APS 2011 Annual Report Download - page 171

Download and view the complete annual report

Please find page 171 of the 2011 APS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PINNACLE WEST CAPITAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

146

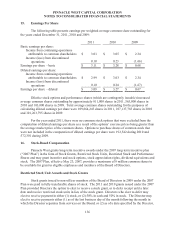

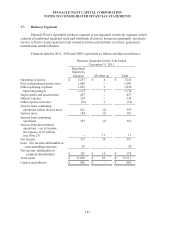

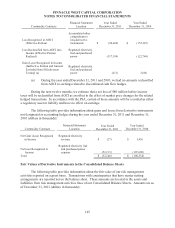

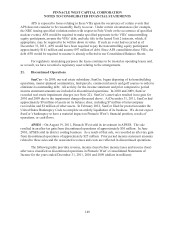

Commodity Contracts

Designated

as Hedging

Instruments

Not

Designated

as Hedging

Instruments

Margin and

Collateral

Provided to

Counterparties

Collateral

Provided from

Counterparties

(a) Other (b) Total

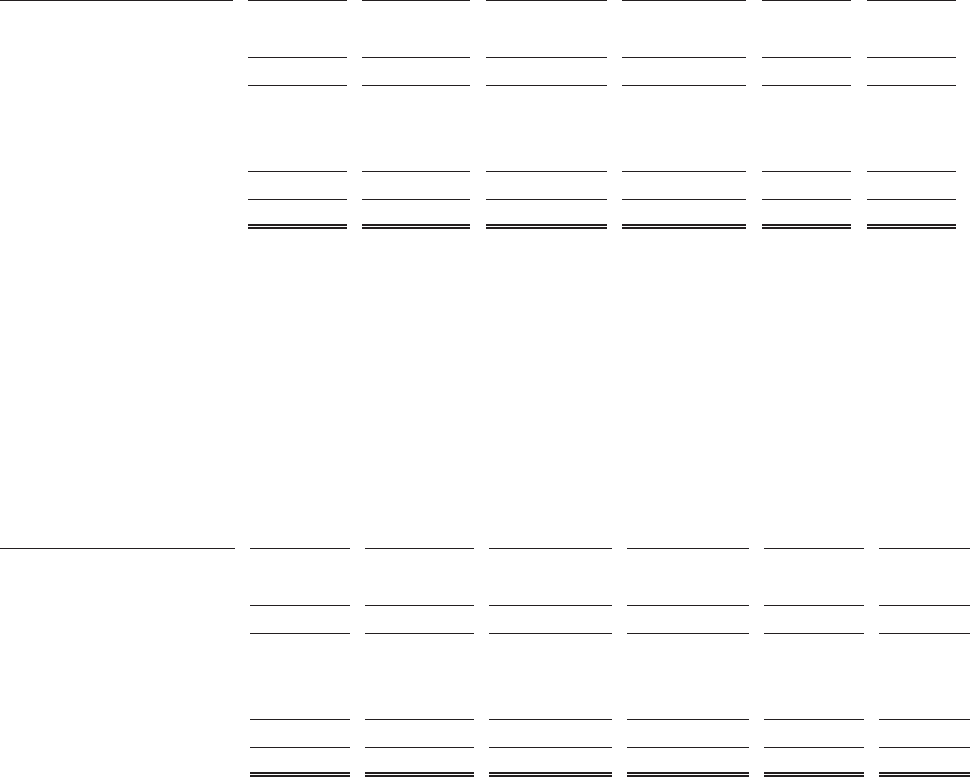

Current Assets $ 7,287 $ 76,162 $ 1,630 $ -- $ (54,815) $ 30,264

Investments and Other Assets 3,804 58,273 -- -- (12,755) 49,322

Total Assets 11,091 134,435 1,630 -- (67,570) 79,586

Current Liabilities (82,195) (124,028) 107,228 (11,145) 56,172 (53,968)

Deferred Credits and Other (68,137) (92,880) 65,768 -- 12,754 (82,495)

Total Liabilities (150,332) (216,908) 172,996 (11,145) 68,926 (136,463)

Total Derivative Instruments $ (139,241) $ (82,473) $ 174,626 $ (11,145) $ 1,356 $ (56,877)

(a) Collateral relates to non-derivative instruments or derivative instruments that qualify

for a scope exception.

(b) Other represents counterparty netting, options, and other risk management contracts.

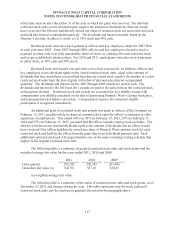

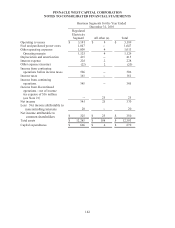

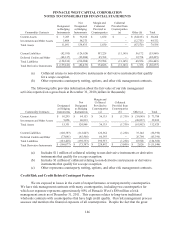

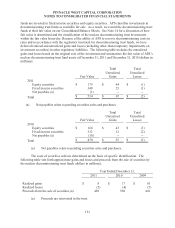

The following table provides information about the fair value of our risk management

activities reported on a gross basis at December 31, 2010 (dollars in thousands):

Commodity Contracts

Designated

as Hedging

Instruments

Not

Designated

as Hedging

Instruments

Margin and

Collateral

Provided to

Counterparties

(a)

Collateral

Provided from

Counterparties

(b) Other (c) Total

Current Assets $ 10,295 $ 64,153 $ 36,135 $ (1,750) $ (35,045) $ 73,788

Investments and Other Assets 5,056 60,813 -- -- (26,837) 39,032

Total Assets 15,351 124,966 36,135 (1,750) (61,882) 112,820

Current Liabilities (108,387) (112,847) 126,364 (1,250) 37,144 (58,976)

Deferred Credits and Other (73,041) (85,506) 66,393 -- 26,764 (65,390)

Total Liabilities (181,428) (198,353) 192,757 (1,250) 63,908 (124,366)

Total Derivative Instruments $ (166,077) $ (73,387) $ 228,892 $ (3,000) $ 2,026 $ (11,546)

(a) Includes $11 million of collateral relating to non-derivative instruments or derivative

instruments that qualify for a scope exception.

(b) Includes $1 million of collateral relating to non-derivative instruments or derivative

instruments that qualify for a scope exception.

(c) Other represents counterparty netting, options, and other risk management contracts.

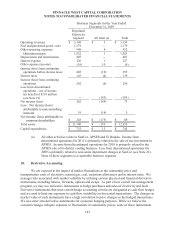

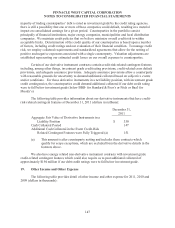

Credit Risk and Credit Related Contingent Features

We are exposed to losses in the event of nonperformance or nonpayment by counterparties.

We have risk management contracts with many counterparties, including two counterparties for

which our exposure represents approximately 80% of Pinnacle West’s $80 million of risk

management assets as of December 31, 2011. This exposure relates to long-term traditional

wholesale contracts with counterparties that have high credit quality. Our risk management process

assesses and monitors the financial exposure of all counterparties. Despite the fact that the great