carrying value... -

Page 58

Notes to Consolidated Financial Statements (Continued) (1) Significant accounting policies and practices (Continued) (k) Revenue recognition (Continued) Railroad transportation revenues are recognized based upon the proportion of service provided as of the balance sheet date. Customer incentives, ... -

Page 59

... to Consolidated Financial Statements (Continued) (1) Significant accounting policies and practices (Continued) (p) Life, annuity and health insurance benefits (Continued) the characteristics of the contract's date of issuance, policy duration and country of risk. The interest rate assumptions used... -

Page 60

... long-held acquisition strategy is to acquire businesses at sensible prices that have consistent earning power, good returns on equity and able and honest management. On December 19, 2013, we acquired NV Energy, Inc. ("NV Energy") through our 89.9% owned subsidiary, Berkshire Hathaway Energy Company... -

Page 61

...Graham Holding Company ("GHC") in exchange for 1,620,190 shares of GHC common stock with an aggregate fair value of $1.13 billion. At the date of the acquisition, the assets of WPLG, which operates a Miami, Florida, ABC affiliated television station, included 2,107 shares of Berkshire Hathaway Class... -

Page 62

... securities are reflected in our Consolidated Balance Sheets as follows (in millions). December 31, 2014 2013 Insurance and other ...Finance and financial products ... $27,397 239 $27,636 $28,785 568 $29,353 Investments in foreign government securities include securities issued by national... -

Page 63

...; Wells Fargo & Company - $26.5 billion; International Business Machines Corporation - $12.3 billion; and The Coca-Cola Company - $16.9 billion). Cost Basis Unrealized Gains Unrealized Losses Fair Value December 31, 2013 * Banks, insurance and finance ...Consumer products ...Commercial, industrial... -

Page 64

...to Consolidated Financial Statements (Continued) (4) Investments in equity securities (Continued) Investments in equity securities are reflected in our Consolidated Balance Sheets as follows (in millions). December 31, 2014 2013 Insurance and other ...Railroad, utilities and energy * ...Finance and... -

Page 65

... the global investment firm 3G Capital (such affiliate, "3G"), through a newly formed holding company, H.J. Heinz Holding Corporation ("Heinz Holding"), acquired H.J. Heinz Company ("Heinz"). Berkshire and 3G each made equity investments in Heinz Holding, which, together with debt financing obtained... -

Page 66

...billion related to the changes in the valuations of warrants of General Electric Company and The Goldman Sachs Group, which were acquired in 2008 and exercised in October 2013. We record investments in equity and fixed maturity securities classified as available-for-sale at fair value and record the... -

Page 67

... of property, plant and equipment of our insurance and other businesses follows (in millions). Ranges of estimated useful life December 31, 2014 2013 Land ...Buildings and improvements ...Machinery and equipment ...Furniture, fixtures and other ...Accumulated depreciation ... - 2 - 40 years 3 - 25... -

Page 68

... of public utility and natural gas pipeline subsidiaries. Assets held for lease and property, plant and equipment of our finance and financial products businesses are summarized below (in millions). Ranges of estimated useful life December 31, 2014 2013 Assets held for lease ...Land ...Buildings... -

Page 69

...of December 31, 2014 and 2013 related to our finance and financial products businesses follows (in millions). December 31, 2014 Notional Liabilities Value December 31, 2013 Notional Liabilities Value Equity index put options ...Credit default ...Other, principally interest rate and foreign currency... -

Page 70

... forward purchases and sales, futures, swaps and options, are used to manage a portion of these price risks. Derivative contract assets are included in other assets of railroad, utilities and energy businesses and were $108 million and $87 million as of December 31, 2014 and December 31, 2013... -

Page 71

... to Consolidated Financial Statements (Continued) (14) Unpaid losses and loss adjustment expenses The liabilities for unpaid losses and loss adjustment expenses are based upon estimates of the ultimate claim costs associated with property and casualty claim occurrences as of the balance sheet dates... -

Page 72

... Average Interest Rate December 31, 2014 2013 Railroad, utilities and energy: Issued by Berkshire Hathaway Energy Company ("BHE") and its subsidiaries: BHE senior unsecured debt due 2017-2045 ...Subsidiary and other debt due 2015-2064 ...Issued by BNSF due 2015-2097 ... 5.1% 5.1% 5.0% $ 7,860... -

Page 73

...Issued by Berkshire Hathaway Finance Corporation ("BHFC") due 2015-2043 ...Issued by other subsidiaries due 2015-2036 ... 3.1% 5.3% $11,178 1,558 $12,736 $11,178 1,951 $13,129 In 2014, BHFC issued $1.15 billion of new senior notes consisting of $1.05 billion of floating rate notes due in 2017 and... -

Page 74

...Consolidated Financial Statements (Continued) (16) Income taxes (Continued) The tax effects of temporary differences that give rise to significant portions of deferred tax assets and deferred tax liabilities are shown below (in millions). December 31, 2014 2013 Deferred tax liabilities: Investments... -

Page 75

... to our Consolidated Financial Statements. At December 31, 2014 and 2013, net unrecognized tax benefits were $645 million and $692 million, respectively. Included in the balance at December 31, 2014, were $505 million of tax positions that, if recognized, would impact the effective tax rate. The... -

Page 76

... Investment in Heinz Holding Preferred Stock ...7,710 7,971 - Other investments ...17,951 17,951 - Loans and finance receivables ...12,826 12,002 - Derivative contract assets (1) ...87 87 3 Derivative contract liabilities: Railroad, utilities and energy (1) ...Finance and financial products: Equity... -

Page 77

... inputs (Level 3) for each of three years ending December 31, 2014 follow (in millions). Investments in fixed maturity securities Investments in equity securities and other investments Net derivative contract liabilities Balance at December 31, 2011 ...Gains (losses) included in: Earnings ...Other... -

Page 78

... model Discount for transferability and hedging restrictions 4,560 Option pricing model Volatility 7% 21% 36 basis points 250 Discounted cash flow Credit spreads Other investments currently consist of preferred stocks and common stock warrants that we acquired in a few relatively large private... -

Page 79

...Par Value (3,225,000,000 shares authorized) Issued Treasury Outstanding Balance at December 31, 2011 ...Conversions of Class A common stock to Class B common stock and exercises of replacement stock options issued in a business acquisition ...Treasury shares acquired ...Balance at December 31, 2012... -

Page 80

... income ...Balance at December 31, 2014 ...Reclassifications from other comprehensive income into net earnings are included on the following line items: Year ending December 31, 2013: Investment gains/losses: Insurance and other ...Finance and financial products ...Other ...Reclassifications... -

Page 81

...benefit rates. Our subsidiaries may make contributions to the plans to meet regulatory requirements and may also make discretionary contributions. The components of net periodic pension expense for each of the three years ending December 31, 2014 are as follows (in millions). 2014 2013 2012 Service... -

Page 82

... assumptions used in determining projected benefit obligations and net periodic pension expense were as follows. 2014 2013 Applicable to pension benefit obligations: Discount rate ...Expected long-term rate of return on plan assets ...Rate of compensation increase ...Discount rate applicable to net... -

Page 83

... to which Berkshire will acquire a controlling interest in the Van Tuyl Group, the nation's largest privately-owned auto dealership group and fifth largest among all U.S. auto dealership groups, as well as 100% of related insurance and real estate businesses. The auto dealership group consists of... -

Page 84

... Underwriting multiple lines of property and casualty insurance policies for primarily commercial accounts Operates one of the largest railroad systems in North America Regulated electric and gas utility, including power generation and distribution activities, and domestic real estate brokerage and... -

Page 85

... our consolidated data for each of the three most recent years is presented in the tables which follow (in millions). 2014 Revenues 2013 2012 Earnings before income taxes 2014 2013 2012 Operating Businesses: Insurance group: Underwriting: GEICO ...General Re ...Berkshire Hathaway Reinsurance Group... -

Page 86

... at year-end 2014 2013 Identifiable assets at year-end 2013 2014 2012 Operating Businesses: Insurance group: GEICO ...General Re ...Berkshire Hathaway Reinsurance and Primary Groups ...Total insurance group ...BNSF ...Berkshire Hathaway Energy ...McLane Company ...Manufacturing ...Service and... -

Page 87

Notes to Consolidated Financial Statements (Continued) (23) Business segment data (Continued) Premiums written and earned by the property/casualty and life/health insurance businesses are summarized below (in millions). 2014 Property/Casualty 2013 2012 2014 Life/Health 2013 2012 Premiums Written: ... -

Page 88

.... 2014 2013 2012 Insurance - underwriting ...Insurance - investment income ...Railroad ...Utilities and energy ...Manufacturing, service and retailing ...Finance and financial products ...Investment and derivative gains/losses ...Other ...Net earnings attributable to Berkshire Hathaway shareholders... -

Page 89

... our insurance businesses are summarized below. Amounts are in millions. 2014 2013 2012 Underwriting gain attributable to: GEICO ...General Re ...Berkshire Hathaway Reinsurance Group ...Berkshire Hathaway Primary Group ...Pre-tax underwriting gain ...Income taxes and noncontrolling interests ...Net... -

Page 90

... years' losses. Underwriting expenses incurred in 2013 declined $170 million (5.1%) to $3.2 billion. Underwriting expenses in 2012 were impacted by a change in U.S. GAAP concerning deferred policy acquisition costs. Excluding the effects of the accounting change, the expense ratio in 2013 declined... -

Page 91

... the effects of foreign currency exchange rate changes, premiums written and earned in 2013 increased $8 million (0.3%) and $83 million (2.9%), respectively, versus 2012. This was primarily due to increases in European treaty business. Our combined property/casualty operations generated pre-tax... -

Page 92

... all three years also reflected charges attributable to the periodic discount accretion on U.S. long-term care liabilities. Berkshire Hathaway Reinsurance Group Through BHRG, we underwrite excess-of-loss reinsurance and quota-share coverages on property and casualty risks for insurers and reinsurers... -

Page 93

... (Continued) Insurance-Underwriting (Continued) Berkshire Hathaway Reinsurance Group (Continued) Property/casualty (Continued) Premiums earned from property/casualty business in 2013 declined $973 million (16%) compared to 2012. Premiums earned in 2013 from the Swiss Re quota-share contract were... -

Page 94

...; and Berkshire Hathaway Guard Insurance Companies ("Guard"), providers of workers' compensation and commercial property and casualty insurance coverage to small and mid-sized businesses. In the second quarter of 2013, we formed Berkshire Hathaway Specialty Insurance ("BH Specialty"), which... -

Page 95

... equity holdings as well as increased overall investments in equity securities. Invested assets derive from shareholder capital and reinvested earnings as well as net liabilities under insurance contracts or "float." The major components of float are unpaid losses, life, annuity and health benefit... -

Page 96

... business groups are classified by type of product shipped and include consumer products, coal, industrial products and agricultural products. Earnings of BNSF are summarized below (in millions). 2014 2013 2012 Revenues ...Operating expenses: Compensation and benefits ...Fuel ...Purchased services... -

Page 97

... (17%) versus 2012. BNSF funds its capital expenditures with cash flow from operations and new debt issuances. In each period, the increased interest expense resulted from higher average outstanding debt. Utilities and Energy ("Berkshire Hathaway Energy Company") We hold an 89.9% ownership interest... -

Page 98

... electric business, reflecting the impact of higher revenues and lower depreciation and amortization expense due to the impact of depreciation rate changes, partially offset by increased energy and operating costs. Revenues in 2013 increased $178 million (5%) over 2012. The increase in revenues... -

Page 99

... due to new borrowings in connection with the NV Energy and AltaLink acquisitions. BHE's consolidated effective income tax rates were 23% in 2014, 7% in 2013 and 9% in 2012. In each year, BHE's income tax rates reflect significant production tax credits from wind-powered electricity generation in... -

Page 100

... operations. In this report, Marmon's transportation equipment manufacturing and leasing businesses are included in our finance and financial products group. Our manufacturing businesses also include several building products businesses (Acme Building Brands, Benjamin Moore, Johns Manville, Shaw... -

Page 101

... copper prices and lower volumes in the electrical and plumbing products businesses and the strategic decision to exit the low margin building wire and copper tubing businesses. Marmon's manufacturing pre-tax earnings were $708 million in 2014, an increase of $111 million (19%) over earnings in 2013... -

Page 102

...which licenses and services a system of over 6,500 stores that offer prepared dairy treats and food; Buffalo News and the BH Media Group ("BH Media"), which includes the Omaha World-Herald, as well as 28 other daily newspapers and numerous other publications; and WPLG (acquired June 30, 2014), which... -

Page 103

... units and average rental rates and relatively stable operating expenses. Earnings from our other finance activities include CORT's furniture leasing business, interest and dividends from a portfolio of investments and our share of the earnings of a commercial mortgage servicing business in which we... -

Page 104

... fair value of the businesses received over the tax-basis cost of the common stock of Phillips 66 and Graham Holdings Company exchanged. Pre-tax investment gains/losses in 2013 were $4.3 billion and included approximately $2.1 billion related to our investments in General Electric and Goldman Sachs... -

Page 105

... several prior business acquisitions (primarily related to the amortization of identifiable intangible assets) and corporate interest expense. These two charges (after-tax) aggregated $682 million in 2014, $514 million in 2013 and $630 million in 2012. Financial Condition Our balance sheet continues... -

Page 106

... in 2017 and 2018. The proceeds from the BHFC notes are used to fund originated loans and acquired loans of Clayton Homes. As described in Note 12 to the accompanying Consolidated Financial Statements, our finance and financial products businesses are party to equity index put option and credit... -

Page 107

... of our consolidated liabilities for unpaid property and casualty losses is presented in the table below. Amounts are in millions. Gross unpaid losses Dec. 31, 2014 Dec. 31, 2013 Net unpaid losses * Dec. 31, 2014 Dec. 31, 2013 GEICO ...General Re ...BHRG ...Berkshire Hathaway Primary Group ...Total... -

Page 108

... or before the balance sheet date. Except for certain workers' compensation liabilities, all liabilities for unpaid property and casualty losses (referred to in this section as "gross unpaid losses") are reflected in the Consolidated Balance Sheets without discounting for time value. The timing and... -

Page 109

... reevaluated through December 31, 2014, producing a corresponding increase to pre-tax earnings in 2014. These reserve developments represented approximately 1.9% of earned premiums in 2014 and approximately 3.6% of prior year-end recorded net liabilities. During 2013, estimated liabilities for pre... -

Page 110

... or financial condition. General Re General Re's gross and net unpaid losses and loss adjustment expenses and gross reserves by major line of business as of December 31, 2014 are summarized below. Amounts are in millions. Type Line of business Reported case reserves ...$ 7,369 Workers' compensation... -

Page 111

... on product (e.g., treaty, facultative and program), line of business (e.g., auto liability, property, and workers' compensation), and jurisdiction. For each reserve cell, premiums and losses are aggregated by accident year, policy year or underwriting year (depending on client reporting practices... -

Page 112

...were $71 million in 2014. In 2014, ultimate loss estimates for asbestos and environmental claims were increased by $72 million. In addition to the previously described methodologies, we consider "survival ratios" based on average net claim payments in recent years versus net unpaid losses as a rough... -

Page 113

... 2014 and $300 million in 2013. In both years, the increases primarily related to asbestos and environmental risks assumed. The increase in 2014, net of deferred charge balances adjustments related to changes in estimated timing and amount of remaining unpaid liabilities, produced charges to pre-tax... -

Page 114

... value of equity index put option contracts using a Black-Scholes based option valuation model. Inputs to the model include the current index value, strike price, interest rate, dividend rate and contract expiration date. The weighted average interest and dividend rates used as of December 31, 2014... -

Page 115

... that are attractively priced in relation to the perceived credit risk. Management recognizes and accepts that losses may occur with respect to assets. We also issue debt in the ordinary course of business to fund business operations, business acquisitions and for other general purposes. We strive... -

Page 116

... 59% of the total fair value of equity investments was concentrated within four companies. We often hold equity investments for long periods of time so we are not troubled by short-term price volatility with respect to our investments provided that the underlying business, economic and management... -

Page 117

... Financial Statements. In addition, we hold investments in common stocks of major multinational companies such as The Coca-Cola Company that have significant foreign business and foreign currency risk of their own. Our net assets subject to translation are primarily in our insurance, utilities... -

Page 118

... subsidiaries, changes in laws or regulations affecting our insurance, railroad, utilities and energy and finance subsidiaries, changes in federal income tax laws, and changes in general economic and market factors that affect the prices of securities or the industries in which we do business. 116 -

Page 119

..., say, Coca-Cola or American Express shares, we think of Berkshire as being a nonmanaging partner in two extraordinary businesses, in which we measure our success by the long-term progress of the companies rather than by the month-to-month movements of their stocks. In fact, we would not care in the... -

Page 120

... they can buy. Overall, Berkshire and its long-term shareholders benefit from a sinking stock market much as a regular purchaser of food benefits from declining food prices. So when the market plummets - as it will from time to time - neither panic nor mourn. It's good news for Berkshire. 5. Because... -

Page 121

... long as we can break even in our insurance underwriting the cost of the float developed from that operation is zero. Neither item, of course, is equity; these are real liabilities. But they are liabilities without covenants or due dates attached to them. In effect, they give us the benefit of debt... -

Page 122

... just as good product or business acquisition ideas are. Therefore we normally will not talk about our investment ideas. This ban extends even to securities we have sold (because we may purchase them again) and to stocks we are incorrectly rumored to be buying. If we deny those reports but say... -

Page 123

...in 1964 we could state with certitude that Berkshire's per-share book value was $19.46. However, that figure considerably overstated the company's intrinsic value, since all of the company's resources were tied up in a sub-profitable textile business. Our textile assets had neither going-concern nor... -

Page 124

...H E B Berkshire Hathaway Inc. S&P 500 Index* S&P 500 Property & Casualty Insurance Index* 228 209 205 160 140 122 117 116 115 100 136 136 131 120 100 80 2009 2010 109 109 2011 2012 2013 2014 * ** Cumulative return for the Standard and Poor's indices based on reinvestment of dividends. It... -

Page 125

... years, our compounded annual gain in pre-tax, non-insurance earnings per share is 21.0%. During the same period, Berkshire's stock price increased at a rate of 22.1% annually. Over time, you can expect our stock price to move in rough tandem with Berkshire's investments and earnings. Market price... -

Page 126

... high and low sales prices per share, as reported on the New York Stock Exchange Composite List during the periods indicated: 2014 Class A High Low High Class B Low High Class A Low High 2013 Class B Low First Quarter ...Second Quarter ...Third Quarter ...Fourth Quarter ...Dividends $188,853 194... -

Page 127

... ...Stahl (1) ...Star Furniture ...TTI, Inc...United Consumer Financial Services (1) ...Vanity Fair Brands (3) ...Wayne Water Systems (1) ...Western Enterprises (1) ...R.C.Willey Home Furnishings ...World Book (1) ...WPLG, Inc...XTRA ...Non-insurance total ...Corporate Office ... 12,423 6,852... -

Page 128

...REAL ESTATE BROKERAGE BUSINESSES Brand State Major Cities Served Number of Agents RealtySouth Roberts Brothers Inc. Long Companies Guarantee Real Estate Intero Real Estate Services Berkshire Hathaway HomeServices California Properties Berkshire Hathaway HomeServices New England Properties Berkshire... -

Page 129

BERKSHIRE HATHAWAY INC. DAILY NEWSPAPERS Publication City Daily Circulation Sunday Alabama Opelika Auburn News Dothan Eagle Florida Jackson County Floridan Iowa The Daily Nonpareil Nebraska York News-Times The North Platte Telegraph Kearney Hub Star-Herald The Grand Island Independent Omaha World-... -

Page 130

128 -

Page 131

129 -

Page 132

130 -

Page 133

131 -

Page 134

132 -

Page 135

133 -

Page 136

134 -

Page 137

135 -

Page 138

See accompanying notes to financ 136 -

Page 139

ng notes to financial statements. 137 -

Page 140

138 -

Page 141

139 -

Page 142

140 -

Page 143

141 -

Page 144

142 -

Page 145

-

Page 146

-

Page 147

BERKSHIRE HATHAWAY INC. DIRECTORS WARREN E. BUFFETT, Chairman and CEO of Berkshire CHARLES T. MUNGER, Vice Chairman of Berkshire HOWARD G. BUFFETT, President of Buffett Farms STEPHEN B. BURKE, Chief Executive Officer of NBCUniversal, a media and entertainment company. SUSAN L. DECKER, Former ... -

Page 148

BERKSHIRE HATHAWAY INC. Executive Offices - 3555 Farnam Street, Omaha, Nebraska 68131