APS 2011 Annual Report Download - page 173

Download and view the complete annual report

Please find page 173 of the 2011 APS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PINNACLE WEST CAPITAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

148

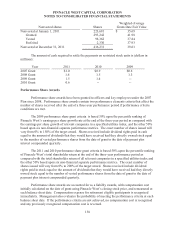

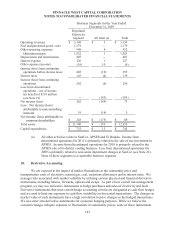

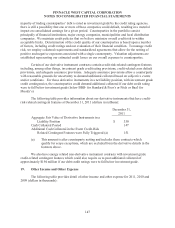

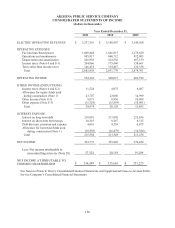

2011 2010 2009

Other income:

Interest income $ 1,850 $ 3,255 $ 1,503

Investment gains – net 1,165 2,797 2,512

Miscellaneous 96 335 1,144

Total other income $ 3,111 $ 6,387 $ 5,159

Other expense:

Non-operating costs $ (7,037) $ (6,831) $ (6,675)

Miscellaneous (3,414) (3,090) (7,625)

Total other expense $ (10,451) $ (9,921) $ (14,300)

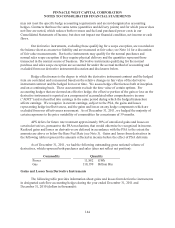

20. Palo Verde Sale Leaseback Variable Interest Entities

In 1986, APS entered into agreements with three separate VIE lessor trusts in order to sell

and lease back interests in Palo Verde Unit 2 and related common facilities. APS will pay

approximately $49 million per year for the years 2011 to 2015 related to these leases. The leases do

not contain fixed price purchase options or residual value guarantees. However, the lease agreements

include fixed rate renewal periods which may have a significant impact on the VIEs’ economic

performance. We have concluded that these fixed rate renewal periods may give APS the ability to

utilize the asset for a significant portion of the asset’s economic life, and therefore provide APS with

the power to direct activities of the VIEs that most significantly impact the VIEs’ economic

performance. In addition to the fixed rate renewal periods, our primary beneficiary analysis also

considered that APS is the operating agent for Palo Verde, has fair value purchase options, and is

obligated to decommission the leased assets.

As a result of consolidation we eliminate rent expense and recognize depreciation and

interest expense, resulting in an increase in net income for 2011, 2010 and 2009 of $28 million, $20

million and $19 million, respectively, entirely attributable to the noncontrolling interests. Income

attributable to Pinnacle West shareholders remains the same. Consolidation of these VIEs also

results in changes to our Consolidated Statements of Cash Flows, but does not impact net cash flows.

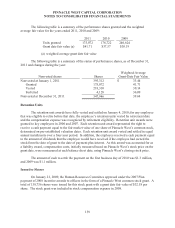

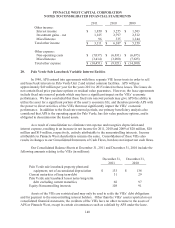

Our Consolidated Balance Sheets at December 31, 2011 and December 31, 2010 include the

following amounts relating to the VIEs (in millions):

December 31,

2011

December 31,

2010

Palo Verde sale leaseback property plant and

equipment, net of accumulated depreciation $ 133 $ 138

Current maturities of long term-debt 31 29

Palo Verde sale leaseback lessor notes long-term

debt excluding current maturities 66 97

Equity-Noncontrolling interests 108 91

Assets of the VIEs are restricted and may only be used to settle the VIEs’ debt obligations

and for payment to the noncontrolling interest holders. Other than the VIEs’ assets reported on our

consolidated financial statements, the creditors of the VIEs have no other recourse to the assets of

APS or Pinnacle West, except in certain circumstances such as a default by APS under the lease.