APS 2011 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2011 APS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PINNACLE WEST CAPITAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

113

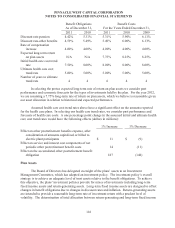

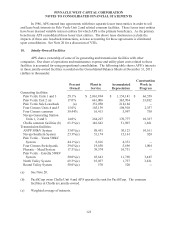

to receive using information about the participant. The pension plan covers nearly all employees. The

supplemental excess benefit retirement plan covers officers of the Company and highly compensated

employees designated for participation by the Board of Directors. Our employees do not contribute to

the plans. Generally, we calculate the benefits based on age, years of service and pay.

Pinnacle West also sponsors another postretirement benefit plan (Pinnacle West Capital

Corporation Group Life and Medical Plan) for the employees of Pinnacle West and its subsidiaries.

This plan provides medical and life insurance benefits to retired employees. Employees must retire to

become eligible for these retirement benefits, which are based on years of service and age. For the

medical insurance plan, retirees make contributions to cover a portion of the plan costs. For the life

insurance plan, retirees do not make contributions. We retain the right to change or eliminate these

benefits.

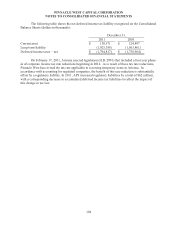

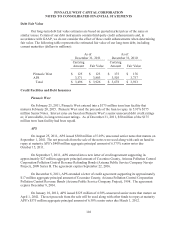

Pinnacle West uses a December 31 measurement date each year for its pension and other

postretirement benefit plans. The market-related value of our plan assets is their fair value at the

measurement date. See Note 14 for discussion of how fair values are determined. Due to subjective

and complex judgments, which may be required in determining fair values, actual results could differ

from the results estimated through the application of these methods.

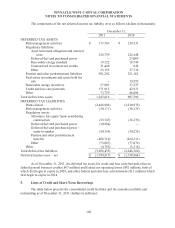

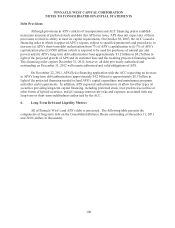

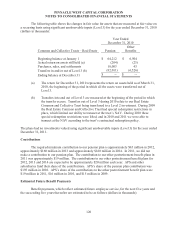

A significant portion of the changes in the actuarial gains and losses of our pension and

postretirement plans is attributable to APS and therefore is recoverable in rates. Accordingly, these

changes are recorded as a regulatory asset. In its 2009 retail rate case settlement, APS received

approval to defer a portion of pension and other postretirement benefit cost increases incurred in 2011

and 2012. During 2011, we deferred pension and other postretirement benefit costs of approximately

$12 million.

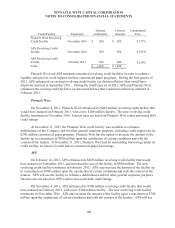

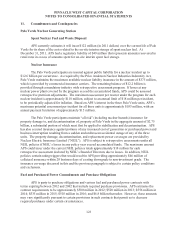

On March 23, 2010, the President signed into law comprehensive health care reform legislation

under the Patient Protection and Affordable Care Act (the “Act”). One feature of the Act is the

elimination of the tax deduction for prescription drug costs that are reimbursed as part of the Medicare

Part D subsidy. Although this tax increase does not take effect until 2013, we are required to recognize

the full accounting impact in our financial statements in the period in which the Act is signed. In

accordance with accounting for regulated companies, the loss of this deduction is substantially offset

by a regulatory asset that will be recovered through future electric revenues. In the first quarter of

2010, Pinnacle West charged regulatory assets for a total of $42 million, with a corresponding increase

in accumulated deferred income tax liabilities, to reflect the impact of this change in tax law.

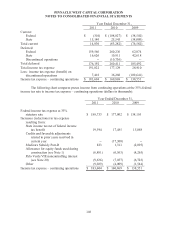

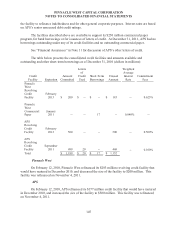

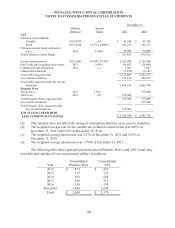

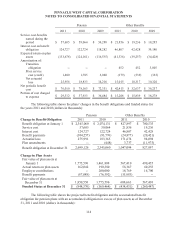

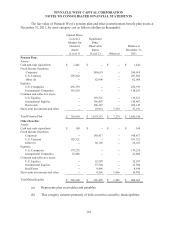

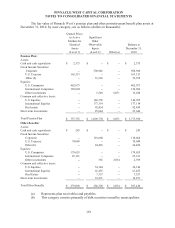

The following table provides details of the plans’ net periodic benefit costs and the portion of

these costs charged to expense (including administrative costs and excluding amounts capitalized as

overhead construction, billed to electric plant participants or charged to the regulatory asset) (dollars in

thousands):