APS 2011 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2011 APS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PINNACLE WEST CAPITAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

92

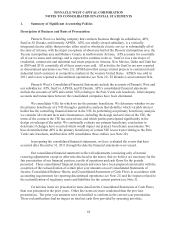

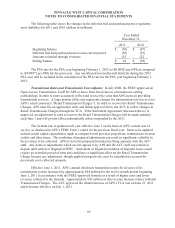

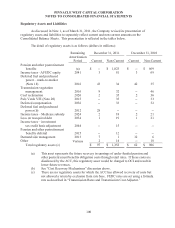

Retirement Plans and Other Benefits

Pinnacle West sponsors a qualified defined benefit and account balance pension plan for the

employees of Pinnacle West and its subsidiaries. We also sponsor another postretirement benefit plan

for the employees of Pinnacle West and our subsidiaries and provide medical and life insurance

benefits to retired employees. Pension and other postretirement benefit expense are determined by

actuarial valuations, based on assumptions that are evaluated annually. See Note 8 for additional

information on pension and other postretirement benefits.

Nuclear Fuel

APS amortizes nuclear fuel by using the unit-of-production method. The unit-of-production

method is based on actual physical usage. APS divides the cost of the fuel by the estimated number of

thermal units it expects to produce with that fuel. APS then multiplies that rate by the number of

thermal units produced within the current period. This calculation determines the current period

nuclear fuel expense.

APS also charges nuclear fuel expense for the interim storage and permanent disposal of spent

nuclear fuel. The DOE is responsible for the permanent disposal of spent nuclear fuel and charges

APS $0.001 per kWh of nuclear generation. See Note 11 for information on spent nuclear fuel

disposal and Note 23 for information on nuclear decommissioning costs.

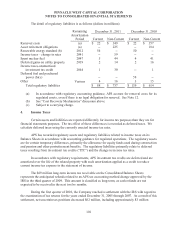

Income Taxes

Income taxes are provided using the asset and liability approach prescribed by guidance

relating to accounting for income taxes. We file our federal income tax return on a consolidated basis

and we file our state income tax returns on a consolidated or unitary basis. In accordance with our

intercompany tax sharing agreement, federal and state income taxes are allocated to each first-tier

subsidiary as though each first-tier subsidiary filed a separate income tax return. Any difference

between that method and the consolidated (and unitary) income tax liability is attributed to the parent

company. The income tax liability accounts reflect the tax and interest associated with management’s

estimate of the largest amount of tax benefit that is greater than 50% likely of being realized upon

settlement for all known and measurable tax exposures. See Note 4.

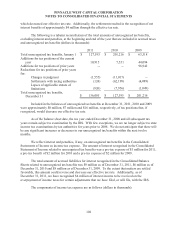

Real Estate Investments

We did not have any real estate investments at December 31, 2011 and December 31, 2010 on

our Consolidated Balance Sheets. For the purposes of evaluating impairment, in accordance with the

provisions on accounting for the impairment or disposal of long-lived assets; we classified our real

estate assets, such as land under development, land held for future development, and commercial

property as “held and used” in 2010 and 2009. When events or changes in circumstances indicated that

the carrying values of real estate assets considered held and used would not be recoverable, we

compared the undiscounted cash flows that we estimated would be generated by each asset to its

carrying amount. If the carrying amount exceeded the undiscounted cash flows, we adjusted the asset

to fair value and recognized an impairment charge. The adjusted value became the new book value

(carrying amount) for held and used assets. Our internal models used inputs that we believe were

consistent with those that would be used by market participants.