APS 2011 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2011 APS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.52

ACC prior to March 31, 2012. However, APS cannot predict whether the ACC will approve the plan as

filed.

Rate Matters. APS needs timely recovery through rates of its capital and operating expenditures

to maintain adequate financial health. APS’s retail rates are regulated by the ACC and its wholesale

electric rates (primarily for transmission) are regulated by the FERC. On June 1, 2011, APS filed a rate

case with the ACC requesting, among other things, an increase in retail rates to allow APS to continue to

maintain and upgrade its electric systems for enhanced reliability, approval of recovery mechanisms,

including a decoupling mechanism, and approval of other programs and mechanisms aimed at energy

efficiency and renewable energy. On January 6, 2012, APS and other parties to the retail rate case

entered into a Settlement Agreement detailing the terms upon which the parties have agreed to settle the

rate case. The Settlement Agreement requires the approval of the ACC. As is the case with all such

agreements, APS cannot predict whether the Settlement Agreement will be approved in the form filed or

what changes may be ordered by the ACC and accepted by the parties. The proposed Settlement

Agreement demonstrates cooperation among APS, the ACC staff, the Residential Utility Consumer

Office and other intervenors to the rate case, and establishes a future rate case filing plan that allows APS

the opportunity to help shape Arizona’s energy future outside of continual rate cases. See Note 3 for

details regarding the current rate case, the Settlement Agreement terms and for information on APS’s

FERC rates.

APS has several recovery mechanisms in place that provide more timely recovery to APS of its

fuel and transmission costs, and costs associated with the promotion and implementation of its demand-

side management and renewable energy efforts and customer programs. These mechanisms are

described more fully in Note 3.

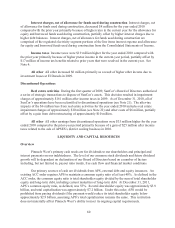

Financial Strength and Flexibility. Pinnacle West and APS currently have ample borrowing

capacity under their respective credit facilities and have been able to access these facilities, ensuring

adequate liquidity for each company. In February 2011, APS entered into a $500 million revolving

credit facility, replacing its $489 million revolving credit facility that would have otherwise terminated in

September 2011. In November 2011, Pinnacle West and APS refinanced their $200 million and $500

million revolving credit facilities, respectively, that would have otherwise matured in February 2013.

In August 2011, APS issued $300 million of 5.05% unsecured senior notes that mature on

September 1, 2041. The net proceeds from the sale of the notes were used along with cash on hand to

repay at maturity APS’s $400 million aggregate principal amount of 6.375% senior notes due

October 15, 2011. In January 2012, APS issued $325 million of 4.50% unsecured senior notes that

mature on April 1, 2042. APS will use the net proceeds from the sale of the notes along with other funds

to pay at maturity its $375 million aggregate principal amount of 6.50% unsecured senior notes that

mature on March 1, 2012.

APSES. On August 19, 2011, Pinnacle West sold its investment in APSES. The sale resulted in

an after-tax gain of approximately $10 million.

Other Subsidiaries. The operations of El Dorado are not expected to have any material impact

on our financial results, or to require any material amounts of capital, over the next three years. As a

result of the continuing distressed conditions in the real estate markets, during 2009 our other first-tier

subsidiary, SunCor, undertook a program to dispose of its homebuilding operations, master-planned

communities, land parcels, commercial assets and golf courses in order to eliminate its outstanding debt.

At December 31, 2011, SunCor had total remaining assets of about $9 million, including $7 million of

intercompany receivables, and no debt. In February 2012, SunCor filed for protection under the United