APS 2011 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2011 APS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PINNACLE WEST CAPITAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

123

11. Commitments and Contingencies

Palo Verde Nuclear Generating Station

Spent Nuclear Fuel and Waste Disposal

APS currently estimates it will incur $122 million (in 2011 dollars) over the current life of Palo

Verde for its share of the costs related to the on-site interim storage of spent nuclear fuel. At

December 31, 2011, APS had a regulatory liability of $49 million that represents amounts recovered in

retail rates in excess of amounts spent for on-site interim spent fuel storage.

Nuclear Insurance

The Palo Verde participants are insured against public liability for a nuclear incident up to

$12.6 billion per occurrence. As required by the Price Anderson Nuclear Industries Indemnity Act,

Palo Verde maintains the maximum available nuclear liability insurance in the amount of $375 million,

which is provided by commercial insurance carriers. The remaining balance of $12.2 billion is

provided through a mandatory industry wide retrospective assessment program. If losses at any

nuclear power plant covered by the program exceed the accumulated funds, APS could be assessed

retrospective premium adjustments. The maximum assessment per reactor under the program for each

nuclear incident is approximately $118 million, subject to an annual limit of $18 million per incident,

to be periodically adjusted for inflation. Based on APS’s interest in the three Palo Verde units, APS’s

maximum potential assessment per incident for all three units is approximately $103 million, with an

annual payment limitation of approximately $15 million.

The Palo Verde participants maintain “all risk” (including nuclear hazards) insurance for

property damage to, and decontamination of, property at Palo Verde in the aggregate amount of $2.75

billion, a substantial portion of which must first be applied to stabilization and decontamination. APS

has also secured insurance against portions of any increased cost of generation or purchased power and

business interruption resulting from a sudden and unforeseen accidental outage of any of the three

units. The property damage, decontamination, and replacement power coverages are provided by

Nuclear Electric Insurance Limited (“NEIL”). APS is subject to retrospective assessments under all

NEIL policies if NEIL’s losses in any policy year exceed accumulated funds. The maximum amount

APS could incur under the current NEIL policies totals approximately $18 million for each

retrospective assessment declared by NEIL’s Board of Directors due to losses. In addition, NEIL

policies contain rating triggers that would result in APS providing approximately $46 million of

collateral assurance within 20 business days of a rating downgrade to non-investment grade. The

insurance coverage discussed in this and the previous paragraph is subject to certain policy conditions

and exclusions.

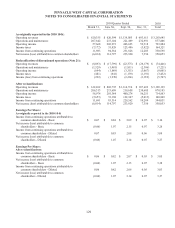

Fuel and Purchased Power Commitments and Purchase Obligations

APS is party to purchase obligations and various fuel and purchased power contracts with

terms expiring between 2012 and 2042 that include required purchase provisions. APS estimates the

contract requirements to be approximately $580 million in 2012; $528 million in 2013; $556 million in

2014; $535 million in 2015; $503 million in 2016; and $6.8 billion thereafter. However, these amounts

may vary significantly pursuant to certain provisions in such contracts that permit us to decrease

required purchases under certain circumstances.