APS 2011 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2011 APS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.62

change in collateral and margin cash provided as a result of changes in commodity prices, and other

changes in working capital. In addition, APS’s operating cash flows included income tax payments to

the parent company of approximately $81 million in 2010.

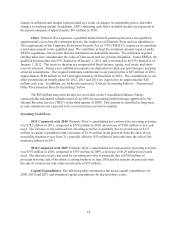

Other Pinnacle West sponsors a qualified defined benefit pension plan and a non-qualified

supplemental excess benefit retirement plan for the employees of Pinnacle West and our subsidiaries.

The requirements of the Employee Retirement Security Act of 1974 (“ERISA”) require us to contribute

a minimum amount to the qualified plan. We contribute at least the minimum amount required under

ERISA regulations, but no more than the maximum tax-deductible amount. The minimum required

funding takes into consideration the value of plan assets and our pension obligation. Under ERISA, the

qualified pension plan was 89% funded as of January 1, 2011 and is estimated to be 85% funded as of

January 1, 2012. The assets in the plan are comprised of fixed-income, equity, real estate, and short-

term investments. Future year contribution amounts are dependent on plan asset performance and plan

actuarial assumptions. The required minimum contribution to our pension plan is $65 million in 2012,

approximately $160 million in 2013 and approximately $160 million in 2014. The contributions to our

other postretirement benefit plans for 2012, 2013 and 2014 are expected to be approximately $20

million each year. In addition, see further discussion in “Critical Accounting Policies – Pension and

Other Postretirement Benefit Accounting” below.

The $69 million long-term income tax receivable on the Consolidated Balance Sheets

represents the anticipated refunds related to an APS tax accounting method change approved by the

Internal Revenue Service (“IRS”) in the third quarter of 2009. This amount is classified as long-term,

as cash refunds are not expected to be received in the next twelve months.

Investing Cash Flows

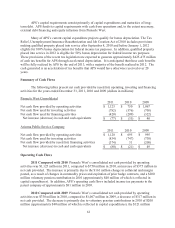

2011 Compared with 2010 Pinnacle West’s consolidated net cash used for investing activities

was $782 million in 2011, compared to $576 million in 2010, an increase of $206 million in net cash

used. The increase in net cash used for investing activities is primarily due to an increase of $131

million in capital expenditures and a decrease of $126 million in net proceeds from the sales of our

non-utility businesses (see Note 21), partially offset by $55 million of proceeds from the sale of life

insurance policies in 2011.

2010 Compared with 2009 Pinnacle West’s consolidated net cash used for investing activities

was $576 million in 2010, compared to $705 million in 2009, a decrease of $129 million in net cash

used. The decrease in net cash used for investing activities is primarily due to $100 million of

proceeds from the sale of the district cooling business in June 2010 and the increase in proceeds from

the sale of commercial real estate investments of $29 million.

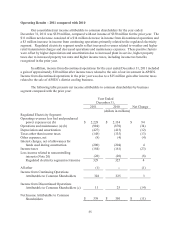

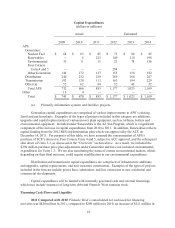

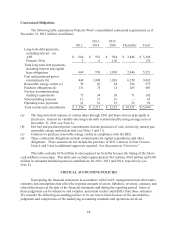

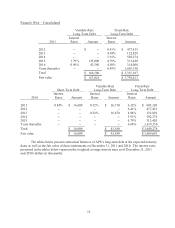

Capital Expenditures The following table summarizes the actual capital expenditures for

2009, 2010 and 2011 and estimated capital expenditures for the next three years: