APS 2011 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2011 APS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.65

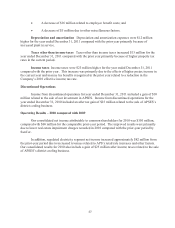

On December 8, 2011, APS extended a letter of credit agreement supporting its approximately

$17 million aggregate principal amount of Coconino County, Arizona Pollution Control Corporation

Pollution Control Revenue Bonds (Arizona Public Service Company Project), 1998. The agreement

expires December 8, 2016.

On January 10, 2012, APS issued $325 million of 4.50% unsecured senior notes that mature on

April 1, 2042. The net proceeds from the sale along with other funds will be used to repay at maturity

APS’s $375 million aggregate principal amount of 6.50% senior notes due March 1, 2012.

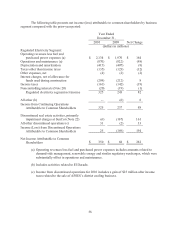

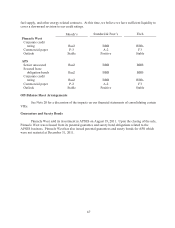

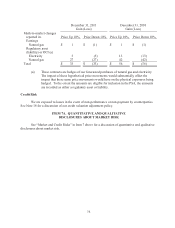

Available Credit Facilities Pinnacle West and APS maintain committed revolving credit

facilities in order to enhance liquidity and provide credit support for their commercial paper programs.

On November 4, 2011, Pinnacle West refinanced its $200 million revolving credit facility that

would have matured in February 2013, with a new $200 million facility. The new revolving credit

facility terminates in November 2016. Interest rates are based on Pinnacle West’s senior unsecured

debt credit ratings.

At December 31, 2011, the Pinnacle West credit facility was available to refinance

indebtedness of the Company and for other general corporate purposes, including credit support for its

$200 million commercial paper program. Pinnacle West has the option to increase the amount of the

facility up to a maximum of $300 million upon the satisfaction of certain conditions and with the

consent of the lenders. At December 31, 2011, Pinnacle West had no outstanding borrowings under its

credit facility, no letters of credit and no commercial paper borrowings.

On February 14, 2011, APS refinanced its $489 million credit facility that would have matured

in September 2011, and increased the size of the facility to $500 million. The new revolving credit

facility terminates in February 2015. APS may increase the amount of the facility up to a maximum of

$700 million upon the satisfaction of certain conditions and with the consent of the lenders. APS will

use the facility to refinance indebtedness and for other general corporate purposes. Interest rates are

based on APS’s senior unsecured debt credit ratings.

On November 4, 2011, APS refinanced its $500 million revolving credit facility that would

have matured in February 2013, with a new $500 million facility. The new revolving credit facility

terminates in November 2016. APS may increase the amount of the facility up to a maximum of $700

million upon the satisfaction of certain conditions and with the consent of the lenders. APS will use

the facility to refinance indebtedness and for other general corporate purposes. Interest rates are based

on APS’s senior unsecured debt credit ratings.

At December 31, 2011, APS had two credit facilities totaling $1 billion as described above.

The facilities described above are available to support its $250 million commercial paper program, for

bank borrowings, or for issuances of letters of credit. At December 31, 2011, APS had no borrowings

outstanding under any of its credit facilities and no outstanding commercial paper.

See “Financial Assurances” in Note 11 for a discussion of APS’s letters of credit.