APS 2011 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2011 APS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

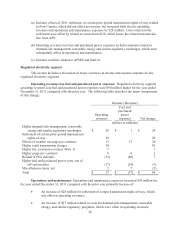

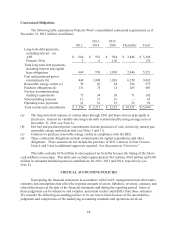

66

Other Financing Matters See Note 3 for information regarding the PSA approved by the

ACC. Although APS defers actual retail fuel and purchased power costs to the extent those costs vary

from the Base Fuel Rate on a current basis, APS’s recovery or refund of the deferrals from or to its

ratepayers, as appropriate, is subject to annual and, if necessary, periodic PSA adjustments.

See Note 3 for information regarding the settlement related to the 2008 retail rate case, which

includes ACC authorization and requirements of equity infusions into APS of at least $700 million by

December 31, 2014 ($253 million of which was infused into APS from proceeds of a Pinnacle West

equity issuance in 2010).

See Note 18 for information related to the change in our margin accounts.

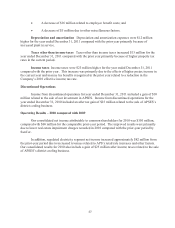

Debt Provisions

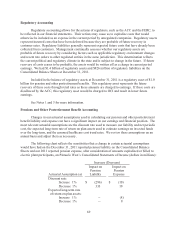

Pinnacle West's and APS’s debt covenants related to their respective bank financing

arrangements include maximum debt to capitalization ratios. Pinnacle West and APS comply with this

covenant. For both Pinnacle West and APS, this covenant requires that the ratio of consolidated debt

to total consolidated capitalization not exceed 65%. At December 31, 2011, the ratio was

approximately 47% for Pinnacle West and 46% for APS. Failure to comply with such covenant levels

would result in an event of default which, generally speaking, would require the immediate repayment

of the debt subject to the covenants and could cross-default other debt. See further discussion of "cross-

default" provisions below.

Neither Pinnacle West's nor APS’s financing agreements contain "rating triggers" that would

result in an acceleration of the required interest and principal payments in the event of a rating

downgrade. However, our bank credit agreements contain a pricing grid in which the interest rates we

pay for borrowings thereunder are determined by our current credit ratings.

All of Pinnacle West's loan agreements contain "cross-default" provisions that would result in

defaults and the potential acceleration of payment under these loan agreements if Pinnacle West or

APS were to default under certain other material agreements. All of APS’s bank agreements contain

cross-default provisions that would result in defaults and the potential acceleration of payment under

these bank agreements if APS were to default under certain other material agreements. Pinnacle West

and APS do not have a material adverse change restriction for credit facility borrowings.

See Note 6 for further discussions of liquidity matters.

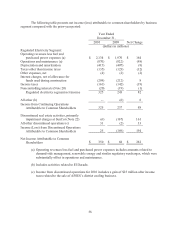

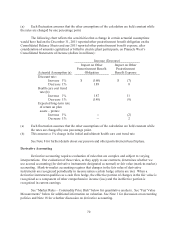

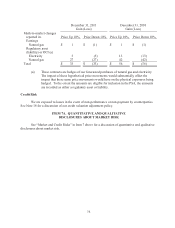

Credit Ratings

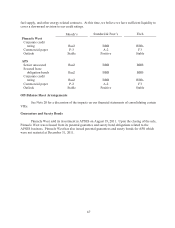

The ratings of securities of Pinnacle West and APS as of February 15, 2012 are shown below.

We are disclosing these credit ratings to enhance understanding of our cost of short-term and long-term

capital and our ability to access the markets for liquidity and long-term debt. The ratings reflect the

respective views of the rating agencies, from which an explanation of the significance of their ratings

may be obtained. There is no assurance that these ratings will continue for any given period of time.

The ratings may be revised or withdrawn entirely by the rating agencies if, in their respective

judgments, circumstances so warrant. Any downward revision or withdrawal may adversely affect the

market price of Pinnacle West’s or APS’s securities and/or result in an increase in the cost of, or limit

access to, capital. Such revisions may also result in substantial additional cash or other collateral

requirements related to certain derivative instruments, insurance policies, natural gas transportation,