APS 2011 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2011 APS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248

|

|

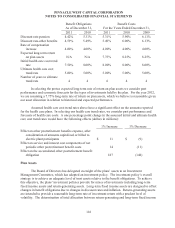

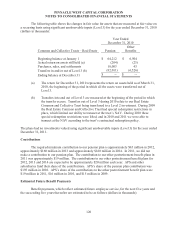

PINNACLE WEST CAPITAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

111

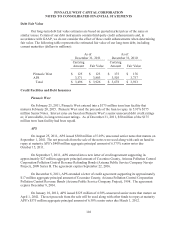

See Lines of Credit and Short-Term Borrowings in Note 5 and “Financial Assurances” in

Note 11 for discussion of APS’s other letters of credit.

Debt Provisions

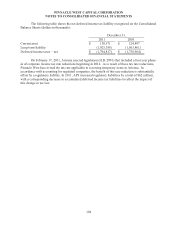

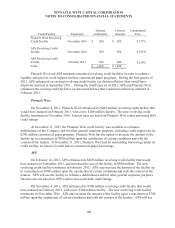

Pinnacle West's and APS’s debt covenants related to their respective bank financing

arrangements include maximum debt to capitalization ratios. Pinnacle West and APS comply with this

covenant. For both Pinnacle West and APS, this covenant requires that the ratio of consolidated debt

to total consolidated capitalization not exceed 65%. At December 31, 2011, the ratio was

approximately 47% for Pinnacle West and 46% for APS. Failure to comply with such covenant levels

would result in an event of default which, generally speaking, would require the immediate repayment

of the debt subject to the covenants and could cross-default other debt. See further discussion of "cross-

default" provisions below.

Neither Pinnacle West's nor APS’s financing agreements contain "rating triggers" that would

result in an acceleration of the required interest and principal payments in the event of a rating

downgrade. However, our bank credit agreements contain a pricing grid in which the interest rates we

pay for borrowings thereunder are determined by our current credit ratings.

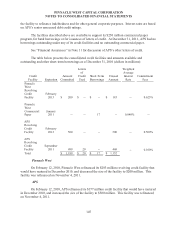

All of Pinnacle West's loan agreements contain "cross-default" provisions that would result in

defaults and the potential acceleration of payment under these loan agreements if Pinnacle West or

APS were to default under certain other material agreements. All of APS’s bank agreements contain

cross-default provisions that would result in defaults and the potential acceleration of payment under

these bank agreements if APS were to default under certain other material agreements. Pinnacle West

and APS do not have a material adverse change restriction for credit facility borrowings.

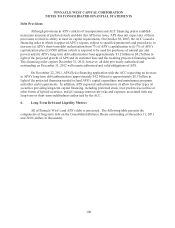

An existing ACC order requires APS to maintain a common equity ratio of at least 40%. As

defined in the ACC order, the common equity ratio is total shareholder equity divided by the sum of

total shareholder equity and long-term debt, including current maturities of long-term debt. At

December 31, 2011, APS was in compliance with this common equity ratio requirement. Its total

shareholder equity was approximately $3.9 billion, and total capitalization was approximately

$7.2 billion. APS would be prohibited from paying dividends if the payment would reduce its total

shareholder equity below approximately $2.9 billion, assuming APS’s total capitalization remains the

same. Since APS was in compliance with this common equity ratio requirement, this restriction does

not materially affect Pinnacle West's ability to meet its ongoing capital requirements.