APS 2011 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2011 APS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PINNACLE WEST CAPITAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

127

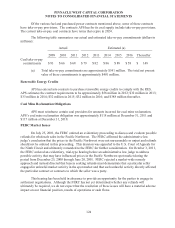

the payment of principal and interest of such debt obligations. These letters of credit expire in 2016.

APS has also entered into letters of credit to support certain equity participants in the Palo Verde sale

leaseback transactions (see Note 20 for further details on the Palo Verde sale leaseback transactions).

These letters of credit will expire at December 31, 2015, totaling approximately $52 million.

Additionally, APS has issued two letters of credit to support the collateral obligations under a certain

natural gas tolling contracts entered into with third parties. At December 31, 2011, $30 million of

letters of credit were outstanding to support these tolling contract obligations. These letters of credit

will expire in 2015 and 2016.

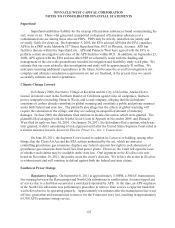

We enter into agreements that include indemnification provisions relating to liabilities arising

from or related to certain of our agreements; most significantly, APS has agreed to indemnify the

equity participants and other parties in the Palo Verde sale leaseback transactions with respect to

certain tax matters. Generally, a maximum obligation is not explicitly stated in the indemnification

provisions and, therefore, the overall maximum amount of the obligation under such indemnification

provisions cannot be reasonably estimated. Based on historical experience and evaluation of the

specific indemnities, we do not believe that any material loss related to such indemnification

provisions is likely.

Pinnacle West sold its investment in APSES on August 19, 2011. Upon the closing of the sale,

Pinnacle West was released from its parental guarantee and surety bond obligations related to the

APSES business. Pinnacle West has also issued parental guarantees and surety bonds for APS which

were not material at December 31, 2011.

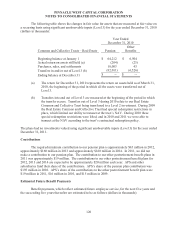

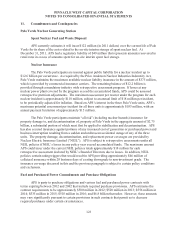

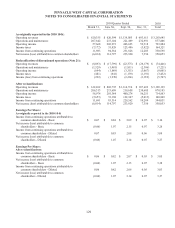

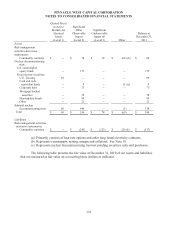

12. Asset Retirement Obligations

APS has asset retirement obligations for its Palo Verde nuclear facilities and certain other

generation, transmission and distribution assets. The Palo Verde asset retirement obligation primarily

relates to final plant decommissioning. This obligation is based on the NRC’s requirements for

disposal of radiated property or plant and agreements APS reached with the ACC for final

decommissioning of the plant. In the first quarter of 2011, a new decommissioning study with updated

cash flow estimates was completed for Palo Verde. This study reflects the twenty-year license

extension approved by the NRC on April 21, 2011, which extends the commencement of

decommissioning to 2045. The non-nuclear generation asset retirement obligations primarily relate to

requirements for removing portions of those plants at the end of the plant life or lease term.

Some of APS’s transmission and distribution assets have asset retirement obligations because

they are subject to right of way and easement agreements that require final removal. These agreements

have a history of uninterrupted renewal that APS expects to continue. As a result, APS cannot

reasonably estimate the fair value of the asset retirement obligation related to such distribution and

transmission assets.

Additionally, APS has aquifer protection permits for some of its generation sites that require

the closure of certain facilities at those sites.

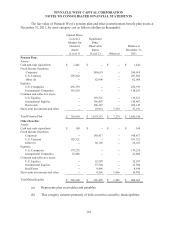

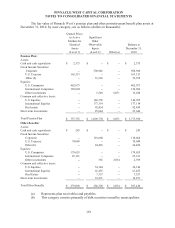

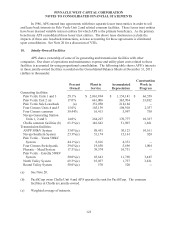

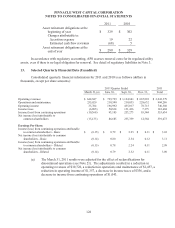

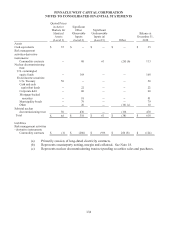

The following schedule shows the change in our asset retirement obligations for 2011 and 2010

(dollars in millions):