APS 2011 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2011 APS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PINNACLE WEST CAPITAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

131

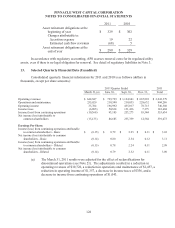

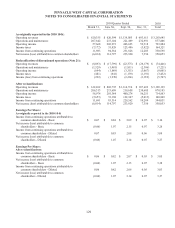

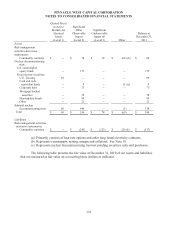

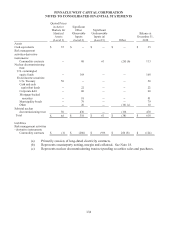

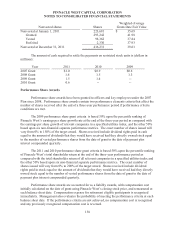

Recurring Fair Value Measurements

We apply recurring fair value measurements to certain cash equivalents, derivative instruments,

investments held in our nuclear decommissioning trust and plan assets held in our retirement and other

benefit plans. See Note 8 for the fair value discussion of plan assets held in our retirement and other

benefit plans.

Cash Equivalents

Cash equivalents represent short-term investments with original maturities of three months or

less in exchange traded money market funds that are valued using quoted prices in active markets.

Risk Management Activities – Derivative Instruments

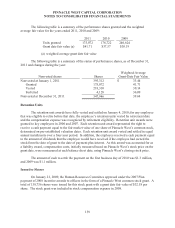

Exchange traded commodity contracts are valued using unadjusted quoted prices. For non-

exchange traded commodity contracts, we calculate fair market value based on the average of the bid

and offer price, discounted to reflect net present value. We maintain certain valuation adjustments for

a number of risks associated with the valuation of future commitments. These include valuation

adjustments for liquidity and credit risks based on the financial condition of counterparties. The

liquidity valuation adjustment represents the cost that would be incurred if all unmatched positions

were closed out or hedged. The credit valuation adjustment represents estimated credit losses on our

net exposure to counterparties, taking into account netting agreements, expected default experience for

the credit rating of the counterparties and the overall diversification of the portfolio. We maintain

credit policies that management believes minimize overall credit risk.

Certain non-exchange traded commodity contracts are valued based on unobservable inputs

due to the long-term nature of contracts or the unique location of the transactions. Our long-dated

energy transactions consist of observable valuations for the near term portion and unobservable

valuations for the long-term portions of the transaction. Certain option contracts are valued using

option valuation models which utilize both observable and unobservable inputs such as volatility rates

and correlation factors. When the unobservable portion is significant to the overall valuation of the

transaction, the entire transaction is classified as Level 3. Our classification of instruments as Level 3

is primarily reflective of the long-term nature of our energy transactions and the use of option valuation

models with significant unobservable inputs.

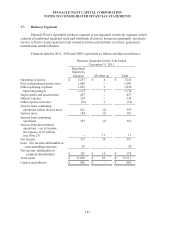

Investments Held in our Nuclear Decommissioning Trust

The nuclear decommissioning trust invests in fixed income securities and equity securities.

Equity securities are held indirectly through commingled funds. The commingled funds are valued

based on NAV, which is primarily derived from the quoted active market prices of the underlying

equity securities. We may transact in these commingled funds on a semi-monthly basis at the NAV,

and accordingly classify these investments as Level 2. The commingled funds, which are similar to

mutual funds, are maintained by a bank and hold investments in accordance with the stated objective of

tracking the performance of the S&P 500 index. Because the commingled fund shares are offered to a

limited group of investors, they are not considered to be traded in an active market.