APS 2011 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2011 APS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248

|

|

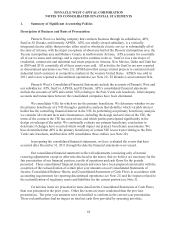

PINNACLE WEST CAPITAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

93

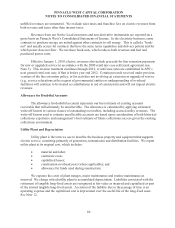

Cash and Cash Equivalents

We consider all highly liquid investments with a remaining maturity of three months or less at

acquisition to be cash equivalents.

Intangible Assets

We have no goodwill recorded and have separately disclosed other intangible assets, primarily

APS’s software, on Pinnacle West’s Consolidated Balance Sheets. The intangible assets are amortized

over their finite useful lives. Amortization expense was $47 million in 2011, $45 million in 2010, and

$35 million in 2009. Estimated amortization expense on existing intangible assets over the next five

years is $42 million in 2012, $35 million in 2013, $28 million in 2014, $21 million in 2015, and $13

million in 2016. At December 31, 2011, the weighted average remaining amortization period for

intangible assets was 7 years.

Investments

El Dorado accounts for its investments using either the equity method (if significant influence)

or the cost method (if less than 20% ownership).

Our investments in the nuclear decommissioning trust fund are accounted for in accordance

with guidance on accounting for certain investments in debt and equity securities. See Note 14 and

Note 23 for more information on these investments.

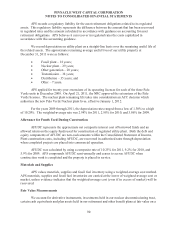

2. New Accounting Standards

In May 2011, the FASB issued amended guidance to converge fair value measurement and

disclosure requirements for GAAP and IFRS. The amended guidance clarifies how certain fair value

measurement principles should be applied and requires enhanced fair value disclosures. The guidance

is effective for us on January 1, 2012. The adoption of this new guidance will result in additional fair

value disclosures, but will not impact our financial statement results.

In June 2011, the FASB issued amended guidance on the presentation of comprehensive

income intended to increase the prominence of items reported in other comprehensive income and to

facilitate convergence with IFRS. The amended guidance requires entities to present total

comprehensive income, which includes components of net income and components of other

comprehensive income, in either a single continuous statement of comprehensive income or in two

separate but consecutive statements. The guidance is effective for us on January 1, 2012. The guidance

will change our presentation of comprehensive income, but will not impact our financial statement

results.